Suppose that each firm in a competitive industry has the following costs:

Total cost: TC = 50 + ½ q2

Marginal cost: MC = q

where q is an individual firm’s quantity produced.

The market demand curve for this product is

Demand: QD = 120 − P

where P is the

a. What is each firm’s fixed cost? What is its variable cost? Give the equation for

b. Graph average-total-cost curve and the marginal-cost curve for q from 5 to 15. At what quantity is average-total-cost curve at its minimum? What is marginal cost and average total cost at that quantity?

c Give the equation for each firm’s supply curve.

d. Give the equation for the market supply curve for the short run in which the number of firms is fixed.

e. What is the

f. In this equilibrium, how much does each firm produce? Calculate each firm’s profit or loss. Is there incentive for firms to enter or exit?

g. In the long run with free entry and exit, what is the equilibrium price and quantity in this market?

h. In this long-run equilibrium, how much does each firm produce? How many firms are in the market?

Subpart (a):

Calculate average total cost.

Explanation of Solution

The total cost equation, marginal cost equation and demand equation are given below:

The fixed cost and variable cost of each firm are determined from Equation (1). Here, the fixed cost is a part of the total cost and will not change in response to a change in quantity. The variable cost is a part of the total cost and it changes in response to a change in quantity. So, the fixed cost is $50 and the variable cost is

Average total cost equation is represented below:

Or

Concept introduction:

Average total cost: The average total cost is the total cost per unit of the output produced by a firm.

Subpart (b):

Draw average total cost curve.

Explanation of Solution

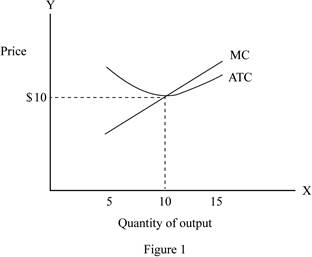

Figure 1 represents the average total cost curve and marginal cost curve.

From the above figure, the x-axis shows the quantity of the output and the y-axis shows the price level.

From the graph, the average total cost is at its minimum, when they produce 10 units of output. The average total cost and marginal cost are at the quantity of 10 units of output.

Concept introduction:

Average total cost: The average total cost is the total cost per unit of the output produced by a firm.

Subpart (c):

Supply curve.

Explanation of Solution

In the perfect competition, the supply curve is even, as the marginal cost curve is beyond the intersecting point of the average total cost curve.

Supply curve for each firm is shown below:

Concept introduction:

Marginal cost curve: The marginal cost is the additional cost incurred on the additional production and its curve is U-shaped, which represents the combination of price level and quantity of output.

Subpart (d):

Quantity supply.

Explanation of Solution

In the short-run, there are currently 9 firms. So, the market supply curve is determined by using the following formula:

Hence, the short-run market supply curve is shown below:

Concept introduction:

Supply: Supply refers to the total value of the goods and services that are available for the purchase at a particular price in a given period of time.

Subpart (e):

Equilibrium price and quantity.

Explanation of Solution

The equilibrium quantity and price are determined by using the following formula:

Substitute the respective values in Equation (8) to calculate the equilibrium quantity and price.

Thus, the equilibrium price is $12.

Substitute the price of $12 in Equation (3) to calculate the equilibrium quantity.

Thus, the equilibrium quantity is 108 units.

Concept introduction:

Equilibrium price: It is the price at which the quantity demanded of a good or service is equal to the quantity supplied.

Equilibrium: It is the market price and quantity determined by equating the supply to the demand. At this equilibrium point, the supply will be equal to the demand and there will be no excess demand or supply in the economy. Thus, the economy will be at equilibrium.

Subpart (f):

Calculate profit.

Explanation of Solution

In the short-run equilibrium, each firm produces 12 units

Profit can be calculated by using the following formula:

Substitute the respective values in Equation (9) to calculate the profit.

Thus, the profit is $22.

Since the firms have positive value in making profit, there will be a benefit for the firm entering the market.

Concept introduction:

Profit: Profit refers to the excess revenue after subtracting the total cost from the total revenue.

Subpart (g):

Equilibrium quantity.

Explanation of Solution

In the long-run, the firm earns zero economic profit, so the price is equal to the minimum average total cost. Since the average total cost is $10, the equilibrium price is also be $10.

Equilibrium quantity can be determined by using Equation (3), when the equilibrium price is $10.

Thus, the long-run equilibrium quantity is 110.

Concept introduction:

Equilibrium: It is the market price and quantity determined by equating the supply to the demand. At this equilibrium point, the supply will be equal to the demand and there will be no excess demand or supply in the economy. Thus, the economy will be at equilibrium.

Subpart (h):

Number of firms in the long run.

Explanation of Solution

In the long-run, the firm produces 10 units of output. This is because in the long-run, the production price of the firm is equal to the minimum average total cost. The average total cost is 10 units. Also, there are 11 firms

Long run: Thelong run refers to the time, which changes the production variable to adjust to the market situation.

Want to see more full solutions like this?

Chapter 13 Solutions

Essentials of Economics (MindTap Course List)

- Assume general inflation is 2.5% per year. What is the price tag in 8 years for an item that has an inflation rate of 4.5% that costs $700 today? Please show every step and formula, don't use excel. The answer should be $1203, thank you.arrow_forwardThe average cost of a certain model car was $22,000 ten years ago. This year the average cost is $35,000.(a) Calculate the average monthly inflation rate (fm) for this model.(b) Given the monthly rate fm, what is the effective annual rate, f, of inflation for this model?(c) Estimate what these will sell for 10 years from now, expressed in today’s dollars. Please show all steps and formulas, don't use excel. The answer should be (a) 0.3877%, (b) 4.753%, (c) $55,682arrow_forwardA mining corporation purchased $120,000 of production machinery and depreciated it using 40% bonus depreciation with the balance using 5-year MACRS depreciation, a 5-year depreciable life, and zero salvage value. The corporation is a profitable one that has a 22% combined incremental tax rate. At the end of 5 years the mining company changed its method of operation and sold the production machinery for $40,000. During the 5 years the machinery was used, it reduced mine operation costs by $32,000 a year before taxes. If the company MARR is 12% after taxes, was the investment in the machinery a satisfactory one? Please show every step with formulas and don't use excel. The answer should be 14.8%, thank you.arrow_forward

- An engineer is working on the layout of a new research and experimentation facility. Two operators will be required. If, however, an additional $100,000 of instrumentation and remote controls were added, the plant could be run by a single operator. The total before-tax cost of each plant operator is projected at $35,000 per year. The instrumentation and controls will be depreciated by means of a modified accelerated cost recovery system (MACRS). If this corporation (22% combined corporate tax rate) invests in the additional instrumentation and controls. how long will it take for the after-tax benefits to equal the $100,000 cost? In other words, what is the after-tax payback period? Please write out every step and formula, don't use excel. The answer should be 3.08 years, thank you.arrow_forwardThe effective combined tax rate in a firm is 28%. An outlay of $2 million for certain new assets is under consideration. Over the next 9 years, these assets will be responsible for annual receipts of $650,000 and annual disbursements (other than for income tax) of $225,000. After this time, they will be used only for stand-by purposes with no future excess of receipts over disbursements. (a) What is the prospective rate of return before income taxes? (b)What is the prospective rate of return after taxes if straight-line depreciation can be used to write off these assets for tax purposes in 9 years? (c) What is the prospective rate of return after taxes if it is assumed that these assets must be written off for tax purposes over the next 20 years, using straight-line depreciation? Please write out each step with formulas and don't use Excel. The answers should be (a)15.4% (b) 11.5% (c) 10.0%, thank youarrow_forward- 1. (Maximum length one page) Consider an infectious disease with the following characteristics: Individuals can exist in three states, susceptible, infected, and recovered. Once recovered, an individual cannot be re-infected and remains immune for life. The transmission rate, t, is 1/20. The recovery rate, k, is 1/5. Each person interacts randomly with others in the population and has contacts with 10 people each time period. There is no birth or death in the population. -Initially all people are susceptible. - No one dies from the disease and there is no treatment. a) Draw a compartmental model for this infectious disease.arrow_forward

- Consider an obstetrician who can perform two types of deliveries: normal deliveries and cesarean deliveries. Each typeof delivery provides different levels of income for the physician, and the physician has some ability to induce patientsto opt for cesarean deliveries. The model is as follows:The physician’s utility is defined as:U = U(Y, I)where:• Y is the income from performing deliveries.• I is the total disutility from inducementThe income Y from deliveries depends on the type of delivery:Y = Yn · N + YC · Cwhere:• Yn is the income per normal delivery, Yn = 1, 000• YC is the income per cesarean delivery, Yc = 1, 500,• Initial number of births Binitial = 100,• Post-shock number of births Bshock = 90,• a(i) = 0.1 + 0.05i is the fraction of total births that are cesareans, which increases with inducement level i,• the physician sets the inducement level to i = 2.• N = B · (1 − a(i)) is the number of normal deliveries,• C = B · a(i) is the number of cesarean deliveriesDue to a…arrow_forwardConsider an obstetrician who can perform two types of deliveries: normal deliveries and cesarean deliveries. Each typeof delivery provides different levels of income for the physician, and the physician has some ability to induce patientsto opt for cesarean deliveries. The model is as follows:The physician’s utility is defined as:U = U(Y, I)where:• Y is the income from performing deliveries.• I is the total disutility from inducementThe income Y from deliveries depends on the type of delivery:Y = Yn · N + YC · Cwhere:• Yn is the income per normal delivery, Yn = 1, 000• YC is the income per cesarean delivery, Yc = 1, 500,• Initial number of births Binitial = 100,• Post-shock number of births Bshock = 90,• a(i) = 0.1 + 0.05i is the fraction of total births that are cesareans, which increases with inducement level i,• the physician sets the inducement level to i = 2.• N = B · (1 − a(i)) is the number of normal deliveries,• C = B · a(i) is the number of cesarean deliveriesDue to a…arrow_forwardepidemiology. 2 to 3 setences max for each questionarrow_forward

- epidemilogy. one paragraph MAX for each question please.arrow_forwardA firm operates with the production function Q = K2 L. Q is the number of units of output per day when the firm rents K units of capital and employs L workers each day. The manager has been given a production target: to produce 8,000 units per day. She knows that the daily rental price of capital is $400 per unit and the wage rate is $200 day. a. What is the returns to scale of this production function? Show mathematically. b. Currently the firm employs 80 workers per day. What is the firm’s daily total cost if it rents just enough capital to produce at its target? c. Compare the marginal product per dollar spent on K and on L when the firm operates at the input choice in part (b). What does this suggest about the way the firm might change its choice of K and L if it wants to reduce the total cost in meeting its target? Explain your answer very clearly. d. In the long run, how much K and L should the firm choose if it wants to minimize the cost of producing 8,000 units of output a day?…arrow_forwardAndrew’s utility depends on consuming L, hours of leisure and Y a composite good. Andrew can work as many hours as he wants to at the wage rate of w, and the price of Y is $1. Andrew’s indifference curves exhibit diminishing MRS. When Andrew’s wage rate decreases, he spends less time working. Answer the following questions using a indifference curve-budget line diagram. Explain your answers carefully. a. Does the substitution effect cause him to work less hours? (If the direction of the effect is ambiguous, say so, and show why on your diagram) b. Does the income effect cause him to work less hours? (If the direction of the effect is ambiguous, say so, and show why on your diagram)arrow_forward

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning