1.

Prepare the

1.

Explanation of Solution

Investment: It refers to the process of using the currently held excess cash to earn profitable returns in future. The investments can be made in equity securities such as shares or debt securities such as bonds.

Prepare the journal entries in the books of Company D for the year 2016.

| Date | Account Title and Explanation | Debit | Credit |

| February 3, 2016 | Investment in Available-for-sale Securities | $36,000 | |

| Cash | $36,000 | ||

| (To record the purchase of Company B's 3000 shares) | |||

| April 1, 2016 | Investment in Available-for-sale Securities | $20,000 | |

| Interest income (1) | $600 | ||

| Cash | $20,600 | ||

| (To record the purchase of Incorporation S's bonds) | |||

| June 30, 2016 | Cash | $1,950 | |

| Dividend income | $750 | ||

| Interest income (2) | $1,200 | ||

| (To record the interest and dividend received) | |||

| September 1, 2016 | Investment in Available-for-sale Securities | $88,000 | |

| Cash | $88,000 | ||

| (To record the purchase of Company W's 4000 shares) | |||

| November 1, 2016 | Investment in Available-for-sale Securities | $30,000 | |

| Interest income (3) | $1,375 | ||

| Cash | $31,375 | ||

| (To record the purchase of Incorporation W's bonds) | |||

| December 1, 2016 | Cash | $1,650 | |

| Interest income (4) | $1,650 | ||

| (To record the interest received from Company E's bond) | |||

| December 1, 2016 | Cash | $30,300 | |

| Investment in Available-for-sale Securities | $30,000 | ||

| Gain on sale of Available-for-sale Securities | $300 | ||

| (To record the sale of Company E's bond on profit) | |||

| December 30, 2016 | Cash | $750 | |

| Dividend income | $750 | ||

| (To record the dividend received for Company B's share) | |||

| December 30, 2016 | Cash | $35,300 | |

| Loss on sale of Available-for-sale Securities | $700 | ||

| Investment in Available-for-sale Securities | $36,000 | ||

| (To record the sale of Company B's share on loss) | |||

| December 31, 2016 | Cash | $1,200 | |

| Interest income (5) | $1,200 | ||

| (To record the interest received from Incorporation S's bond) | |||

| December 31, 2016 | Allowance for change in fair value of investment | $4,200 | |

| Unrealized holding gain/loss: Available-for-sale securities (7) | $4,200 | ||

| (To adjust the allowance and the unrealized gain on holding the Securities) |

Table (1)

Working note (1):

Determine the amount of interest income paid by Company D.

Working note (2):

Calculate the amount of interest income received from Incorporation S’s bond.

Working note (3):

Calculate the amount of interest income paid by Company D.

Working note (4):

Calculate the amount of interest income received from Company E’s bond.

Working note (5):

Calculate the amount of interest income.

Working note (6):

Determine the fair value of investment in Corporation W’s stock.

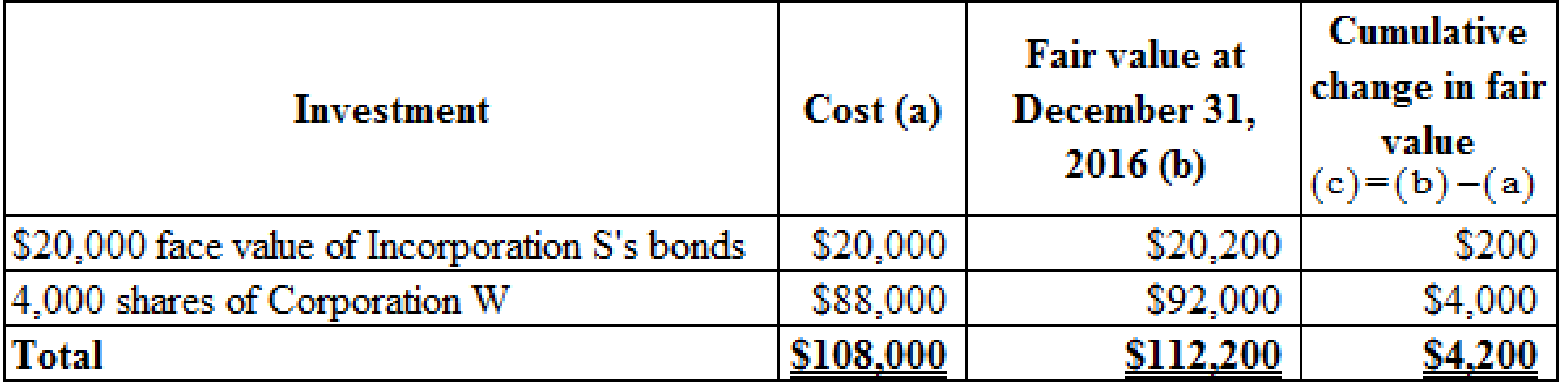

Working note (7):

Determine the net amount of unrealized gain or loss on available-for-sale securities as on December 31, 2016.

Table (2)

2.

Show the items of income or loss of Company D for the year ended December 31, 2016.

2.

Explanation of Solution

Show the items of income or loss of Company D for the year ended December 31, 2016.

| Particulars | Amount |

| Interest income (8) | $2,075 |

| Dividend income (9) | $1,500 |

| Loss on sale of available-for-sale securities | ($ 700) |

| Gain on sale of available-for-sale securities | $300 |

Table (3)

Working note (8):

Calculate the amount of interest income.

Working note (9):

Calculate the amount of dividend income.

3.

Show the carrying value of Company D’s investment in available-for-sale securities at its

3.

Explanation of Solution

Show the carrying value of Company D’s investment in available-for-sale securities at its balance sheet at December 31, 2016.

| Company D | |

| Balance sheet Statement (Partial) | |

| As at December 31, 2016 | |

| Assets | Amount |

| Current assets: | |

| Investment in available-for-sale securities (at cost) | $108,000 |

| Add : Allowance for change in fair value of investment | $4,200 |

| Investment in available-for-sale securities (at fair value) | $112,200 |

Table (4)

Want to see more full solutions like this?

Chapter 13 Solutions

Intermediate Accounting: Reporting and Analysis

- Provide answerarrow_forwardA firm sells 3,800 units of an item each year. The carrying cost per unit is $3.56 and the fixed costs per order are $84. What is the economic order quantity? (Please round units to the nearest whole number)arrow_forwardColson Manufacturing uses a job order costing system.During one month, Colson purchased $178,000 of raw materials on credit; issued materials to the production of $267,000 ofwhich $16,000 were indirect. Colson incurred a factory payroll of $192,000, of which $35,000 was indirect labor. Colson uses apredetermined overhead rate of 150% of direct labor cost. The total manufacturing costs added during the period are_.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning