Concept explainers

Cost Allocation for Travel Reimbursement

Your company has a travel policy that reimburses employees for the “ordinary and necessary” costs of business travel. Employees often mix a business trip with pleasure by either extending the time at the destination or traveling from the business destination to a nearby resort or other personal destination. When this happens, an allocation must be made between the business and personal portions of the trip. However, the travel policy is unclear on the allocation method to follow.

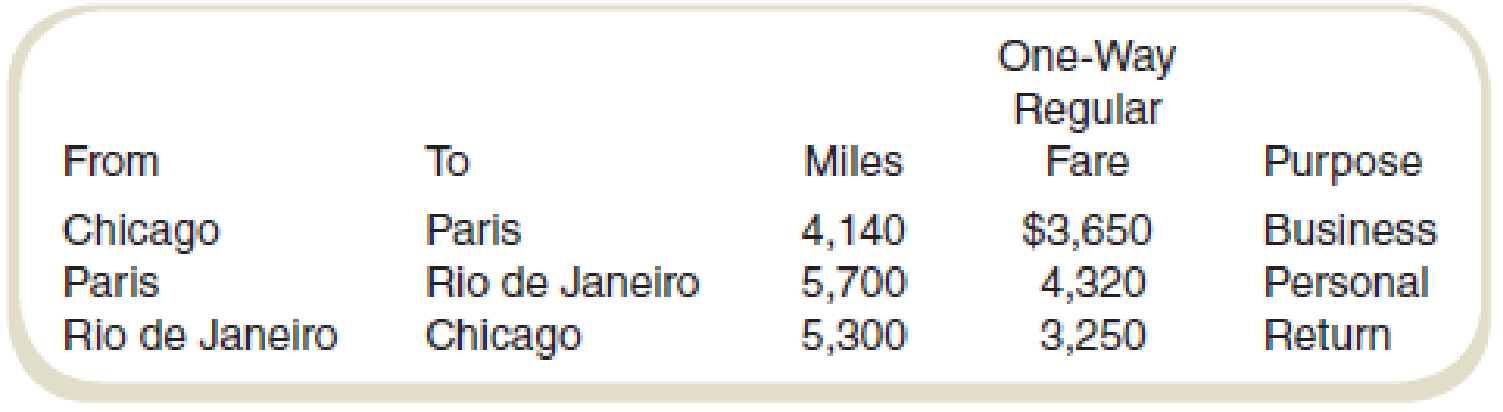

Consider this example. An employee obtained a business-class ticket for $9,537 and traveled the following itinerary:

On the date of the flights between Chicago and Paris (and return), a restricted round-trip fare of $4,900 was available.

Required

- a. Compute the business portion of the airfare and state the basis for the indicated allocation that is appropriate according to each of the following independent scenarios:

- 1. Based on the maximum reimbursement for the employee.

- 2. Based on the minimum cost to the company.

- b. Write a short report to management explaining the method that you think should be used and why. You do not have to restrict your recommendation to either of the methods in requirement (a).

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Fundamentals of Cost Accounting

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning