Concept explainers

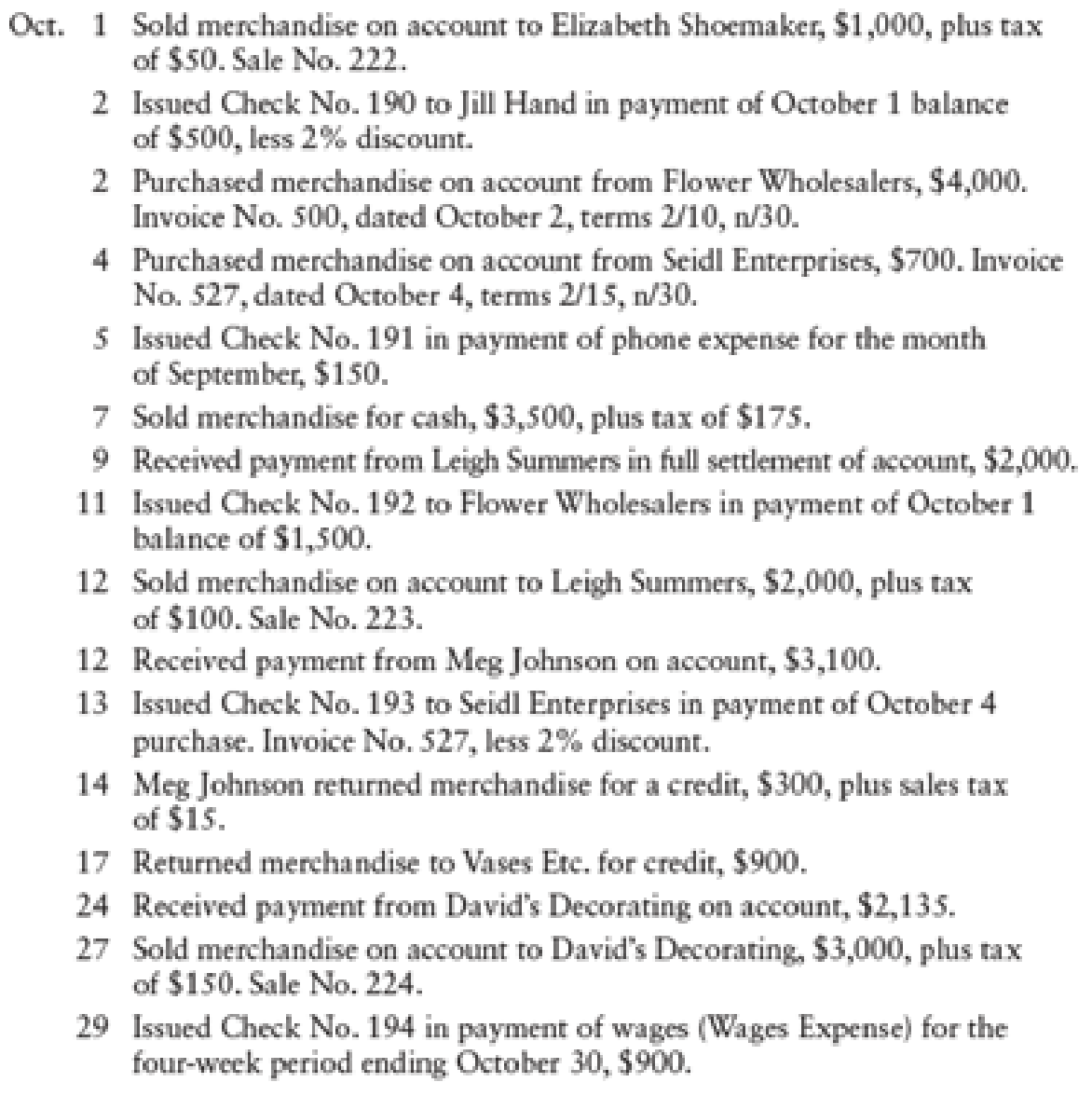

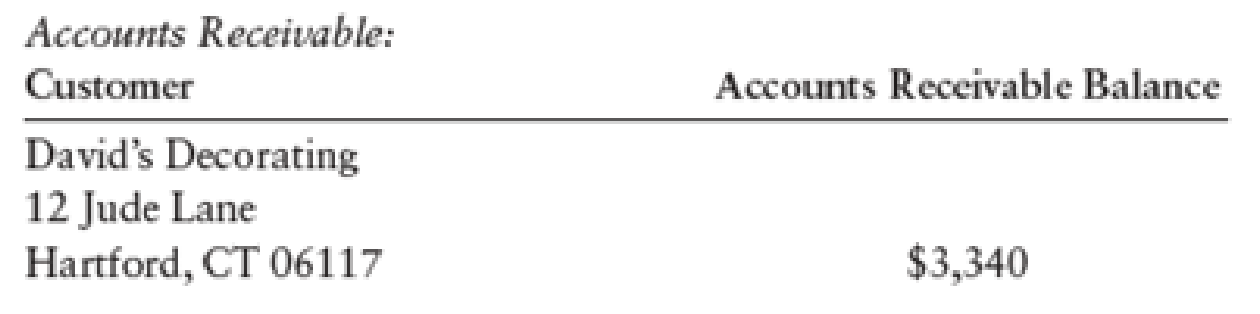

During the month of October 20--, The Pink Petal flower shop engaged in the following transactions:

Selected account balances as of October 1 were as follows:

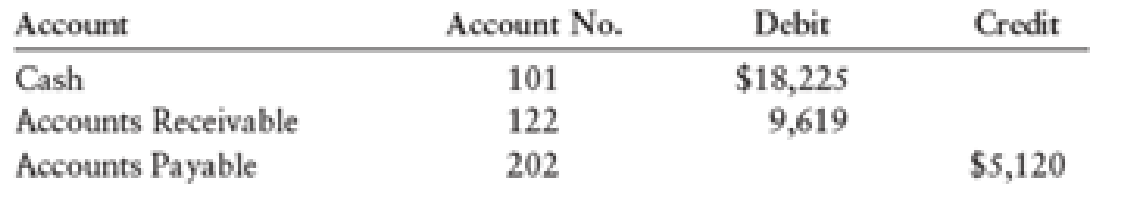

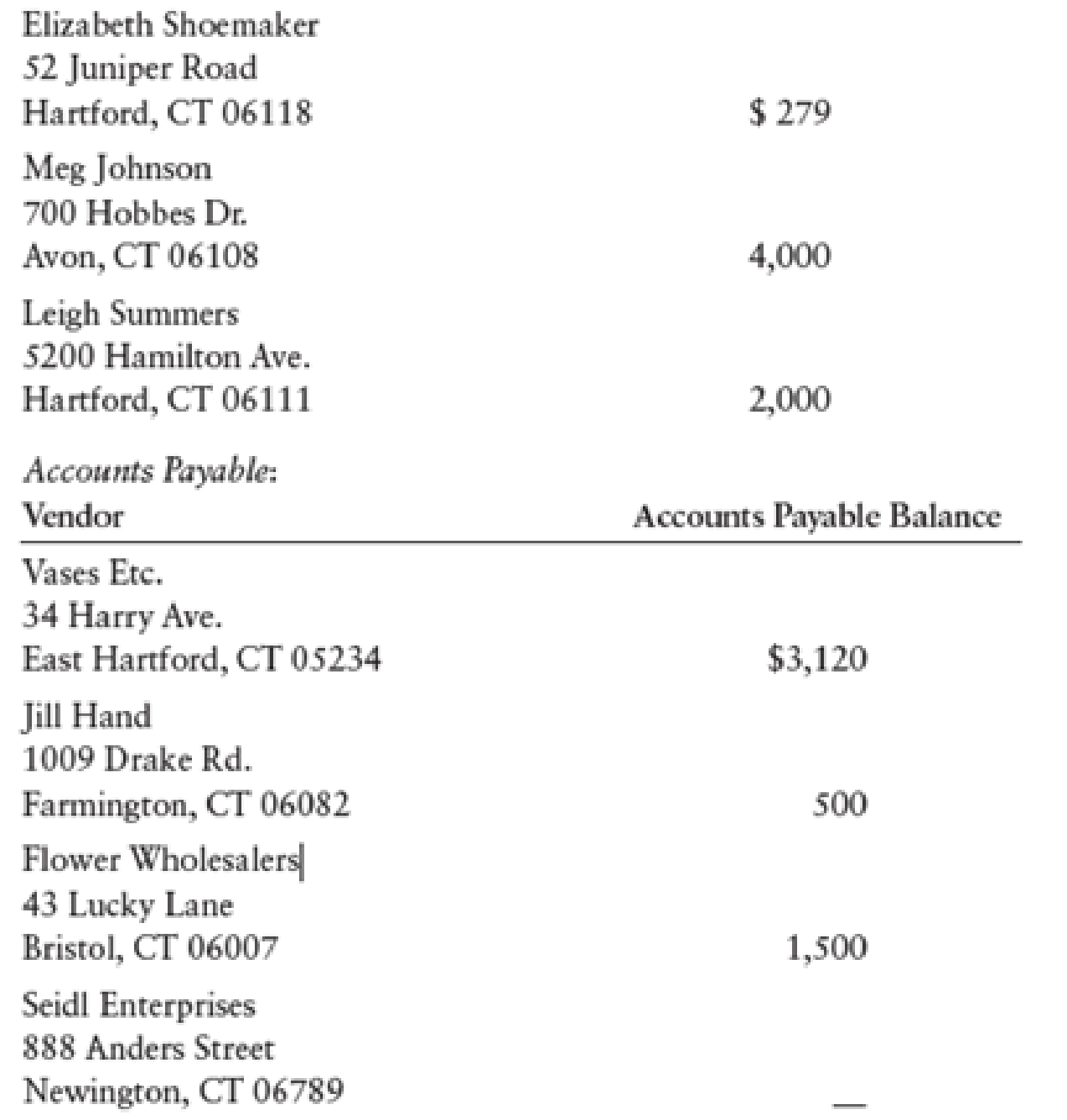

The Pink Petal also had the following subsidiary ledger balances as of October 1:

REQUIRED

- 1. Record the transactions in a sales journal (page 7), cash receipts journal (page 10), purchases journal (page 6), cash payments journal (page 11), and general journal (page 5). Total, verify, and rule the columns where appropriate at the end of the month.

- 2. Post from the journals to the general ledger,

accounts receivable ledger, and accounts payable ledger accounts. Use account numbers as shown in the chapter.

1.

Prepare the given transaction in the sales journal, cash receipts journal, purchase journal, cash payment journal, and general journal and verify the total column and rule the column.

Explanation of Solution

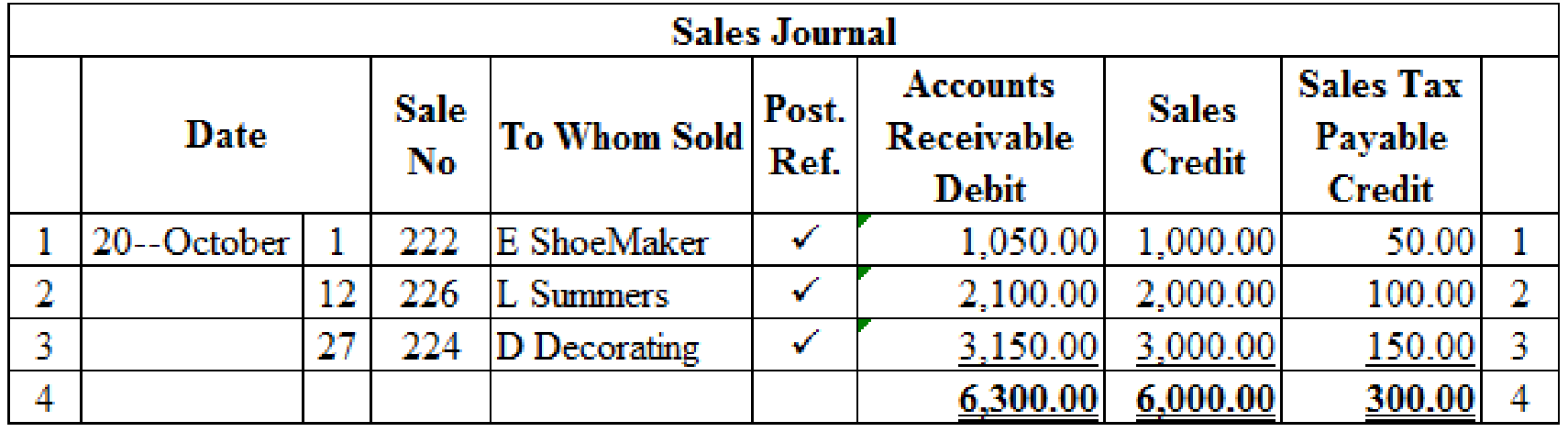

Sales Journal:

Sales journal is one form of special journal book, which records all the sales transactions that are sold to customers on credit. In a single column sales journal, debit aspect of accounts receivable and credit aspect of inventory are recorded, and then posted to individual subsidiary customer account.

Prepare the given transaction in a sales journal and verify the total column and rule the column:

Table (1)

Verification of total debit and credit column:

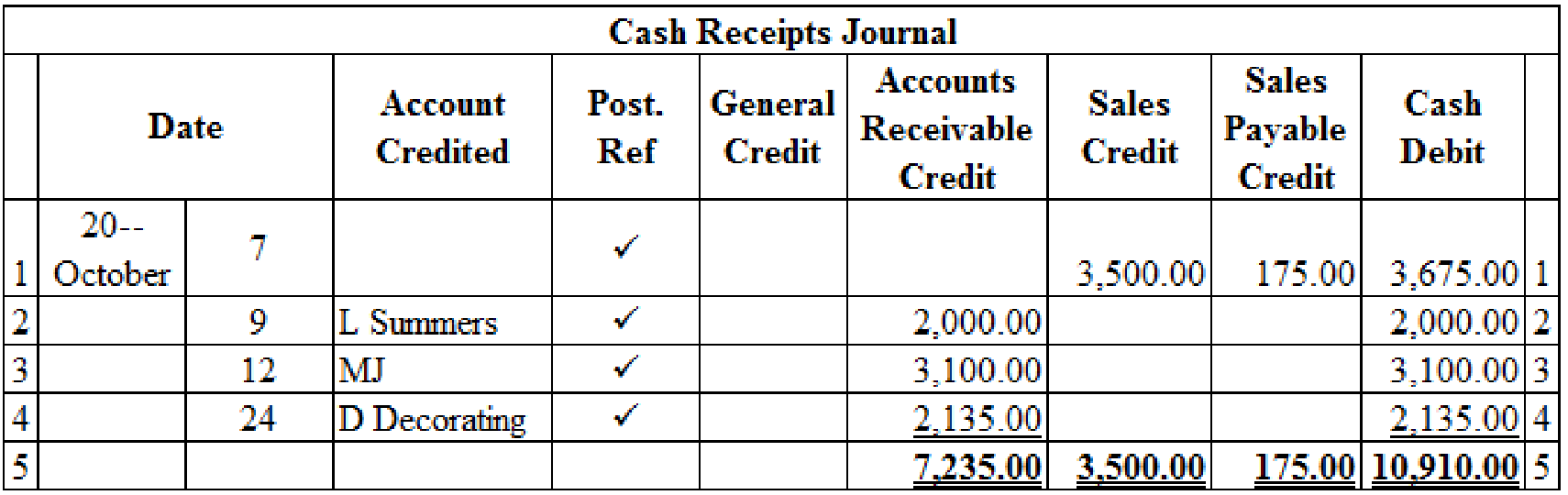

Cash Receipts Journal: It is a special book where only cash receipts transactions that are received from customers, merchandise sales and service made in cash and collection of accounts receivable are recorded.

The following are the some examples of transactions that would be recorded in the Other Accounts credit column of the cash receipts journal:

- • Cash received as interest on notes payable

- • Interest revenue received from debtors

- • Cash receipts from bank loans

- • Cash receipts for capital investments

Prepare the given transactions in the cash receipts journal and verify the total column and rule the column:

Table (2)

Verification of total debit and credit column:

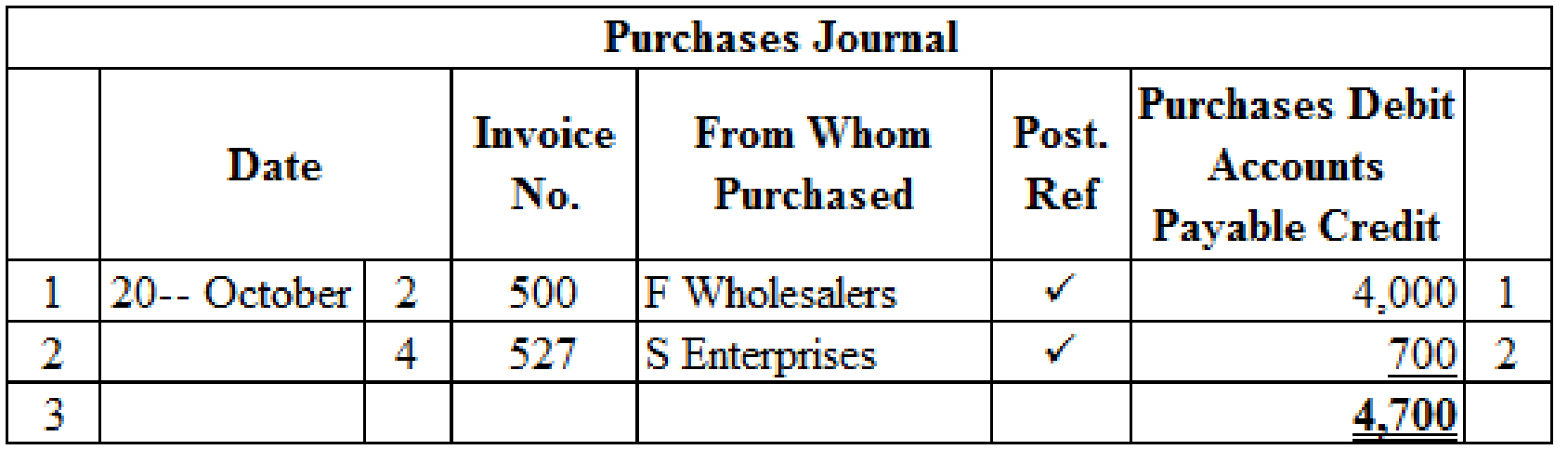

Purchase Journal: Purchase journal records all the merchandise purchase on credit. In a single column purchase journal, debit aspect of inventory and credit aspect of accounts payable are recorded, and then posted to individual subsidiary supplier account.

Prepare the transactions in the purchase journal:

Table (3)

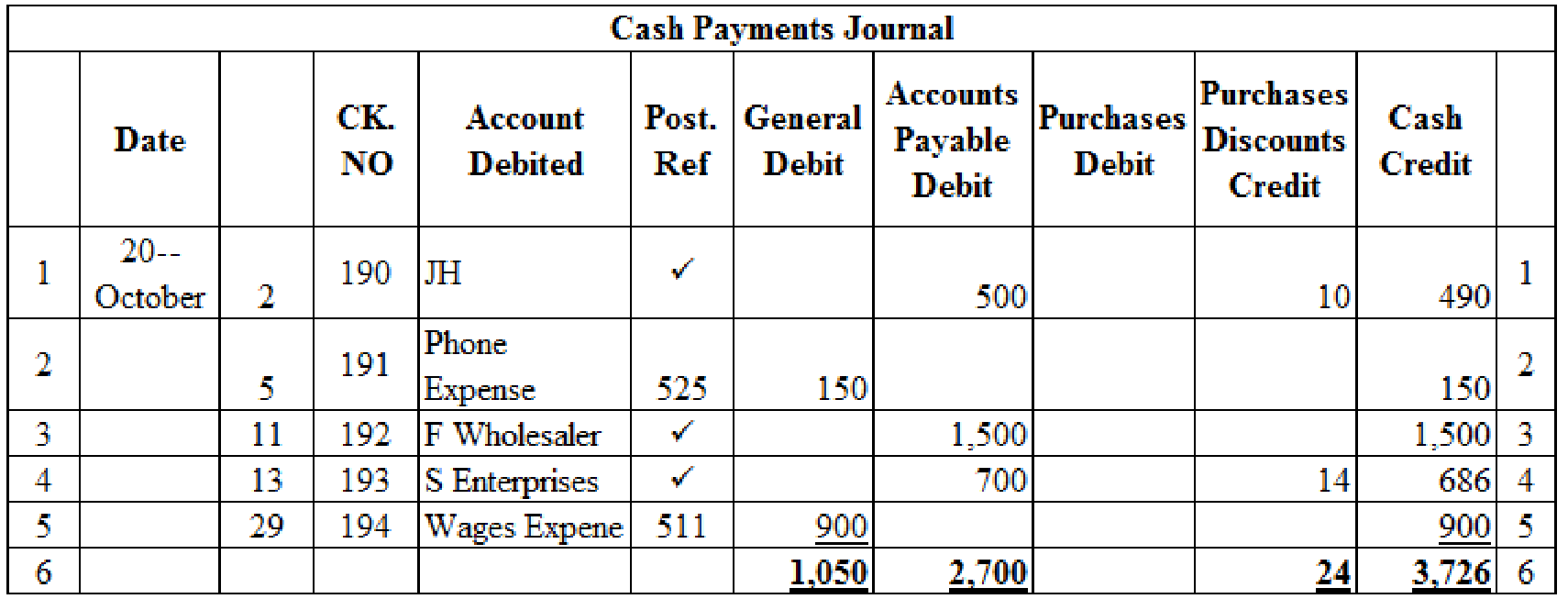

Cash payments journal: Cash payments journal refers to the journal that is used to record the all transaction which is involve the cash payments. For example, the business paid cash to employees (salary paid to employees).

Cash payments journal is used to record merchandise purchases made in cash and payments of accounts payable. It also records all other cash payments to various purposes. To include all these transactions, companies use multi-column cash payments journal.

Prepare the transactions in a cash payments journal and total the each column of cash payments journal:

Table (4)

Use the general journal to record the sales returns and allowances:

General Journal: It is a book where all the monetary transactions are recorded in the form of journal entries on the date of their occurrence in a chronological order.

Transaction on October 14:

| General Journal | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 14 | Sales Returns and Allowances | 401.1 | 300.00 | ||

| Sales Tax Payable | 231 | 15.00 | ||||

| Accounts Receivable, MJ | 122/✓ | 315.00 | ||||

| (Record merchandise returned) | ||||||

Table (5)

Description:

- ■ Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- ■ Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- ■ Accounts Receivable, MJ Company is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Transaction on October 17:

| Page: 3 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 17 | Accounts Payable, V Etc. | 202/✓ | 900 | ||

| Purchases Returns and Allowances | 501.1 | 900 | ||||

| (Record merchandise returned) | ||||||

Table (6)

Description:

- ■ Accounts Payable, V Etc, is a liability account. Since inventory is returned, amount to be paid has decreased, liability account is decreased, and a decrease in liability is debited.

- ■ Purchases Returns and Allowances is a contra-cost account, and contra-cost accounts increase the equity value, and an increase in equity is credited.

2.

Post the prepared journals to the general ledger, accounts receivable ledger and accounts payable ledger accounts.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the prepared journals to the general ledger:

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 1 | Balance | ✓ | 18,225 | |||

| 31 | CR10 | 10,910 | 29,135 | ||||

| 31 | CP11 | 3,726 | 25,409 | ||||

Table (7)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 1 | Balance | ✓ | 9,619 | |||

| 14 | J5 | 315 | 9,304 | ||||

| 31 | S7 | 6,300 | 15,604 | ||||

| 31 | CR10 | 7,235 | 8,369 | ||||

Table (8)

| ACCOUNT Accounts Payable ACCOUNT NO. 202 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 1 | Balance | ✓ | 5,120 | |||

| 17 | J5 | 900 | 4,220 | ||||

| 31 | P6 | 4,700 | 8,920 | ||||

| 31 | CP11 | 2,700 | 6,220 | ||||

Table (9)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 14 | J5 | 15 | 15 | |||

| 31 | S7 | 300 | 285 | ||||

| 31 | CR10 | 175 | 460 | ||||

Table (10)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 31 | S7 | 6,000 | 6,000 | |||

| 31 | CR10 | 3,500 | 9,500 | ||||

Table (11)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 14 | J5 | 300.00 | 300.00 | |||

Table (12)

| ACCOUNT Purchases ACCOUNT NO. 501 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 31 | P6 | 4,700 | 4,700 | |||

Table (13)

| ACCOUNT Purchases Return and Allowances ACCOUNT NO. 501.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 17 | J5 | 900 | 900 | |||

Table (14)

| ACCOUNT Purchases Discounts ACCOUNT NO. 501.2 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 31 | CP11 | 24 | 24 | |||

Table (15)

| ACCOUNT Wages Expense ACCOUNT NO. 511 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 29 | CP11 | 900 | 900 | |||

Table (16)

| ACCOUNT Phone Expense ACCOUNT NO. 5125 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| October | 5 | CP11 | 150 | 150 | |||

Table (17)

Post the prepared journals to the accounts receivable ledger:

| NAME D Decorating | ||||||

| ADDRESS 12 J Lane, H, CT 06117 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| October | 1 | Balance | ✓ | 3,340 | ||

| 24 | CR10 | 2,135 | 1,205 | |||

| 27 | S7 | 3,150 | 4,355 | |||

Table (18)

| NAME MJ | ||||||

| ADDRESS 700 H DR., AVON, CT 06108 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| October | 1 | Balance | ✓ | 4,000 | ||

| 12 | CR10 | 3,100 | 900 | |||

| 14 | J5 | 315 | 585 | |||

Table (19)

| NAME E Shoe Maker | ||||||

| ADDRESS 52 J Road, H, CT 06118 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| October | 1 | Balance | ✓ | 279 | ||

| 1 | S7 | 1,050 | 1,329 | |||

Table (20)

| NAME L Summers | ||||||

| ADDRESS 5200 H Avenue., H CT 06111 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| October | 1 | Balance | ✓ | 2,000 | ||

| 9 | CR10 | 2,000 | ||||

| 12 | S7 | 2,100 | 2,100 | |||

Table (21)

Post the journals to the accounts payable ledger:

| NAME F Wholesalers | ||||||

| ADDRESS 43 L Lane., B CT 06007 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| October | 1 | Balance | ✓ | 1,500 | ||

| 2 | P6 | 4,000 | 5,500 | |||

| 11 | CP11 | 1,500 | 4,000 | |||

Table (22)

| NAME J Hand | ||||||

| ADDRESS 1009 D Rd., F CT 06082 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| October | 1 | Balance | ✓ | 500 | ||

| 2 | CP11 | 500 | 0 | |||

Table (23)

| NAME S Enterprises | ||||||

| ADDRESS 88 A Street, N, CT 06789 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| October | 4 | P6 | 700 | 700 | ||

| 13 | CP11 | 700 | 0 | |||

Table (24)

| NAME V Etc. | ||||||

| ADDRESS 34 h Avenue., East H, CT 05234 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| October | 1 | Balance | ✓ | 3,120 | ||

| 17 | J5 | 900 | 2,220 | |||

Table (25)

Want to see more full solutions like this?

Chapter 12 Solutions

College Accounting, Chapters 1-9

- Repsola is a drilling company that operates an offshore Oilfield in Feeland. Five years ago, Feeland had a major oil discovery and granted licenses to drill oil to reputable,experienced drilling companies. The licensing agreement requires the company to remove the oil rig at the end of production and restore the seabed. Ninety percent of the eventual costs of undertaking the work relate to the removal of the oil rig and restoration of damage caused by building it and ten percent arise through the extraction of the oil. At the Statement of Financial Position (SOFP) date (December 31 2025), the rig has been constructed but no oil has been extractedOn January 1st 2023, Repsola obtained the license to construct an oil rig at a cost of $500 million. Two years later the oil rig was completed. The rig is expected to be removed in 20 years from the date of acquisition. The estimated eventual cost is 100million. The company’s cost of capital is 10% and its year end is December 31st. Repsola…arrow_forward(a) A property lease includes a requirement that the premises are to be repainted every five years and the future cost is estimated at $100,000. The lessee prefers to spread the cost over the five years by charging $$20,000 against profits each year. Thereby creating a provision of $100,000 in five years’ time and affecting profits equally each year. Requirement: Was it correct for the lessee to provide for this cost? Explain your decision (5 marks) (b) A retail store has a policy of refunding purchases by dissatisfied customers, even though it is under no legal obligation. Its policy of making refunds is generally known. Requirements: Should a provision be made at year end (9 marksarrow_forwardPart A Unique Schools Supplies & Uniforms (USSU) designs and manufactures knapsack bags for students. After production, the bags are placed into individual cases, before being transferred into Finished Goods. The accounting records of the business reflect the following data at June 30, 2024, for the manufacturing of bags for Debe High School. Inventory Raw Materials 1/7/2023 30/6/2024 $230,000 $260,000 Work in Progress $348,300 $203,300 Finished Goods $632,900 $485,000 Other information: Sales Revenue Factory Supplies Used Direct Factory Labor Raw Materials Purchased Plant janitorial service Depreciation: Plant & Equipment $5,731,000 75,000 792,000 560,000 37,000 186,000 Total Utilities 481,250 Production Supervisor's Salary 450,000 School Logo (for bags) Design Costs 26,000 Packaging Cases Cost 42,000 Total Insurance 168,000 Delivery Vehicle Drivers' Wages 181,500 Depreciation: Delivery Vehicle 53,290 Property Taxes 240,000 Administrative Wages & Salaries 801,250 1% of Sales Revenue…arrow_forward

- Repsola is a drilling company that operates an offshore Oilfield in Feeland. Five yearsago, Feeland had a major oil discovery and granted licenses to drill oil to reputable,experienced drilling companies. The licensing agreement requires the company toremove the oil rig at the end of production and restore the seabed. Ninety percent ofthe eventual costs of undertaking the work relate to the removal of the oil rig andrestoration of damage caused by building it and ten percent arise through theextraction of the oil. At the Statement of Financial Position (SOFP) date (December 312025), the rig has been constructed but no oil has been extractedOn January 1st 2023, Repsola obtained the license to construct an oil rig at a cost of$500 million. Two years later the oil rig was completed. The rig is expected to beremoved in 20 years from the date of acquisition. The estimated eventual cost is 100million. The company’s cost of capital is 10% and its year end is December 31st. Repsolauses…arrow_forwardprovide answerarrow_forwardhello teacher please help mearrow_forward

- ansarrow_forward1 Of the total utilities, 80% relates to manufacturing and 20% relates to general and administrative costs. 2 Of the total insurance, 66% relates to the Factory Plant & Equipment & 33% relates to general & administrative costs. 3 The property taxes should be shared: 75% manufacturing & 25% general & administrative costs. Required: i) Calculate the raw material used in production by Unique School Supplies & Uniforms. ii) What is the total factory overhead costs incurred by Unique School Supplies & Uniforms during the period? iii) Determine the prime cost & conversion cost of the knapsacks manufactured. iv) Prepare a schedule of cost of goods manufactured for the year ended June 30, 2024, clearly showing total manufacturing cost & total manufacturing costs to account for. v) What is the selling price per knapsack if Unique School Supplies & Uniforms manufactured 925 knapsacks for the Debe High School and uses a mark-up of 25% on cost? vi) How does the format of the income statement for a…arrow_forwardexpert of account answerarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,