Concept explainers

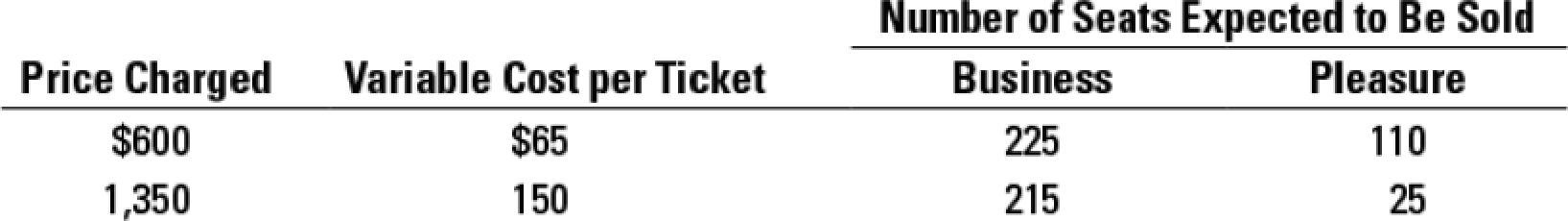

Airline pricing, considerations other than cost in pricing. Costal Airways is about to introduce a daily round-trip flight from New York to Los Angeles and is determining how to price its round-trip tickets.

The

Pleasure travelers start their travel during one week, spend at least one weekend at their destination, and return the following week or thereafter. Business travelers usually start and complete their travel within the same work week. They do not stay over weekends.

Assume that round-trip fuel costs are fixed costs of $18,500 and that fixed costs allocated to the round-trip flight for airplane-lease costs, ground services, and flight-crew salaries total $150,000.

- 1. If you could charge different prices to business travelers and pleasure travelers, would you? Show your computations.

- 2. Explain the key factor (or factors) for your answer in requirement 1.

- 3. How might Costal Airways implement

price discrimination ? That is, what plan could the airline formulate so that business travelers and pleasure travelers each pay the price the airline desires?

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

COST ACCOUNTING

- Need answer the financial accounting questionarrow_forwardWhat is the direct materials quantity variance on these general accounting question?arrow_forwardCullumber Company uses a job-order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labour cost in Department D, direct labour hours in Department E, and machine hours in Department K. In establishing the predetermined overhead rates for 2022, the following estimates were made for the year. Department D E K Manufacturing overhead $1,280,000 $1,500,000 $840,000 Direct labour costs $1,600,000 $1,312,500 $472,500 Direct labour hours 105,000 125,000 42,000 Machine hours 420,000 525,000 120,000 The following information pertains to January 2022 for each manufacturing department. Department D E K Direct materials used Direct labour costs $147,000 $132,300 $81,900 $126,000 $115,500 $39,375 Manufacturing overhead incurred $103,950 $128,600 $73,950 Direct labour hours 8,400 11,550 3,675 Machine hours 35,700 47,250 10,380 Your answer is partially correct. Calculate the predetermined overhead rate for each department.…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning