Concept explainers

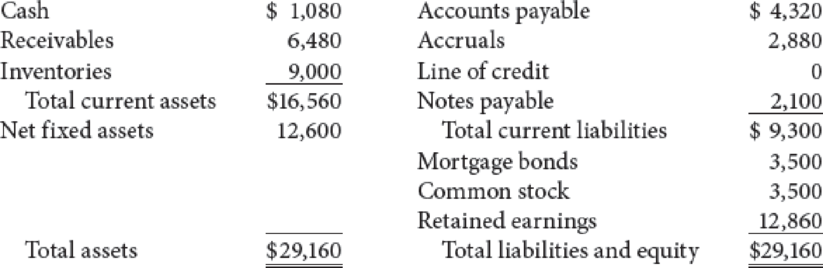

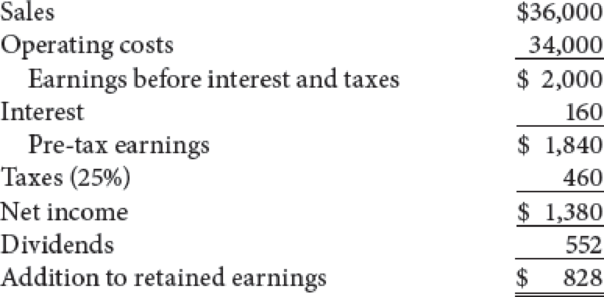

Stevens Textile Corporation’s 2019 financial statements are shown here. Stevens grew rapidly in 2019 and financed the growth with notes payable and long-term bonds. Stevens expects sales to grow by 15% in the next year but will finance the growth with a line of credit, not notes payable or long-term bonds. Use the

- a. What is the projected value for earnings before interest and taxes?

- b. What is the projected value for pre-tax earnings?

- c. What is the projected net income?

- d. What is the projected addition to retained earnings?

- e. What is the projected value of total current assets?

- f. What is the projected value of total assets?

- g. What is the projected sum of accounts payable, accruals, and notes payable?

- h. What is the forecasted line of credit?

Balance Sheet as of December 31, 2019 (Thousands of Dollars)

Income Statement for December 31, 2019 (Thousands of Dollars)

Trending nowThis is a popular solution!

Chapter 12 Solutions

FINANCIAL MANAGEMENT

- Don't used hand raiting and don't used Ai solutionarrow_forward3 years ago, you invested $9,200. In 3 years, you expect to have $14,167. If you expect to earn the same annual return after 3 years from today as the annual return implied from the past and expected values given in the problem, then in how many years from today do you expect to have $28,798?arrow_forwardPlease Don't use Ai solutionarrow_forward

- Ends Feb 2 Discuss and explain in detail the "Purpose of Financial Analysis" as well as the two main way we use Financial Ratios to do this.arrow_forwardWhat is the key arguments of the supporters of the EITC? Explain.arrow_forwardWhat is the requirements to be eligible to receive the EITC? Explain.arrow_forward

- Adidas annual income statement 2022-2023 and 2024arrow_forwardNikes annual balance sheet and income statement for 2022-2023 and 2024arrow_forwardWhat is the value at the end of year 3 of a perpetual stream of $70,000 semi-annual payments that begins at the end of year 7? The APR is 12% compounded quarterly.arrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT