Intermediate Accounting: Reporting and Analysis

2nd Edition

ISBN: 9781285453828

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 10P

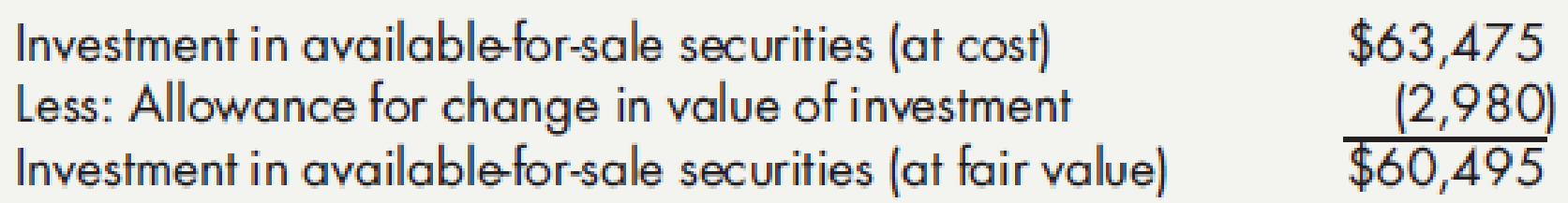

Available-for-Sale Investments Manson Incorporated reported the following current asset on its December 31, 2015,

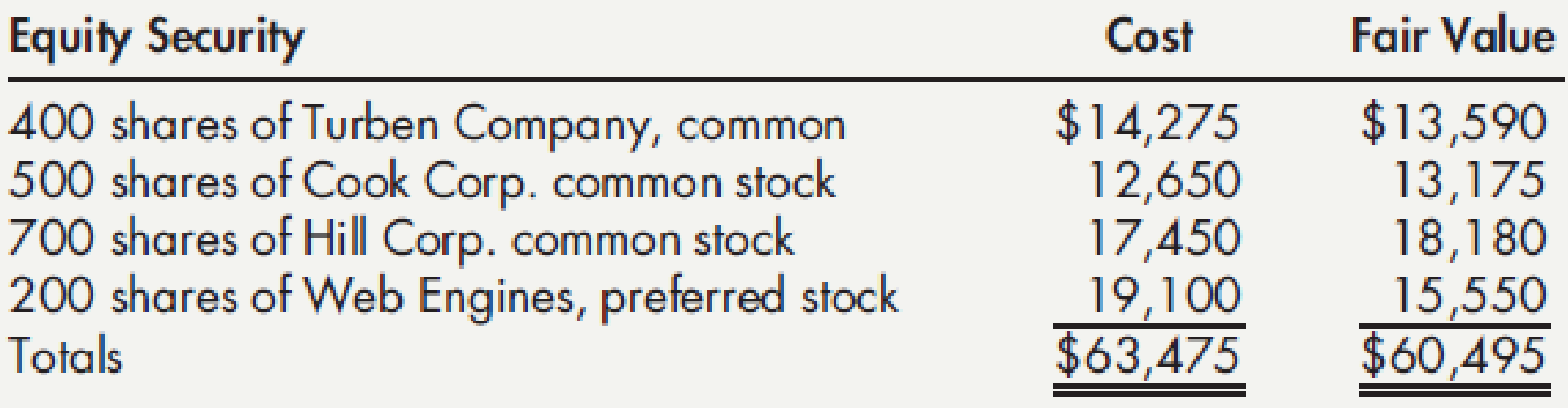

An analysis of Manson’s investments on December 31, 2015, reveals the following:

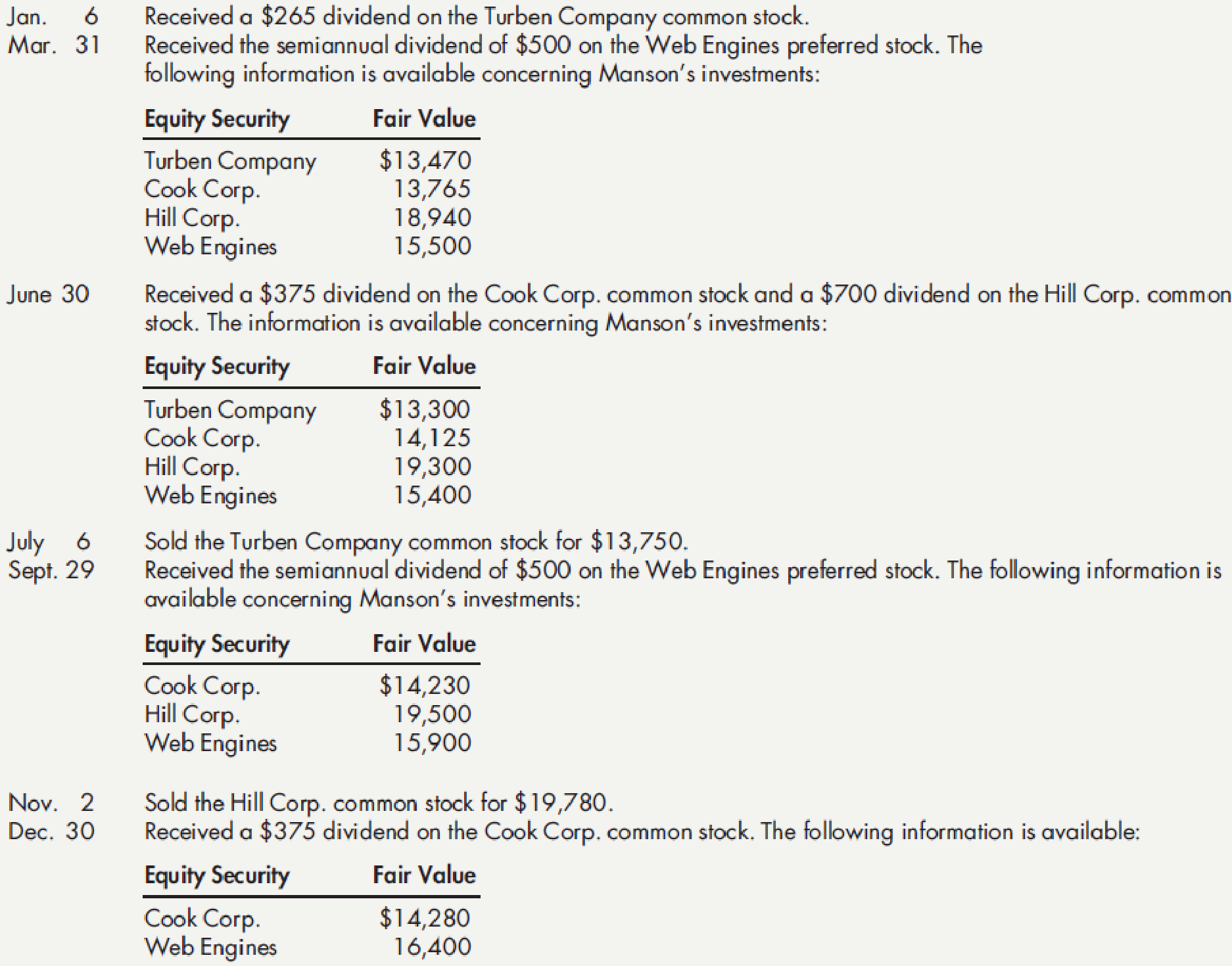

During 2016, the following transactions related to Manson’s investments occurred:

Required:

- 1. Assuming Manson prepares quarterly financial statements, prepare

journal entries to record the preceding information. - 2. Show the items of income or loss from investment transactions that Manson reports for each quarter of 2016.

- 3. Show how Manson’s investments are reported on the balance sheet on March 31, 2016; June 30, 2016; September 30, 2016; and December 31, 2016.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

provide correct answer

Please solve. The screen print is kind of split. Please look carefully.

Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a

commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-

purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of

multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct

labor hours are 96,300 or [1.5 hours x (54,000+10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the

predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for

the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial

models.

The company's managers identified six activity cost pools and related…

Chapter 13 Solutions

Intermediate Accounting: Reporting and Analysis

Ch. 13 - Prob. 1GICh. 13 - Provide brief definitions for the following terms:...Ch. 13 - Prob. 3GICh. 13 - Prob. 4GICh. 13 - Prob. 5GICh. 13 - Briefly summarize the accounting for an investment...Ch. 13 - Prob. 7GICh. 13 - Prob. 8GICh. 13 - Prob. 9GICh. 13 - Prob. 10GI

Ch. 13 - Prob. 11GICh. 13 - Prob. 12GICh. 13 - Prob. 13GICh. 13 - Prob. 14GICh. 13 - Briefly describe how to determine and record the...Ch. 13 - Prob. 16GICh. 13 - Prob. 17GICh. 13 - Prob. 18GICh. 13 - Prob. 19GICh. 13 - How does IFRS categorize minority passive...Ch. 13 - Prob. 21GICh. 13 - Prob. 22GICh. 13 - Prob. 23GICh. 13 - Prob. 24GICh. 13 - Prob. 25GICh. 13 - Prob. 26GICh. 13 - Prob. 27GICh. 13 - What is a fund? Distinguish between a fund and an...Ch. 13 - Prob. 29GICh. 13 - Prob. 30GICh. 13 - On January 1, 2016, Weaver Company purchased as...Ch. 13 - Prob. 2MCCh. 13 - Prob. 3MCCh. 13 - Prob. 4MCCh. 13 - Prob. 5MCCh. 13 - Prob. 6MCCh. 13 - A security in a portfolio of available-for-sale...Ch. 13 - Prob. 8MCCh. 13 - Cash dividends declared out of current earnings...Ch. 13 - Prob. 10MCCh. 13 - Prob. 1RECh. 13 - Prob. 2RECh. 13 - Prob. 3RECh. 13 - Prob. 4RECh. 13 - Prob. 5RECh. 13 - Prob. 6RECh. 13 - Prob. 7RECh. 13 - Prob. 8RECh. 13 - Prob. 9RECh. 13 - Prob. 10RECh. 13 - Prob. 11RECh. 13 - Prob. 12RECh. 13 - Prob. 13RECh. 13 - On January 1, Kilgore Inc. accepts a 20,000...Ch. 13 - Prob. 15RECh. 13 - Prob. 16RECh. 13 - Prob. 1ECh. 13 - Prob. 2ECh. 13 - Prob. 3ECh. 13 - Prob. 4ECh. 13 - Prob. 5ECh. 13 - Prob. 6ECh. 13 - Prob. 7ECh. 13 - Prob. 8ECh. 13 - Prob. 9ECh. 13 - Prob. 10ECh. 13 - Prob. 11ECh. 13 - Prob. 12ECh. 13 - Prob. 13ECh. 13 - Prob. 14ECh. 13 - Prob. 15ECh. 13 - Prob. 16ECh. 13 - Prob. 17ECh. 13 - Prob. 18ECh. 13 - Prob. 19ECh. 13 - Prob. 20ECh. 13 - Prob. 21ECh. 13 - Prob. 22ECh. 13 - Prob. 23ECh. 13 - Prob. 24ECh. 13 - Prob. 25ECh. 13 - Prob. 26ECh. 13 - Prob. 1PCh. 13 - Prob. 2PCh. 13 - Prob. 3PCh. 13 - Prob. 4PCh. 13 - Prob. 5PCh. 13 - Prob. 6PCh. 13 - Trading Securities 8th State Bank prepares interim...Ch. 13 - Available-for-Sale Securities Holly Company...Ch. 13 - Investments in Equity Securities Noonan...Ch. 13 - Available-for-Sale Investments Manson Incorporated...Ch. 13 - Prob. 11PCh. 13 - Prob. 12PCh. 13 - Prob. 13PCh. 13 - Prob. 14PCh. 13 - Prob. 15PCh. 13 - Prob. 16PCh. 13 - Prob. 17PCh. 13 - Prob. 18PCh. 13 - Prob. 19PCh. 13 - Prob. 20PCh. 13 - Prob. 21PCh. 13 - Prob. 22PCh. 13 - Prob. 23PCh. 13 - Prob. 1CCh. 13 - Investments in Securities Cane Company has two...Ch. 13 - Prob. 3CCh. 13 - Prob. 4CCh. 13 - Available-for-Sale Securities The following are...Ch. 13 - Prob. 6CCh. 13 - Prob. 7CCh. 13 - Prob. 8CCh. 13 - Prob. 9CCh. 13 - Prob. 10C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardThe completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forwardPlease given step by step explanation general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License