MANAGERIAL ACCOUNTING CONNECT ACCESS

17th Edition

ISBN: 9781265750879

Author: Garrison

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 22P

PROBLEM 12-22 Special Order Decisions LO12-4

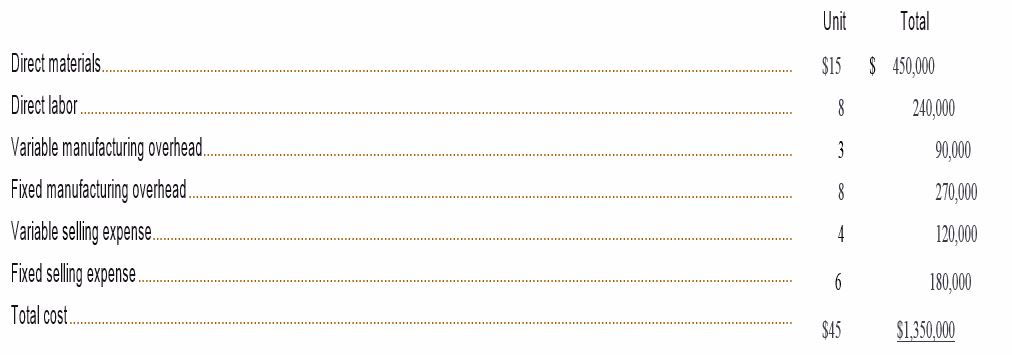

Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 30,000 Rets per year. Costs associated with this level of production and sales are given below:

The Rets normally sell for $50 each. Fixed manufacturing

Required:

- Assume that due to a recession, Polaski Company expects to sell only 25,000 Rets through regular channels next year. A large retail chain has offered to purchase 5,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order: thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a special machine to engrave the retail chain’s name on the 5,000 units. This machine would cost $10,000. Polaski Company has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage) of accepting the special order?

- Refer to the original data. Assume again that Polaski Company expects to sell only 25,000 Rets through regular channels next year. The U.S. Army would like to make a one-time-only purchase of 5,000 Rets. The Army would pay a fixed fee of SI.80 per Ret and it would reimburse Polaski Company for all costs of production (variable and fixed) associated with the units. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army’s special order?

- Assume the same situation as described in (2) above, except that the company expects to sell 30,000 Rets through regular channels next year. Thus, accepting the U.S. Army’s order would require giving up regular sales of 5,000 Rets. Given this new information, what is the financial advantage (disadvantage) of accepting the U.S. Army’s special order?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting question with the appropriate accounting analysis techniques?

I am looking for the correct answer to this general accounting problem using valid accounting standards.

Please explain the correct approach for solving this general accounting question.

Chapter 13 Solutions

MANAGERIAL ACCOUNTING CONNECT ACCESS

Ch. 13.A - EXERCISE 12A-1 Absorption Costing Approach to...Ch. 13.A - EXERCISE 12A-2 Customer Latitude and Pricing...Ch. 13.A - Prob. 3ECh. 13.A - Prob. 4ECh. 13.A - Prob. 5ECh. 13.A - EXERCISE 12A-6 Value-Based Pricing; Absorption...Ch. 13.A - Prob. 7ECh. 13.A - Prob. 8PCh. 13.A - Prob. 9PCh. 13.A - Prob. 10P

Ch. 13.A - Prob. 11PCh. 13.A -

PROBLEM 12A-12 Absorption Costing Approach to...Ch. 13.A - PROBLEM 12A-13 Value-Based Pricing LO12-10 The...Ch. 13 - Prob. 1QCh. 13 - Prob. 2QCh. 13 - Prob. 3QCh. 13 - Prob. 4QCh. 13 - “Variable costs and differential costs mean the...Ch. 13 - 12-6 "All future costs are relevant in decision...Ch. 13 - Prentice Company is considering dropping one of...Ch. 13 - Prob. 8QCh. 13 - 12-9 What is the danger in allocating common fixed...Ch. 13 - 12-10 How does opportunity cost enter into a make...Ch. 13 - 12-11 Give at least four examples of possible...Ch. 13 - 12-12 How will relating product contribution...Ch. 13 - Define the following terms: joint products, joint...Ch. 13 - 12-14 From a decision-making point of view, should...Ch. 13 - What guideline should be used in determining...Ch. 13 - Prob. 16QCh. 13 - Prob. 1AECh. 13 - Prob. 2AECh. 13 - Cane Company manufactures two products called...Ch. 13 - (

Alpha Beta

$30

$...Ch. 13 - Prob. 3F15Ch. 13 - Prob. 4F15Ch. 13 - Prob. 5F15Ch. 13 - (

Alpha Beta

$30

$...Ch. 13 - Prob. 7F15Ch. 13 -

Cane Company manufactures two products called...Ch. 13 - Prob. 9F15Ch. 13 - (

Alpha Beta

$30

$...Ch. 13 - Prob. 11F15Ch. 13 - Prob. 12F15Ch. 13 - (

Alpha ...Ch. 13 - (

Alpha Beta

$30

$...Ch. 13 - (

Alpha Beta

$30

$...Ch. 13 -

EXERCISE 12-1 Identifying Relevant Costs...Ch. 13 -

EXERCISE 12-2 Dropping or Retaining a Segment...Ch. 13 -

EXERCISE 12-3 Make or Buy Decision LO12-3

Troy...Ch. 13 -

EXERCISE 12-4 Special Order Decision...Ch. 13 -

EXERCISE 12-5 Volume Trade-Off Decisions...Ch. 13 - Prob. 6ECh. 13 - Prob. 7ECh. 13 - Prob. 8ECh. 13 - Prob. 9ECh. 13 - Prob. 10ECh. 13 - (

$3.60

10.00

2.40

9.00

$25.00

)

EXERCISE 12-11...Ch. 13 - Prob. 12ECh. 13 - EXERCISE 12-13 Sell or Process Further Decision...Ch. 13 - en

r

Ch. 13 - Prob. 15ECh. 13 - (

$150

31

20

29

3

24

15

$272

$34

)

EXERCISE...Ch. 13 - Prob. 17ECh. 13 - Prob. 18PCh. 13 - PROBLEM 12-19 Dropping or Retaining a Segment...Ch. 13 -

PROBLEM 12-20 Sell or Process Further Decision...Ch. 13 - Prob. 21PCh. 13 - PROBLEM 12-22 Special Order Decisions LO12-4...Ch. 13 -

PROBLEM 12-23 Make or Buy Decision LO12-3

Silven...Ch. 13 - Prob. 24PCh. 13 - Prob. 25PCh. 13 - Prob. 26PCh. 13 - Prob. 27PCh. 13 - Prob. 28PCh. 13 - CASE 12-29 Sell or Process Further Decision LO12-7...Ch. 13 -

CASE 12-30 Ethics and the Manager; Shut Dora or...Ch. 13 - CASE 12-31 Integrative Case: Relevant Costs;...Ch. 13 -

CASE 12-32 Make or Buy Decisions; Volume...Ch. 13 - Prob. 33C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- Please explain the solution to this financial accounting problem with accurate principles.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardPlease help me solve this general accounting problem with the correct financial process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Revenue recognition explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=816Q6pOaGv4;License: Standard Youtube License