Stock transaction for corporate expansion

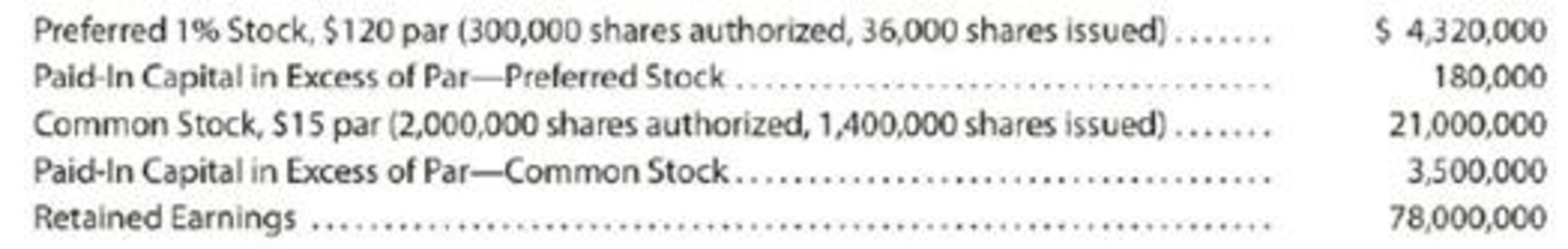

Pulsar Optics produces medical lasers for use in hospitals. The accounts and their balances appear in the ledger of Pulsar Optics on April 30 of the current year as follows:

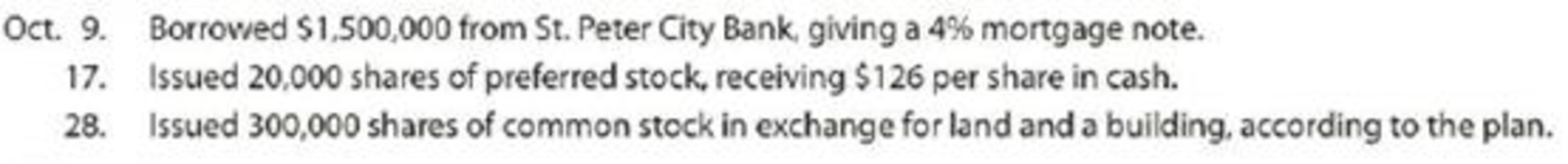

At the annual stockholders’ meeting on August 5, the board of directors presented a plan for modernizing and expanding plant operations at a cost of approximately $9,000,000. The plan provided (a) that the corporation borrow $1,500,000, (b) that 20,000 shares of the unissued

Instructions

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Financial And Managerial Accounting

- Company B had an estimated 230,000 direct labor hours, $486,000 manufacturing overhead, and 27,000 machine hours. The actual were 220,700 direct labor hours, 38,600 machine hours, and $505,000 manufacturing overhead. They determine overhead based upon machine hours. Calculate the predetermined overhead rate.arrow_forwardWhat is the value of ending long term debt? Answer pleasearrow_forwardcan you please solve thisarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,