College Accounting: A Career Approach (with Quickbooks Accountant 2015 Cd-rom)

12th Edition

ISBN: 9781305863385

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 1PA

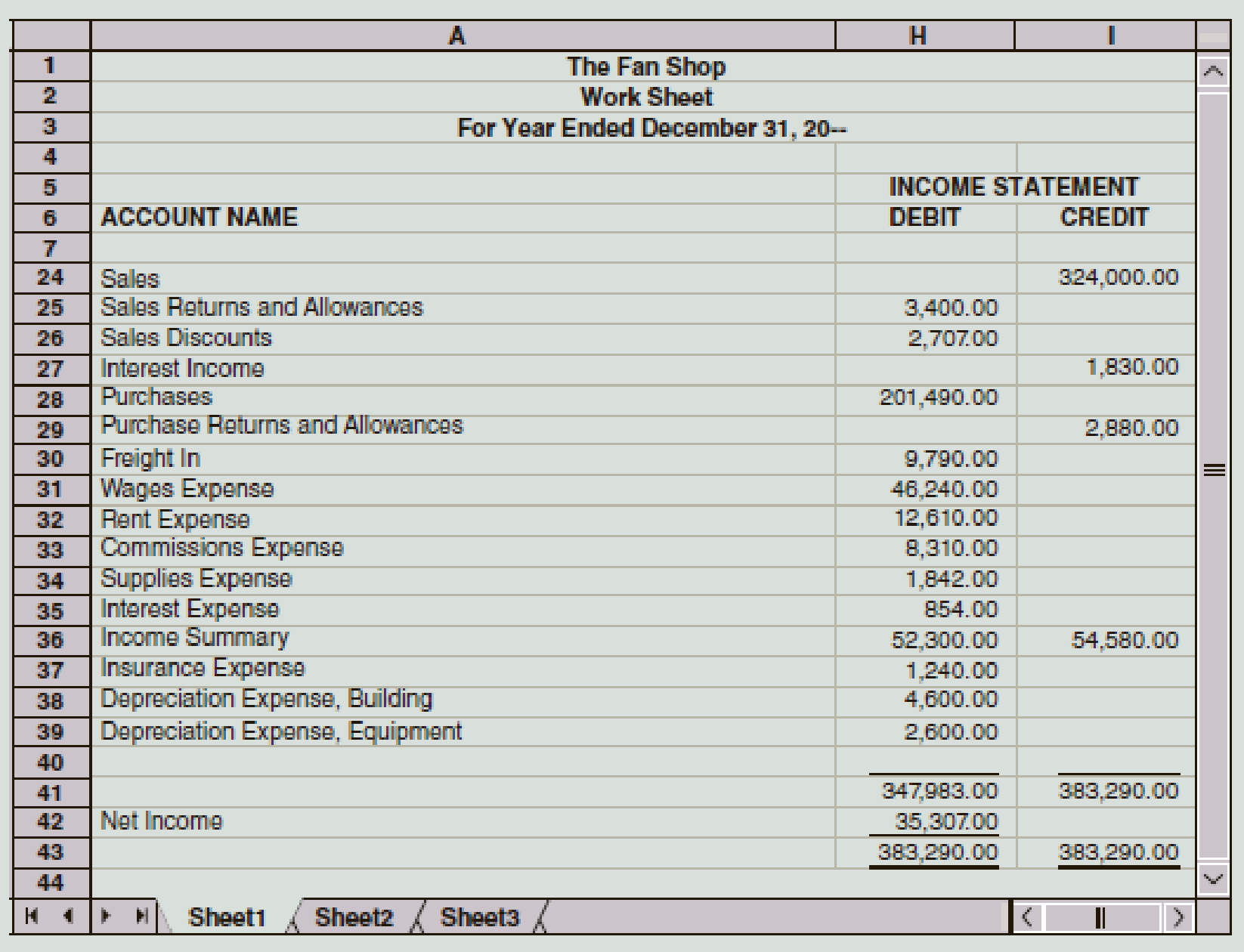

A partial work sheet for The Fan Shop is presented here. The merchandise inventory at the beginning of the year was $52,300. P. G. Ochoa, the owner, withdrew $30,500 during the year.

Required

- 1. Prepare an income statement.

- 2. Journalize the closing entries.

Check Figure

Cost of Goods Sold, $206,120

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Bonnie and Clyde are the only two shareholders in Getaway Corporation. Bonnie owns 60 shares with a basis of $3,000, and Clyde owns the remaining 40 shares with a basis of $12,000. At year-end, Getaway is considering different alternatives for redeeming some shares of stock. Evaluate whether each of these stock redemption transactions qualify for sale or exchange treatment.

Getaway redeems 29 of Bonnie’s shares for $10,000. Getaway has $26,000 of E&P at year-end and Bonnie is unrelated to Clyde.

Novak supply company a newly formed corporation , incurred the following expenditures related to the land , to buildings, and to machinery and equipment.

abstract company's fee for title search $1,170

architect's fee $7,133

cash paid for land and dilapidated building thereon $195,750

removal of old building $45,000

LESS: salvage $12,375 $32,625

Interest on short term loans during construction…

Year

Cash Flow

0

-$ 27,000

1

11,000

2

3

14,000

10,000

What is the NPV for the project if the required return is 10 percent?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

NPV

$ 1,873.28

At a required return of 10 percent, should the firm accept this project?

No

Yes

What is the NPV for the project if the required return is 26 percent?

Chapter 12 Solutions

College Accounting: A Career Approach (with Quickbooks Accountant 2015 Cd-rom)

Ch. 12 - What is the term used for the profit on a sale...Ch. 12 - Which of the following is not an example of a...Ch. 12 - Prob. 3QYCh. 12 - What is the third entry of the closing procedure...Ch. 12 - What general journal entry is used to undo a...Ch. 12 - Prob. 1DQCh. 12 - What is the difference between the cost of goods...Ch. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - Prob. 5DQ

Ch. 12 - Explain the calculation of net sales and net...Ch. 12 - Prob. 7DQCh. 12 - What are the rules for recognizing whether an...Ch. 12 - Prob. 9DQCh. 12 - Calculate the missing items in the following:Ch. 12 - Using the following information, prepare the Cost...Ch. 12 - Prob. 3ECh. 12 - The Income Statement columns of the August 31...Ch. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - From the following T accounts, journalize the...Ch. 12 - From the following information, journalize the...Ch. 12 - A partial work sheet for The Fan Shop is presented...Ch. 12 - Prob. 2PACh. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - A partial work sheet for McKnight Music Store is...Ch. 12 - Here is the partial work sheet for Meyer Mountain...Ch. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - Costco is the largest chain of membership...Ch. 12 - A music store sells new instruments. The store...Ch. 12 - You are an owner/bookkeeper in a country whose...Ch. 12 - Prob. 4ACh. 12 - Prob. 5ACh. 12 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

• Illustrate and interpret shifts in the short-run and long-run aggregate supply curves.

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

What is precedent, and how does it affect common law?

Business in Action

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following were selected from among the transactions completed by Babcock Company during November of the current year: Nov. 3 Purchased merchandise on account from Moonlight Co., list price $85,000, trade discount 25%, terms FOB destination, 2/10, n/30. 4 Sold merchandise for cash, $37,680. The cost of the goods sold was $22,600. 5 Purchased merchandise on account from Papoose Creek Co., $47,500, terms FOB shipping point, 2/10, n/30, with prepaid freight of $810 added to the invoice. 6 Returned merchandise with an invoice amount of $13,500 ($18,000 list price less trade discount of 25%) purchased on November 3 from Moonlight Co. 8 Sold merchandise on account to Quinn Co., $15,600 with terms n/15. The cost of the goods sold was $9,400. 13 Paid Moonlight Co. on account for purchase of November 3, less return of November 6. 14 Sold merchandise with a list price of $236,000 to customers who used VISA and who redeemed $8,000 of pointof- sale coupons. The cost…arrow_forwardHello teacher please solve this questionsarrow_forwardHelp me to solve this questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License