1.

Prepare a segmented income statement for Company S.

1.

Explanation of Solution

Segment reporting: Segment reporting refers to the process of preparing accounting report by segment and for the entire organization. Several organizations prepare segmented income statements to show the income for major segments and for the enterprise as a whole.

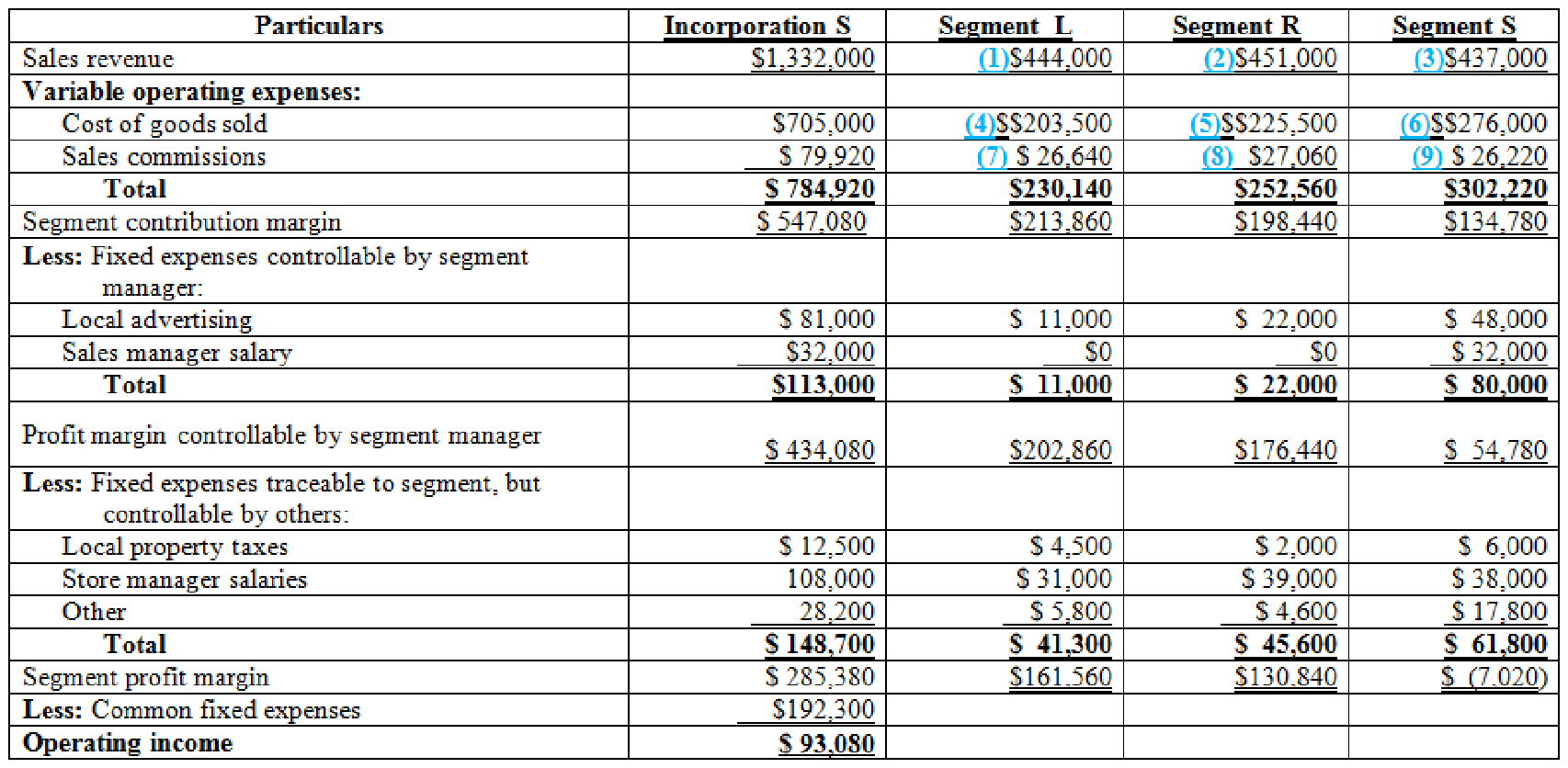

Prepare a segmented income statement:

Figure (1)

Working notes:

(1)Calculate the sales revenue for Segment L:

(2)Calculate the sales revenue for Segment R:

(3)Calculate the sales revenue for Segment S:

(4)Calculate the cost of goods sold for Segment L:

(5)Calculate the cost of goods sold for Segment R:

(6)Calculate the cost of goods sold for Segment S:

(7)Sales commissions for Segment L:

(8)Sales commissions for Segment R:

(9)Sales commissions for Segment S:

2.

Find out the weakest-performing store and present an analysis of the probable causes of poor performance.

2.

Explanation of Solution

- Segment S is the weakest segment due to the several factors.

- Segment L and Segment R has greater markups on cost 118% and 100% correspondingly. However, markups on cost for Segment S are only 58%.

- Segment S is the only store which has a sales manager and spends more on advertising than segment L and segment R.

- Segment S is having the lowest gross dollar sales while compared to the other two stores and Segment R’s return on these outlays seems inadequate.

- Segment S’s “other” non-controllable costs are much higher than Segment L and Segment R.

3.

Explain whether CEO should use a store’s segment contribution margin, identify whether the profit margin is controllable by the store manager or a stores’ segment profit margin while evaluation the performance of store manager.

3.

Explanation of Solution

- Incorporation S uses responsibility accounting system wherein, the managers and centers are measured on the basis of items under their control.

- Decision should be made by studying the profit margin controllable by the store, since this is a personnel type of decision making.

- The contribution margin of the segment not include fixed costs under the control of the store manager, in contrast , a profit margin of the segment reflects all traceable costs whether controllable or not.

Want to see more full solutions like this?

Chapter 12 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning