Fundamentals of Cost Accounting

6th Edition

ISBN: 9781260708783

Author: LANEN, William

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 40E

Alternative Allocation Bases

Thompson Aeronautics repairs aircraft engines. The company’s Purchasing Department supports its two departments, Defense and Commercial. The Defense division has contracts with the Department of Defense and the Commercial division works primarily with domestic airlines and air freight companies. The cost of the Purchasing Department is $6 million annually.

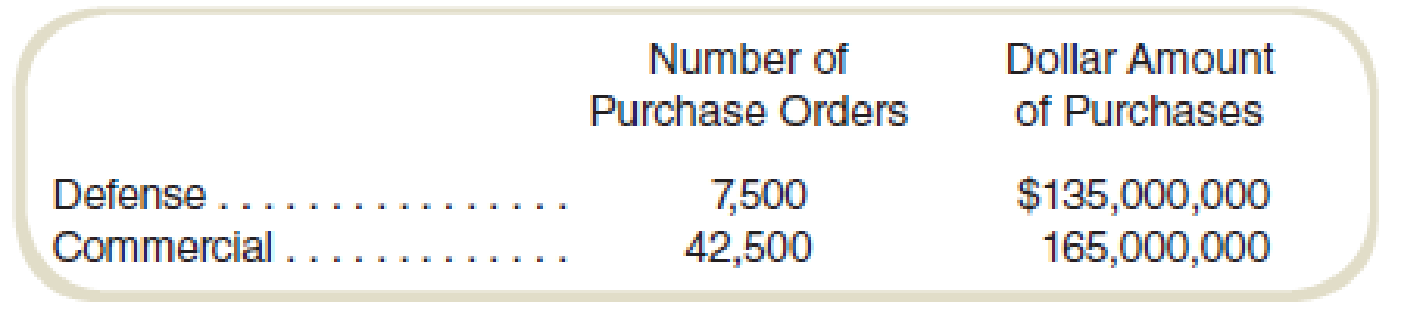

Information on the activity of the Purchasing Department for the last year follows:

Required

- a. What is the cost charged to each division if Thompson allocates Purchasing Department costs based on the number of purchase orders?

- b. What is the cost charged to each division if Thompson allocates Purchasing Department costs based on the dollar amount of the purchases?

- c. Contracts with the Defense Department are on a cost-plus fixed fee basis, meaning the price is based on the cost of repairing an engine, including any

overhead assigned to the division. Contracts with commercial airlines and air freight companies are almost all fixed price, meaning the price does not depend directly on the cost. Will this affect Thompson’s choice of an allocation base? Should it?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What would be the total amount of receivable related to this loan

MEG Adventures pays $525,000 plus $13,000 in closing costs to buy out a competitor. The real estate consists of land appraised at $62,000, a building appraised at $211,400, and paddleboats appraised at $255,400. Compute the cost that should be allocated to the building.

For your initial post, answer the following questions on this course MGT 305

What has been the most confusing information from the course and why?

What has been the most interesting topic and why?

Chapter 12 Solutions

Fundamentals of Cost Accounting

Ch. 12 - What does decentralization mean in the context of...Ch. 12 - Why is performance measurement an important...Ch. 12 - Prob. 3RQCh. 12 - What does dysfunctional decision making refer to?Ch. 12 - Prob. 5RQCh. 12 - What are the five basic kinds of decentralized...Ch. 12 - What is goal congruence? How is it different from...Ch. 12 - Prob. 8RQCh. 12 - What is relative performance evaluation?Ch. 12 - Prob. 10RQ

Ch. 12 - Prob. 11RQCh. 12 - Prob. 12RQCh. 12 - The management control system collects information...Ch. 12 - Salespeople are often paid a commission based on...Ch. 12 - Prob. 15CADQCh. 12 - Prob. 16CADQCh. 12 - On December 30, a manager determines that income...Ch. 12 - Prob. 18CADQCh. 12 - Prob. 19CADQCh. 12 - The manager of an operating department just...Ch. 12 - In the previous chapters, we considered different...Ch. 12 - A company has a bonus plan that states that...Ch. 12 - Prob. 23CADQCh. 12 - Prob. 24CADQCh. 12 - Prob. 25CADQCh. 12 - Prob. 26CADQCh. 12 - Prob. 27CADQCh. 12 - Prob. 28CADQCh. 12 - Prob. 29ECh. 12 - Evaluating Management Control SystemsEthical...Ch. 12 - Prob. 31ECh. 12 - Management Control Systems and Incentives A...Ch. 12 - Prob. 33ECh. 12 - Prob. 34ECh. 12 - Prob. 35ECh. 12 - Alternative Allocation Bases: Service Bartolo...Ch. 12 - Prob. 37ECh. 12 - Single versus Dual Rates: Ethical Considerations A...Ch. 12 - Single versus Dual Rates

Using the data for the...Ch. 12 - Alternative Allocation Bases Thompson Aeronautics...Ch. 12 - Tone at the Top, Ethics Once upon a time, a major...Ch. 12 - Prob. 42ECh. 12 - Prob. 43ECh. 12 - Internal Controls Commonly in many organizations,...Ch. 12 - Evaluating Management Control Systems SPG Company...Ch. 12 - Analyze Performance Report for Decentralized...Ch. 12 - Divisional Performance Measurement: Behavioral...Ch. 12 - Prob. 48PCh. 12 - Prob. 49PCh. 12 - Cost Allocations: Comparison of Dual and Single...Ch. 12 - Cost Allocation for Travel Reimbursement Your...Ch. 12 - Incentives, Illegal Activities, and Ethics An...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License