Concept explainers

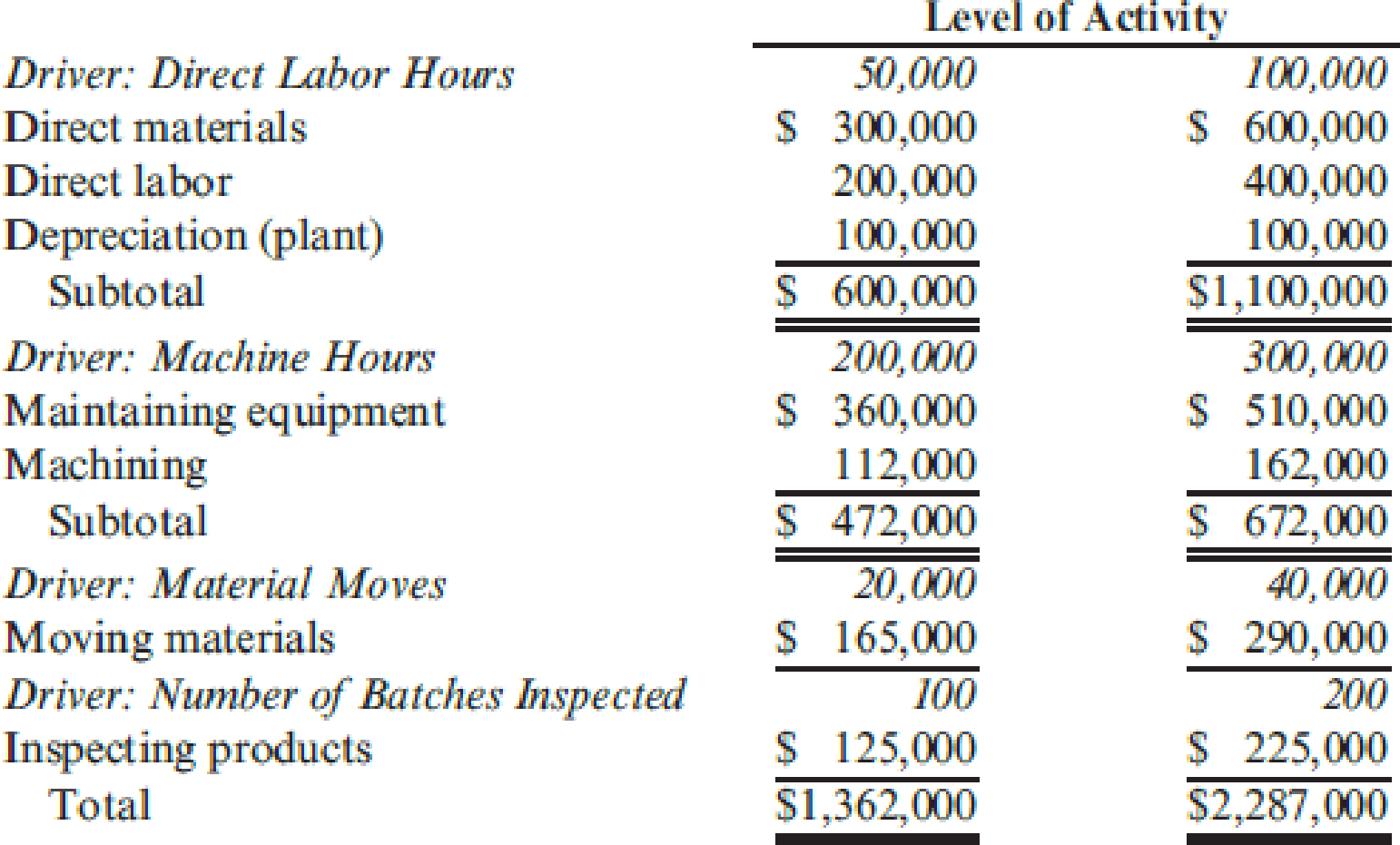

Douglas Davis, controller for Marston, Inc., prepared the following budget for

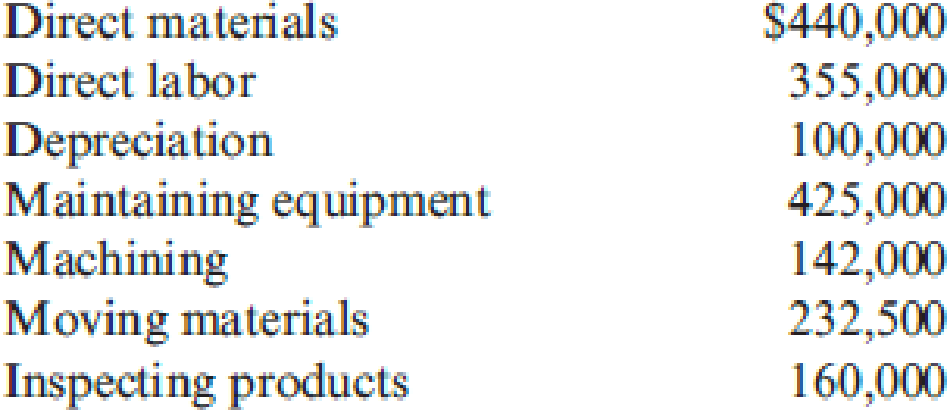

During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred:

Marston applies

Required:

- 1. Prepare a performance report for Marston’s manufacturing costs in the current year.

- 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost.

- 3. One of Marston’s managers said the following: “Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at $10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of $30,000 per year. Also, I know that fuel costs about $0.25 per move.”

Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)

1.

Make a performance report for incorporation M manufacturing costs for the current year.

Explanation of Solution

Prepare a performance report for incorporation M.

| Incorporation M | |||

| Performance Report | |||

| For the year 20X1 | |||

| Particulars | Actual costs | Budgeted costs | Budget variance |

| Direct materials | $ 440,000 | $ 480,000(1) | $40,000 F |

| Direct labour | 355,000 | 320,000(2) | 35,000 U |

| Depreciation | 100,000 | 100,000 | 0 |

| Maintaining equipment | 425,000 | 435,000(3) | 10,000 F |

| Machining | 142,000 | 137,000(4) | 5,000 U |

| Moving materials | 232,500 | 240,000(5) | 7,500 F |

| Inspecting products | 160,000 | 145,000(6) | 15,000 U |

| Total | $ 1,854,500 | $ 1,857,000 | $2,500 F |

Table (1)

Therefore, the budget variance of incorporation M for the year 20X1 is $2,500 favourable.

Note: Budgeted costs are determined using the appropriate cost driver for each method, under the high-low method.

Working notes:

(1)

(2)

(3)

The fixed and variable costs portions of maintaining equipment is calculated using high-low method as follows:

Therefore,

(4)

The fixed and variable costs portion of machining is calculated using high-low method as follows:

Therefore,

(5)

The fixed and variable costs portion of moving materials is calculated using high-low method as follows:

Therefore,

(6)

The fixed and variable costs portion of inspecting products is calculated using high-low method as follows:

Therefore,

2.

Determine the budgeted unit manufacturing cost for Incorporation M.

Explanation of Solution

Compute the pool rates:

Note: The pool (a) incorporates both material and labor costs. The total for each pool represents the appropriate costs related to the given driver in the flexible budget. The totals represent the second activity level of the budget.

Ascertain the unit cost:

| Pool | Calculation | Amount ($) |

| a | $ 110,000 | |

| b | $ 33,600 | |

| c | $ 3,625 | |

| d | $ 5,625 | |

| Total | $ 152,850 | |

| Divide: Units | 10,000 units | |

| Unit cost | | $ 15.29 (rounded off) |

Table (1)

Thus, the unit cost for the incorporation M is $15.29.

3.

Describe how activity-based budgeting may provide useful information for non-value-added activities.

Explanation of Solution

To provide more insight into controlling the activity and its associated cost, it is necessary to have significant knowledge about how the resource costs change with activity drivers and the consumption of resources by each activity.

Example: - The moving material is deemed to be a non-value-added activity, and efforts should be made to diminish the demands for this activity. If the number of moves can able to decrease to 20,000 from the expected 40,000, then the costs can be reduced by not only eliminating the need for the four operators, but also by decreasing the demand to lease from four to two forklifts. Whereas, while considering in the short run, if the demand for their service is reduced, then the cost of leasing forklifts may insist.

| Particulars | 20,000 moves | 40,000 moves |

| Materials handling: | ||

| Forklifts | $ 40,000 | $ 40,000 |

| Operators | $ 120,000 | $ 240,000 |

| Fuel | $ 5,000 | $ 10,000 |

| Total | $ 165,000 | $ 290,000 |

Table (2)

The information assumes that the forklift leases has to be continued in the short run, but the number of operators should be cut down and it is assumed that each operator can do 5,000 moves per year. An extra benefit of $20,000 can be achieved by subleasing the two forklifts. Therefore, the budget, points out that by reducing the requirement for materials handling to 20,000 moves will enable to save between $125,000 and $145,000 relative to the 40,000-move level. If the activity requirement is reduced to nil, an additional amount of up to $165,000 can able to save.

Want to see more full solutions like this?

Chapter 12 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College