Hatfield Medical Supply’s stock price had been lagging its industry averages, so its board of directors brought in a new CEO, Jaiden Lee. Lee had brought in Ashley Novak, a finance MBA who had been working for a consulting company, to replace the old CFO, and Lee asked Novak to develop the financial planning section of the strategic plan. In her previous job, Novak’s primary task had been to help clients develop financial

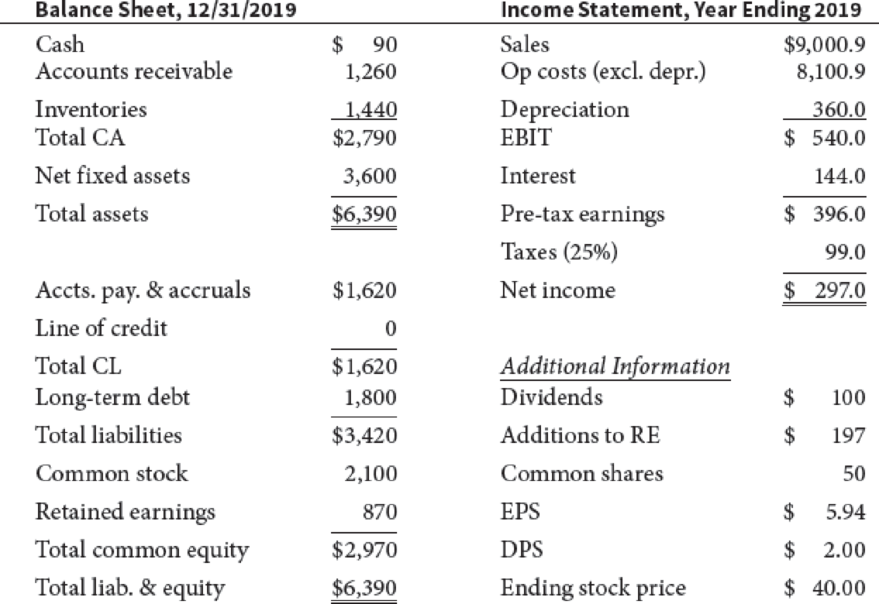

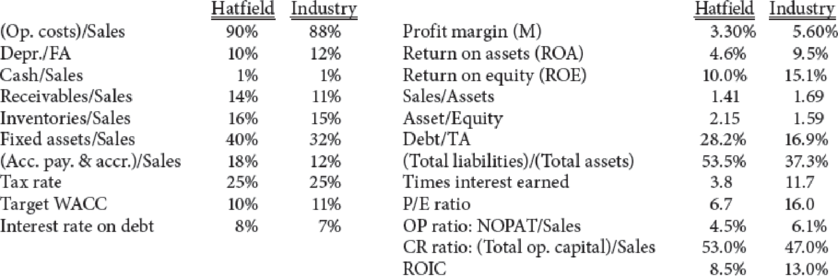

Novak began by comparing Hatfield’s financial ratios to the industry averages. If any ratio was substandard, she discussed it with the responsible manager to see what could be done to improve the situation. The following data show Hatfield’s latest financial statements plus some ratios and other data that Novak plans to use in her analysis.

Hatfield Medical Supply (Millions of Dollars, Except per Share Data)

Selected Additional Data for 2019

Using Hatfield’s data and its industry averages, how well run would you say Hatfield appears to be in comparison with other firms in its industry? What are its primary strengths and weaknesses? Be specific in your answer and point to various ratios that support your position. Also, use the DuPont equation (see Chapter 3) as one part of your analysis.

Trending nowThis is a popular solution!

Chapter 12 Solutions

FINANCIAL MANAGEMENT

- Don't used hand raiting and don't used Ai solutionarrow_forward3 years ago, you invested $9,200. In 3 years, you expect to have $14,167. If you expect to earn the same annual return after 3 years from today as the annual return implied from the past and expected values given in the problem, then in how many years from today do you expect to have $28,798?arrow_forwardPlease Don't use Ai solutionarrow_forward

- Ends Feb 2 Discuss and explain in detail the "Purpose of Financial Analysis" as well as the two main way we use Financial Ratios to do this.arrow_forwardWhat is the key arguments of the supporters of the EITC? Explain.arrow_forwardWhat is the requirements to be eligible to receive the EITC? Explain.arrow_forward

- Adidas annual income statement 2022-2023 and 2024arrow_forwardNikes annual balance sheet and income statement for 2022-2023 and 2024arrow_forwardWhat is the value at the end of year 3 of a perpetual stream of $70,000 semi-annual payments that begins at the end of year 7? The APR is 12% compounded quarterly.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning