Concept explainers

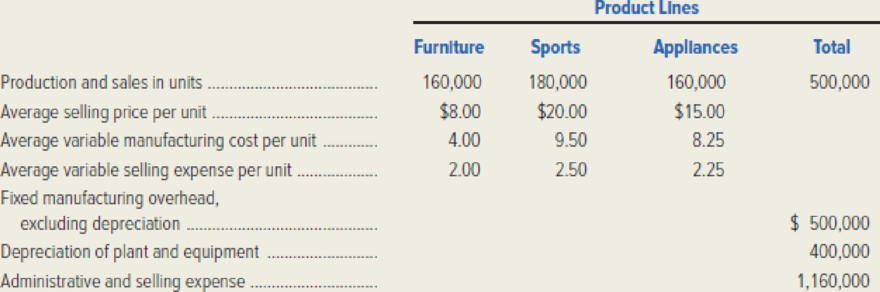

Pacific Rim Industries is a diversified company whose products are marketed both domestically and internationally. The company’s major product lines are furniture, sports equipment, and household appliances. At a recent meeting of Pacific Rim’s board of directors, there was a lengthy discussion on ways to improve overall corporate profitability. The members of the board decided that they required additional financial information about individual corporate operations in order to target areas for improvement.

Danielle Murphy, the controller, has been asked to provide additional data that would assist the board in its investigation. Murphy believes that income statements, prepared along both product lines and geographic areas, would provide the directors with the required insight into corporate operations. Murphy had several discussions with the division managers for each product line and compiled the following information from these meetings.

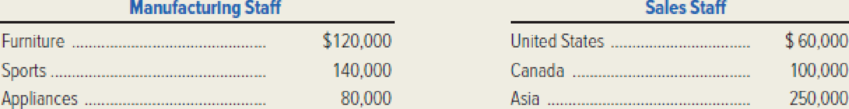

- 1. The division managers concluded that Murphy should allocate fixed manufacturing

overhead to both product lines and geographic areas on the basis of the ratio of the variable costs expended to total variable costs. - 2. Each of the division managers agreed that a reasonable basis for the allocation of

depreciation on plant and equipment would be the ratio of units produced per product line (or per geographical area) to the total number of units produced. - 3. There was little agreement on the allocation of administrative and selling expenses, so Murphy decided to allocate only those expenses that were traceable directly to a segment. For example, manufacturing staff salaries would be allocated to product lines, and sales staff salaries would be allocated to geographic areas. Murphy used the following data for this allocation.

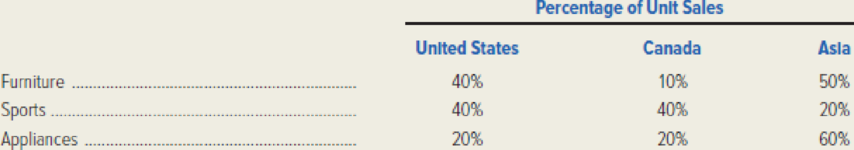

- 4. The division managers were able to provide reliable sales percentages for their product lines by geographical area.

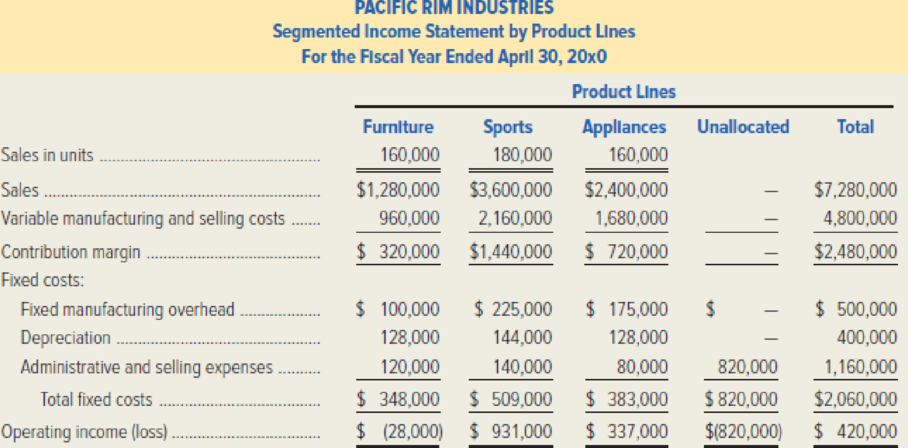

Murphy prepared the following product-line income statement based on the data presented above.

Required:

- 1. Prepare a segmented income statement for Pacific Rim Industries based on the company’s geographical areas. The statement should show the operating income for each segment.

- 2. As a result of the information disclosed by both segmented income statements (by product line and by geographic area), recommend areas where Pacific Rim Industries should focus its attention in order to improve corporate profitability.

1.

Prepare a segmented income statement for Industry P based on the geographical areas of the company.

Explanation of Solution

Segment reporting: Segment reporting refers to the process of preparing accounting report by segment and for the entire organization. Several organizations prepare segmented income statements to show the income for major segments and for the enterprise as a whole.

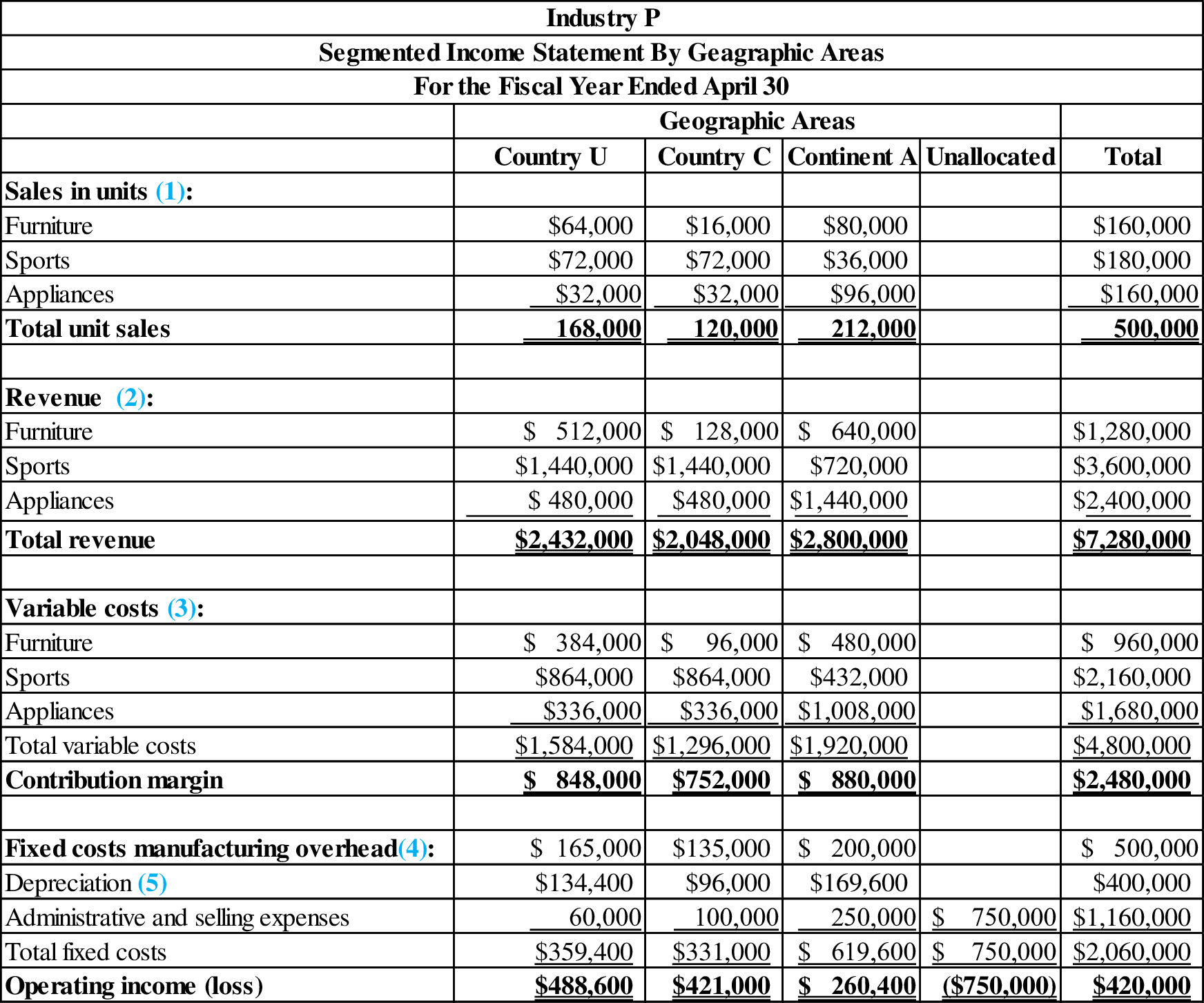

Prepare a segmented income statement:

Figure (1)

Working notes:

(1)Calculate sales in units:

| Total Units | × | % of Sales | = | Units Sold | |

| Country U | |||||

| Furniture | 160,000 | × | 0.4 | = | 64,000 |

| Sports | 180,000 | × | 0.4 | = | 72,000 |

| Appliances | 160,000 | × | 0.2 | = | 32,000 |

| Country C | |||||

| Furniture | 160,000 | × | 0.1 | = | 16,000 |

| Sports | 180,000 | × | 0.4 | = | 72,000 |

| Appliances | 160,000 | × | 0.2 | = | 32,000 |

| Continent A | |||||

| Furniture | 160,000 | × | 0.5 | = | 80,000 |

| Sports | 180,000 | × | 0.2 | = | 36,000 |

| Appliances | 160,000 | × | 0.6 | = | 96,000 |

Table (1)

(2)Calculate revenue:

|

Units Sold (a) |

Unit Price (b) |

Revenue | |

| Country U | |||

| Furniture | 64,000 | $8.00 | $ 512,000 |

| Sports | 72,000 | $20 | $1,440,000 |

| Appliances | 32,000 | $15 | $480,000 |

| Country C | |||

| Furniture | 16,000 | $8 | $128,000 |

| Sports | 72,000 | $20 | $1,440,000 |

| Appliances | 32,000 | $15 | $480,000 |

| Continent A | |||

| Furniture | 80,000 | $8 | $640,000 |

| Sports | 36,000 | $20 | $720,000 |

| Appliances | 96,000 | $15 | $1,440,000 |

Table (2)

(3)Calculate variable costs:

|

Units Sold (a) |

Variable manufacturing Cost per unit (b) |

Variable selling Cost per unit (c) |

Total variable cost | |

| Country U | ||||

| Furniture | 64,000 | $4 | $2 | $384,000 |

| Sports | 72,000 | $10 | $3 | $864,000 |

| Appliances | 32,000 | $8 | $2 | $336,000 |

| Country C | ||||

| Furniture | 16,000 | $4 | $2 | $96,000 |

| Sports | 72,000 | $10 | $3 | $864,000 |

| Appliances | 32,000 | $8 | $2 | $336,000 |

| Continent A | ||||

| Furniture | 80,000 | $4 | $2 | $480,000 |

| Sports | 36,000 | $10 | $3 | $432,000 |

| Appliances | 96,000 | $8 | $2 | $1,008,000 |

Table (3)

(4)Calculate manufacturing overhead:

|

Total Manufacturing Overhead (a) | Area Variable costs |

Proportion of Total (b) |

Allocated Manufacturing Cost | |

| Country U | $500,000 | $1,584,000 | 33% | $165,000 |

| Country C | $500,000 | $1,296,000 | 27% | $135,000 |

| Continent A | $500,000 | $1,920,000 | 40% | $200,000 |

| Total | $4,800,000 | $500,000 |

Table (4)

(5)Calculate depreciation expense:

|

Total Manufacturing Overhead (a) | Area Variable costs |

Proportion of Total (b) |

Allocated Manufacturing Cost | |

| Country U | $400,000 | $168,000 | 33.60% | $134,400 |

| Country C | $400,000 | $120,000 | 24.00% | $96,000 |

| Continent A | $400,000 | $212,000 | 42.40% | $ 169,600 |

| Total | $500,000 | $400,000 |

Table (5)

2.

Recommend areas in which Industry P must focus its attention in order to improve corporate profitability.

Explanation of Solution

Areas where the management of the company must focus its attention in order to enhance corporate profitability include the following:

The income statement by product line provides that the furniture product might not be profitable. The product line of furniture does not have a “positive contribution”. Conversely, the “fixed costs allocated” to the product line will result in a loss. The management must investigate the following factors:

- Discontinuing the manufacture of furniture and focusing on the other product lines that are profitable more.

- Cutting variable costs linked with product line of furniture.

- The probability of maximizing volume by cutting prices or increasing advertising will result in a larger total contribution margin.

- The probability of maximizing the selling price of these products.

- Calculate the amount of fixed costs assigned to furniture is separable if the product line is dropped.

Want to see more full solutions like this?

Chapter 12 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L