COST ACCOUNTING

16th Edition

ISBN: 9781323169261

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 13.24E

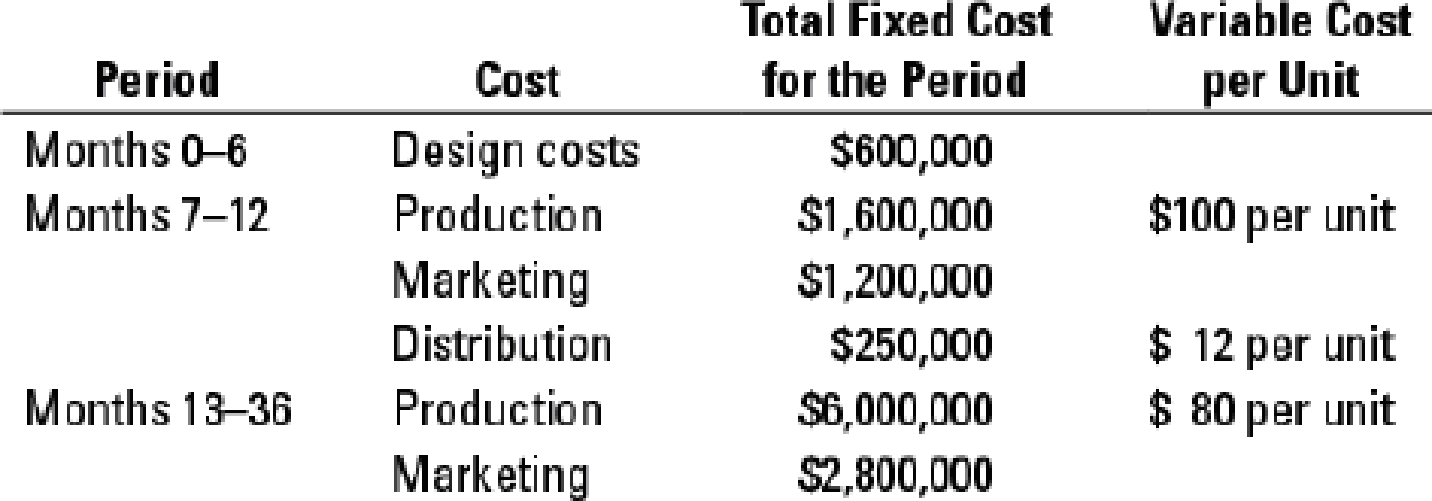

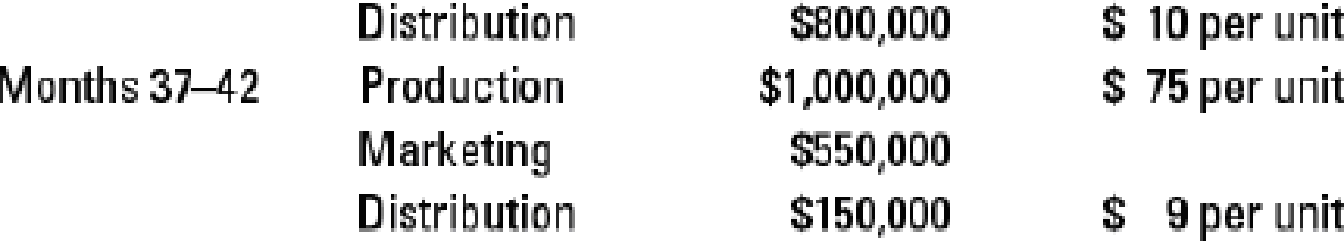

Life-cycle budgeting and costing. Arnold Manufacturing, Inc., plans to develop a new industrial-powered vacuum cleaner for household use that runs exclusively on rechargeable batteries. The product will take 6 months to design and test. The company expects the vacuum sweeper to sell 12,000 units during the first 6 months of sales; 24,000 units per year over the following 2 years; and 10,000 units over the final 6 months of the product’s life cycle. The company expects the following costs:

Ignore the time value of money.

- 1. If Arnold prices the sweepers at $400 each, how much operating income will the company make over the product’s life cycle? What is the operating income per unit? Required

- 2. Excluding the initial product design costs, what is the operating income in each of the three sales phases of the product’s life cycle, assuming the price stays at $400?

- 3. How would you explain the change in budgeted operating income over the product’s life cycle? What other factors does the company need to consider before developing the new vacuum sweeper?

- 4. Arnold is concerned about the operating income it will report in the first sales phase. It is considering pricing the vacuum sweeper at $450 for the first 6 months and decreasing the price to $400 thereafter. With this pricing strategy, Arnold expects to sell 10,000 units instead of 12,000 units in the first 6 months, and the same number of units for the remaining life cycle. Assuming the same cost structure given in the problem, which pricing strategy would you recommend? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

None

Abc

Ans

Chapter 13 Solutions

COST ACCOUNTING

Ch. 13 - What are the three major influences on pricing...Ch. 13 - Relevant costs for pricing decisions are full...Ch. 13 - Describe four purposes of cost allocation.Ch. 13 - How is activity-based costing useful for pricing...Ch. 13 - Describe two alternative approaches to long-run...Ch. 13 - What is a target cost per unit?Ch. 13 - Describe value engineering and its role in target...Ch. 13 - Give two examples of a value-added cost and two...Ch. 13 - It is not important for a company to distinguish...Ch. 13 - Prob. 13.10Q

Ch. 13 - Describe three alternative cost-plus pricing...Ch. 13 - Give two examples in which the difference in the...Ch. 13 - What is life-cycle budgeting?Ch. 13 - What are three benefits of using a product...Ch. 13 - Prob. 13.15QCh. 13 - Which of the following statements regarding price...Ch. 13 - Value-added, non-value-added costs. The Magill...Ch. 13 - Target operating income, value-added costs,...Ch. 13 - Target prices, target costs, activity-based...Ch. 13 - Target costs, effect of product-design changes on...Ch. 13 - Target costs, effect of process-design changes on...Ch. 13 - Cost-plus target return on investment pricing....Ch. 13 - Cost-plus, target pricing, working backward....Ch. 13 - Life-cycle budgeting and costing. Arnold...Ch. 13 - Considerations other than cost in pricing...Ch. 13 - Cost-plus, target pricing, working backward. The...Ch. 13 - Value engineering, target pricing, and target...Ch. 13 - Target service costs, value engineering,...Ch. 13 - Cost-plus, target return on investment pricing....Ch. 13 - Cost-plus, time and materials, ethics. C S...Ch. 13 - Cost-plus and market-based pricing. Georgia Temps,...Ch. 13 - Cost-plus and market-based pricing. (CMA, adapted)...Ch. 13 - Life-cycle costing. Maximum Metal Recycling and...Ch. 13 - Airline pricing, considerations other than cost in...Ch. 13 - Prob. 13.35PCh. 13 - Ethics and pricing. Instyle Interior Designs has...Ch. 13 - Value engineering, target pricing, and locked-in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi expert provide answerarrow_forwardHow much long term debt did the firm have?arrow_forwardWildhorse Windows manufactures and sells custom storm windows for three-season porches. Wildhorse also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be performed by other vendors. Wildhorse enters into the following contract on July 1, 2025, with a local homeowner. The customer purchases windows for a price of $2,650 and chooses Wildhorse to do the installation. Wildhorse charges the same price for the windows irrespective of whether it does the installation or not. The customer pays Wildhorse $1,988 (which equals the standalone selling price of the windows, which have a cost of $1,230) upon delivery and the remaining balance upon installation of the windows. The windows are delivered on September 1, 2025, Wildhorse completes installation on October 15, 2025, and the customer pays the balance due. (a) Wildhorse estimates the standalone selling price of the installation based on an estimated cost of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY