Concept explainers

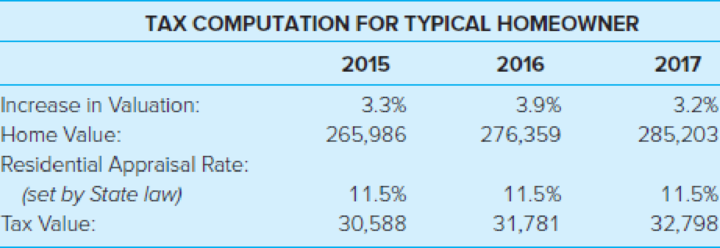

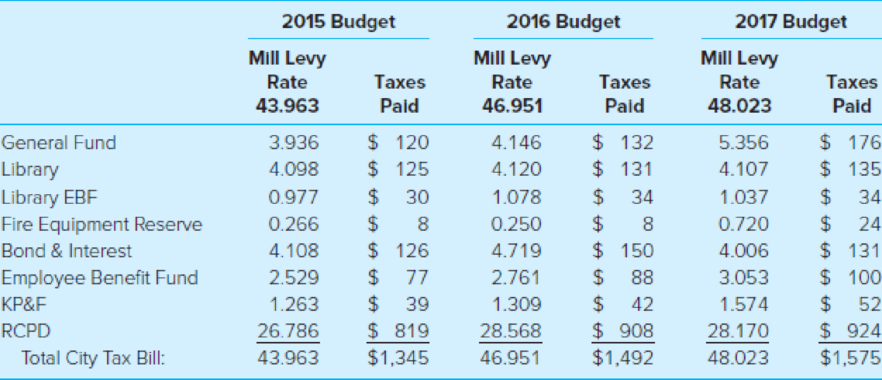

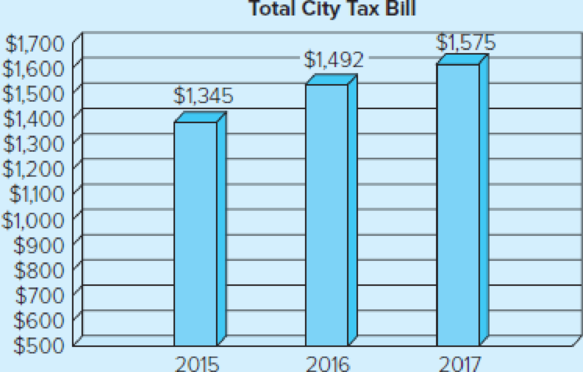

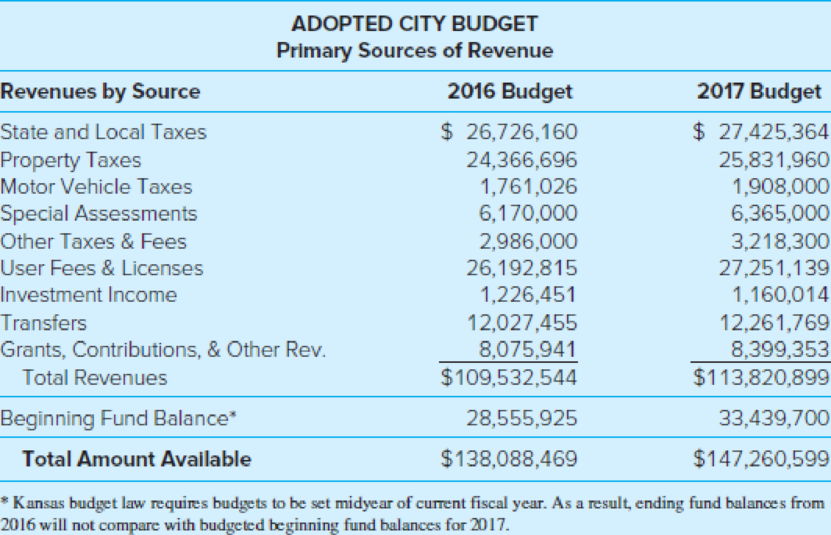

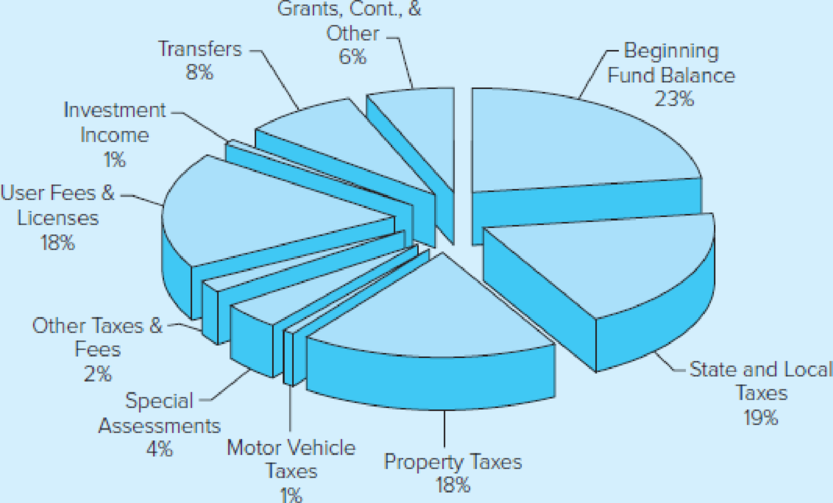

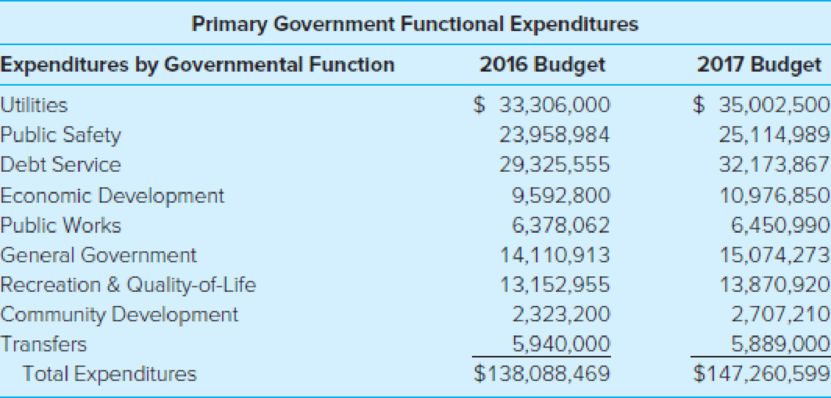

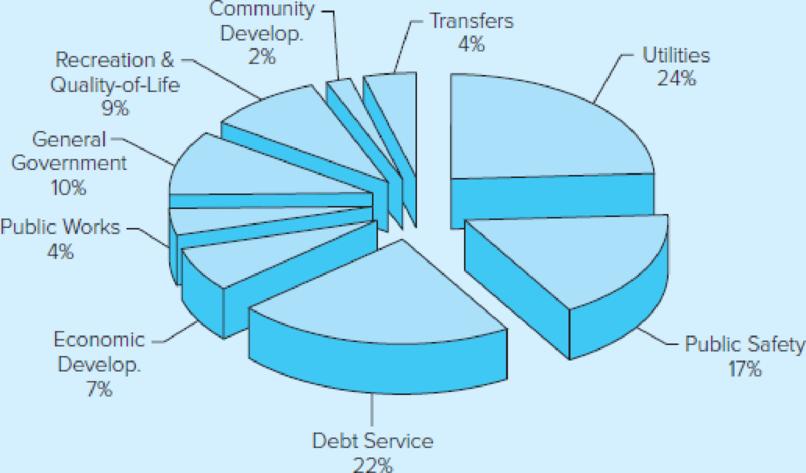

The City of Manhattan, Kansas, prepares an annual Budget Book, a comprehensive document that includes a citywide budget, as well as department budgets. The city has received the GFOA Distinguished Budget Award for more than 25 years. Following are graphical excerpts from the 2017 Budget Book that disclose typical taxpayer tax payments and primary revenue sources and functional expense categories.

Required

- a. Examine the taxpayer calculation for the three-year period. What observations can you make from this illustration? What questions might you ask city budget officials at a public budget hearing?

- b. Examine the pie charts and data provided for revenue sources and functional expenses. What are the primary revenue sources? What are the greatest expenditure categories? Taken together, do you have any questions regarding the city’s finances?

- c. As a citizen, did you find these illustrations user-friendly and relevant?

State & Local Sales Taxes: Includes city/county sales taxes, and franchise fees

Property Taxes: Includes ad valorem, delinquent taxes, and PILOT’s

User Fees & Licenses: Includes licenses & permits, services and sales, program revenue, utility sales, and fines

Investment Income: Includes land rent, farm income, and misc. investment income

Transfers: Includes transfers for utility administrative services, sales tax, debt service, etc.

Grants, Cont., & Other Rev.: Includes contributions, grants, and misc. revenues

Utilities: Includes Water, Wastewater, and Stormwater operations

Public Safety: Includes Fire Operations, Administration, Technical Services, Building Maintenance, Fire Equipment Reserve, Fire Pension K. P. & F., and R.C.P.D

Debt Service: Includes all long-term debt payments

Economic Development: Includes General Improvement, Industrial Promotion, Economic Development Opportunity Fund, CIP Reserves, and Downtown Redevelopment T.I.F.

Public Works: Includes Admin., Streets, Engineering, Traffic, and Special Street & Highway

General Government: Includes General Government, Finance, Human Resources, Airport, Court, General Services, Outside Services, Municipal Parking Lot, City University Fund, Employee Benefits, and Special Alcohol Programs

Recreation & Quality-of-Life: Parks & Recreation, Zoo, Pools, Flint Hills Discovery Center, Library, and Library Employee Benefits

Community Development: Administration and Planning, Business Districts, and Tourism & Convention Fund

Transfers: Includes transfers from Sales Tax to General Fund and Special Revenue Funds

Source: City of Manhattan, Kansas, 2017 Budget Book, pp. 46-49.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

ACCOUNTING F/GOV.+NON...(LL)

- On January 1, 2020, Nexus Technologies purchased a machine for $15,000. The machine was estimated to have a 10-year useful life and a residual value of $800. Straight-line depreciation is used. On January 1, 2022, the machine was exchanged for office equipment with a fair value of $12,500. Assuming that the exchange had commercial substance, how much would be recorded as a gain on disposal of the machine on January 1, 2022? helparrow_forwardi need correct optionarrow_forwardGive me solutionarrow_forward

- Financial Accounting Questionarrow_forwardOn January 1, 2020, Nexus Technologies purchased a machine for $15,000. The machine was estimated to have a 10-year useful life and a residual value of $800. Straight-line depreciation is used. On January 1, 2022, the machine was exchanged for office equipment with a fair value of $12,500. Assuming that the exchange had commercial substance, how much would be recorded as a gain on disposal of the machine on January 1, 2022?arrow_forwardVariable and Absorption Costing Summarized data for the first year of operations for Gorman Products, Inc., are as follows: Sales (70,000 units) Production costs (80,000 units) Direct material Direct labor Manufacturing overhead: Variable Fixed Operating expenses: Variable $2,800,000 880,000 720,000 544,000 320,000 175,000 Fixed 240,000 Depreciation on equipment 60,000 Real estate taxes 18,000 Personal property taxes (inventory & equipment) 28,800 Personnel department expenses 30,000 a. Prepare an income statement based on full absorption costing. Only use a negative sign with your answer for net income (loss), if the answer represents a net loss. Otherwise, do not use negative signs with any answers. Round answers to the nearest whole number, when applicable. Sales Cost of Goods Sold: Absorption Costing Income Statement Beginning Inventory $ 2,800,000 Direct materials Direct labor Manufacturing overhead Less: Ending Inventory Cost of Goods Sold Gross profit $ 880,000 720,000 864,000…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education