Concept explainers

Entries for selected corporate transactions

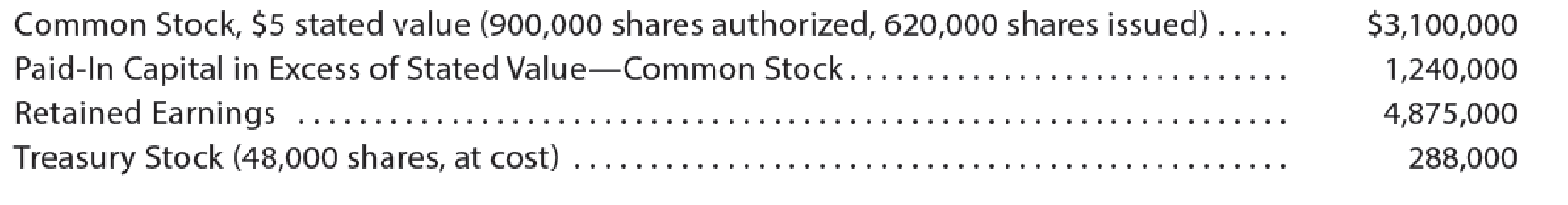

Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Navo-Go Enterprises’ stockholders’ equity accounts, with balances on January 1, 20Y1, are as follows:

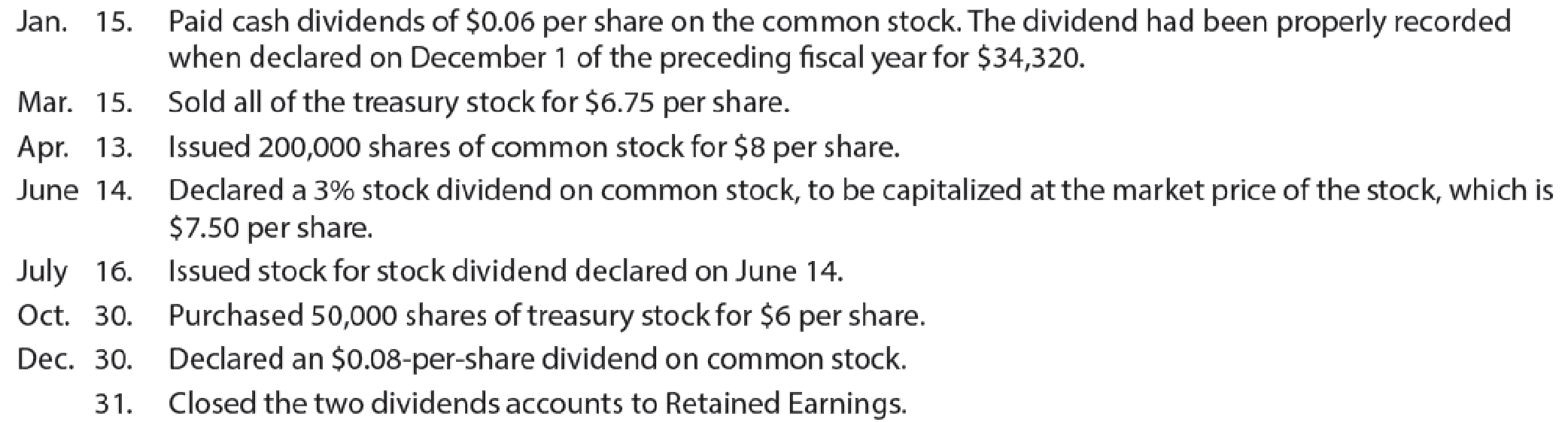

The following selected transactions occurred during the year:

Instructions

- 1. Enter the January 1 balances in T accounts for the stockholders’ equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of

Treasury Stock ; Stock Dividends Distributable; Stock Dividends; Cash Dividends. - 2.

Journalize the entries to record the transactions, and post to the eight selected accounts. Assume that the closing entry for revenues and expenses has been made and post net income of $775,000 to theretained earnings account. - 3. Prepare a statement of stockholders’ equity for the year ended December 31, 20Y1. Assume that net income was $775,000 for the year ended December 31, 20Y6.

- 4. Prepare the “Stockholders’ Equity” section of the December 31, 20Y1, balance sheet.

(1) and (2)

Journalize the transactions and post to the eight selected accounts.

Explanation of Solution

Common stock: These are the ordinary shares that a corporation issues to the investors in order to raise funds. In return, the investors receive a share of profit from the profits earned by the corporation in the form of dividend.

Treasury Stock: It refers to the shares that are reacquired by the corporation that are already issued to the stockholders, but reacquisition does not signify retirement.

Par value: It refers to the value of a stock that is stated by the corporation’s charter. It is also known as face value of a stock.

Stated value: It refers to an amount per share, which is assigned by the board of directors to no par value stock.

Issue of common stock for non-cash assets or services: Corporations often issue common stock for the services received from attorneys or consultants as compensation, or for the purchase of non-cash assets such as land, buildings, or equipment.

Record the transactions for Incorporation NE.

| Date | Account Titles and Explanation | Debit ($) | Credit ($) | |

| 20Y1 | ||||

| January | 15 | Cash Dividends Payable | 34,320 | |

| Cash | 34,320 | |||

| (To record the payment of cash dividends) | ||||

| March | 15 | Cash | 324,000 | |

|

Treasury stock | 288,000 | |||

|

Paid-in capital from treasury stock | 36,000 | |||

| (To record sale of treasury stock for above the cost price of $6 per share) | ||||

| April | 13 | Cash | 1,600,000 | |

| Common Stock | 1,000,000 | |||

|

Paid-in Capital in Excess of stated value Common Stock | 600,000 | |||

| (To record issuance of 200,000 shares in excess of stated value) | ||||

| June | 14 | Stock Dividends (4) | 184,500 | |

|

Common Stock Dividends Distributable (5) | 123,000 | |||

|

Paid-in Capital in excess of Stated Value-Common stock (6) | 61,500 | |||

| (To record the declaration of stock dividends) | ||||

| July | 16 | Common Stock Dividends Distributable (5) | 123,000 | |

| Common Stock | 123,000 | |||

| (To record the distribution of stock dividends) | ||||

| October | 30 | Treasury stock | 300,000 | |

| Cash | 300,000 | |||

| (To record the purchase of 50,000 shares of treasury stock) | ||||

| December | 30 | Cash Dividends (8) | 63,568 | |

| Cash Dividends Payable | 63,568 | |||

| (To record the declaration of cash dividends) | ||||

| December | 31 | Retained Earnings | 248,068 | |

| Stock dividends (4) | 184,500 | |||

| Cash Dividends (8) | 63,568 | |||

| (To record the closing of stock dividends and cash dividends to retained earnings account) | ||||

Table (1)

Working note:

(1)

Calculate treasury stock cost per share.

(2)

Compute number of shares outstanding after the issuance of common stock on April 13.

(3)

Compute the stock dividends shares.

(4)

Compute the stock dividends amount payable to common stockholders.

(5)

Compute common stock dividends distributable value.

(6)

Compute paid-in capital in excess of par value-common stock.

(7)

Compute number of shares outstanding as on December 30.

(8)

Calculate the amount of cash dividend declared on December 28.

Enter the beginning balance and post the transactions into the stockholders’ equity accounts for Incorporation NE.

Common stock account is a component of stockholder’s equity with a normal credit balance.

| Common stock | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| January 1 | Balance | $3,100,000 | |||

| April 13 | Cash | $1,000,000 | |||

| July 16 | Stock dividends distributable | $123,000 | |||

| Total | $ 0 | Total | 4,223,000 | ||

| December 31 | Balance | $4,223,000 | |||

Table (2)

Paid-in capital in excess of stated value - Common stock account is a component of stockholder’s equity with a normal credit balance.

| Paid-in capital in excess of stated value - Common stock | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| January 1 | Balance | $1,240,000 | |||

| April 13 | Cash | $600,000 | |||

| June 14 | Stock dividends | $61,500 | |||

| Total | $ 0 | Total | $ 1,901,500 | ||

| December 31 | Balance | $ 1,901,500 | |||

Table (3)

Retained earnings are a component of stockholder’s equity with a normal credit balance.

| Retained earnings | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| December 31 | Cash and stock dividends | $248,068 | January 1 | Balance | $4,875,000 |

| December 31 | Income summary | $775,000 | |||

| Total | $248,068 | Total | $5,650,000 | ||

| December 31 | Balance | $5,401,932 | |||

Table (4)

Treasury stock is a component of stockholder’s equity with a normal debit balance.

| Treasury stock | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| January 1 | Balance | $288,000 | March 15 | Cash | $288,000 |

| October 30 | Cash | $300,000 | |||

| Total | $ 588,000 | Total | $288,000 | ||

| December 31 | Balance | $ 300,000 | |||

Table (5)

Paid-in capital from treasury stock is a component of stockholder’s equity with a normal credit balance.

| Paid-in capital from treasury stock | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| March 15 | Cash | $36,000 | |||

| Total | $ 0 | Total | $36,000 | ||

| December 31 | Balance | $36,000 | |||

Table (6)

Stock dividend distributable is a contra stockholder’s equity with a normal credit balance.

| Stock dividend distributable | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| July 16 | Common stock | $123,000 | June 14 | Stock dividend | $123,000 |

| Total | $123,000 | Total | $123,000 | ||

| December 31 | Balance | $0 | |||

Table (7)

Stock dividend is a component of stockholder’s equity with a normal debit balance.

| Stock dividend | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| June 14 | Stock dividend distributable | $123,000 | December 31 | Retained earnings | $184,500 |

| July 5 | Paid in capital in excess of stated value –Common value | $61,500 | |||

| Total | $184,500 | Total | $184,500 | ||

| December 31 | Balance | $0 | |||

Table (8)

Cash dividend is a component of stockholder’s equity with a normal debit balance.

| Stock dividend | |||||

| Date | Particulars | Debit | Date | Particulars | Credit |

| December 30 | Cash dividend payable | $63,568 | December 31 | Retained earnings | $63,568 |

| Total | $63,568 | Total | $63,568 | ||

| December 31 | Balance | $0 | |||

Table (9)

(3)

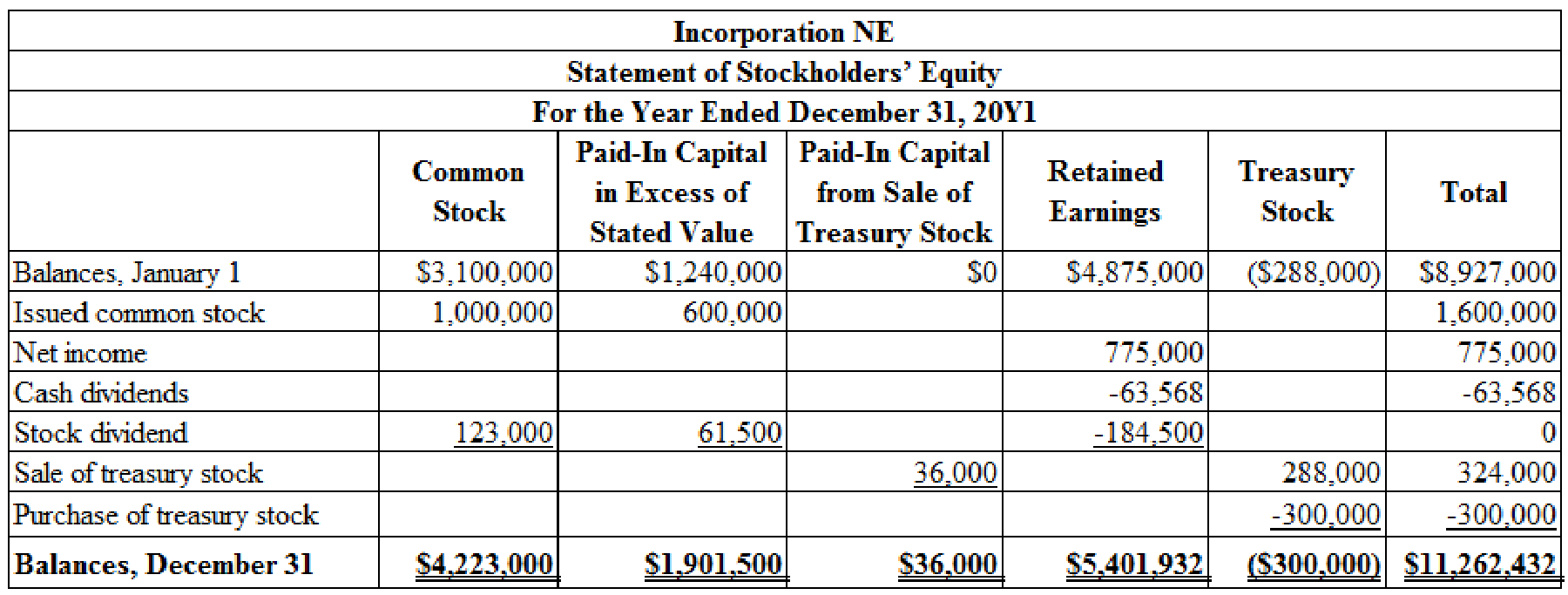

Prepare a statement of stockholders’ equity for the year ended December 31, 20Y1.

Explanation of Solution

Stockholders’ equity statement:

Stockholders’ equity statement shows the events and transaction that cause changes in the stockholders’ equity account during the accounting period. Stockholders’ equity statement starts with the beginning balances, shows the changes that occurred during the accounting year and end with the ending balances of the components of the stockholders’ equity account.

Prepare a statement of stockholders’ equity for the year ended December 31, 20Y1.

Table (10)

4.

Prepare the stockholders’ equity section of the December 31, 20Y1, balance sheet.

Explanation of Solution

Stockholders’ Equity Section: It is refers to the section of the balance sheet that shows the available balance of each stockholder’s equity account as on reported date at the end of the financial year.

Prepare the stockholders’ equity section of the December 31, 20Y1, balance sheet.

| Incorporation NE | |||

| Partial Balance Sheet | |||

| December 31, 20Y1 | |||

| Stockholders' Equity | Amount | Amount | Amount |

| Paid-in capital: | |||

| Common stock, $5 stated (900,000 shares authorized; 620,000 shares issued, 794,600 shares outstanding) | $4,223,000 | ||

| Excess over stated value | $1,901,500 | ||

| Paid-in capital, common stock | $6,124,500 | ||

| From sale of treasury stock | $36,000 | ||

| Total paid-in capital | $6,160,000 | ||

| Retained earnings | $5,401,932 | ||

| Total | $11,562,432 | ||

| Treasury common stock (50,000 shares at cost) | -$300,000 | ||

| Total stockholders' equity | $11,262,432 | ||

Table (11)

Want to see more full solutions like this?

Chapter 12 Solutions

Financial And Managerial Accounting

- Dear tutor. I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardno aiWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forwardDon't use chatgpt Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardDevelopment costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage