Concept explainers

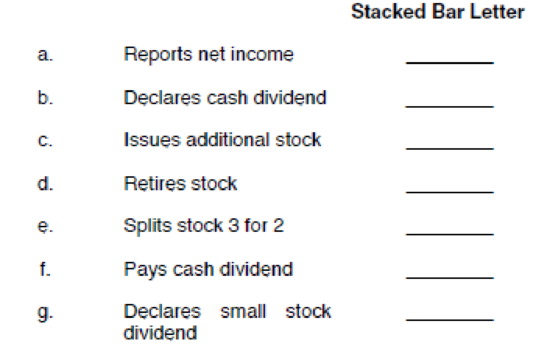

Click the Chart sheet tab. The stacked bar chart shows Chenʼs equity account balances at December 31, 2013. Match the stacked bars (A–G) that best describe what will happen to the equity accounts if the following transactions and events occur in 2014.

Letters may be repeated or not used. Consider each case independently.

When the assignment is complete, close the file without saving it again.

TICKLERS (optional)

Worksheet. Suppose that the $54,000 “Additional paid-in capital” balance at December 31, 2011, comes from two ledger accounts: $42,000 from Paid-in capital in excess of par and $12,000 from Paid-in capital from

Chart. Using the STOCKEQ4 file, prepare a column chart showing the dollar amount of each of the stockholdersʼ equity account balances at December 31, 2013. Treasury stock can be shown as a negative value. Enter your name somewhere on the chart. Save the file again as STOCKEQ4. Print the chart.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Excel Applications for Accounting Principles

- I want the correct answer accountingarrow_forward??!!arrow_forwardQuestion: The 2020 balance sheet of Serena's Sports Gear, Inc., showed long-term debt of $4.5 million, and the 2021 balance sheet showed long-term debt of $5.1 million. The 2021 income statement showed an interest expense of $135,000. What was the firm's cash flow to creditors during 2021? Answer this questionarrow_forward

- Link the examples of the supporting value chain activities to the correct term. Example Activities a. Attorneys writing contracts with suppliers b. Purchasing and installing supply chain software to evaluate supply chain performance c. Purchasing raw materials to use in the manufacturing process d. Determining the cost of one square foot of decking board product e. Hiring new production line workers Supporting Value Chain Activityarrow_forwardes Companies incur all sorts of costs to perform their business processes. Cost accountants will classify them in certain ways to understand them. Required: Classify the following company costs as period or products costs, and as prime and/or conversion costs. Company Costs a. Factory insurance b. Hourly production wages for employees working on assembly line c. Product marketing ing commissions d. Equipment repair e. Rent on factory building f. Corporate office maintenance g. Direct materials h. Business licenses Period or Product Costs Prime and or Conversion Costsarrow_forwardPlease provide answer this general accounting questionarrow_forward

- Question: The 2020 balance sheet of Serena's Sports Gear, Inc., showed long-term debt of $4.5 million, and the 2021 balance sheet showed long-term debt of $5.1 million. The 2021 income statement showed an interest expense of $135,000. What was the firm's cash flow to creditors during 2021?arrow_forward?!!arrow_forwardOmega Corp. has a material standard of 1.8 pounds per unit of output. Each pound has a standard price of $12 per pound. During March, Omega Corp. paid $48,600 for 4,050 pounds, which were used to produce 2,300 units. What is the direct materials quantity variance?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning