Concept explainers

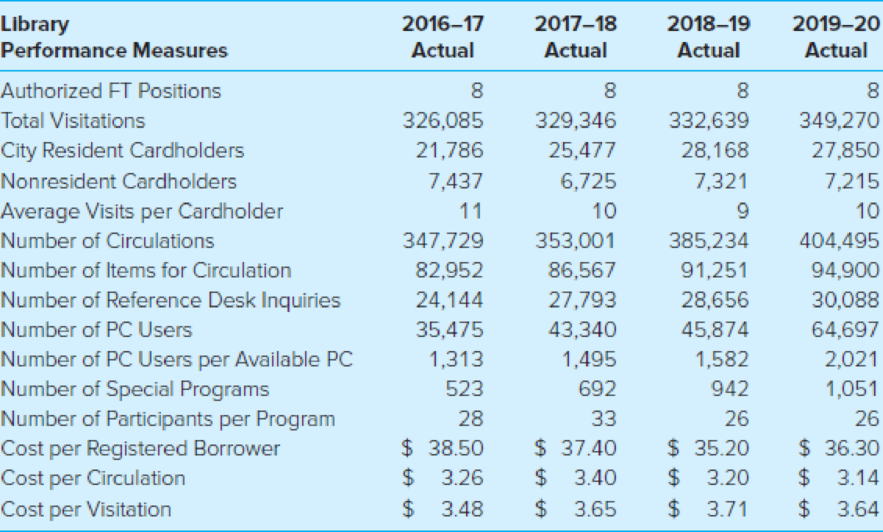

The City of Ashcroft has produced a Service Efforts and Accomplishments report for the past four years in an attempt to answer the question “How are we doing?” for its citizens. Reproduced here is an excerpt from the 2016–2020 SEA report that details library services. The report shows the efforts of library staff to offer more library programs to the increasing population and customer base in the city. Program participation has seen steady increases over the past four years, with some programs so high in demand waiting lists to participate are starting to occur.

Citizen Perceptions

The 2018 community survey reported that 86 percent of city residents rated library services as “good” or “excellent,” only marginally down from 88 percent in 2016. For the variety of materials at the library, 79 percent of citizens rated the variety as “good” or “excellent,” unchanged from 2016.

Library Budget

The owner of a house with a total assessed valuation of $200,000 paid property taxes of $67 in FY 2020 to support the library. Twenty-six percent (26%) of the library’s FY 2020 budget depends upon support from Fairview County in return for services provided to rural Polk County residents. Fairview County’s support is expected to decrease after FY 2020. Options being considered to offset the loss of county funding include allocation of General Fund monies and/or reduction in library services.

Source: SEA reports issued by the City of Ankeny, Iowa.

Required

- a. Which of the performance measures best represents inputs, outputs, and outcomes?

- b. How does the city demonstrate that its financial resources are used efficiently?

- c. How would you address a citizen who feels he or she is not getting his or her money’s worth?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

ACCOUNTING F/GOV.+NON...(LL)

- Amherst City provides a defined benefit pension plan for employees of the city electric utility, an enterprise fund. Assume that the projected level of earnings on plan investments is $199,000, the service cost component is $257,500, and interest on the pension liability is $164,500 for the year. The City is amortizing a deferred outflow resulting from a change in plan assumptions from a prior year in the amount of $7,650 per year. Requried: Prepare journal entries to record annual pension expenses for the enterprise fund.arrow_forwardGeneral accountingarrow_forwardAmherst City provides a defined benefit pension plan for employees of the city electric utility, an enterprise fund. Assume that the projected level of earnings on plan investments is $165,000, the service cost component is $260,000, and interest on the pension liability is $99,000 for the year. The City is amortizing a deferred outflow resulting from a change in plan assumptions from a prior year in the amount of $5,500 per year. Requried: Prepare journal entries to record annual pension expenses for the enterprise fund.arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning