(Learning Objectives 4, 5: Calculate and analyze ratios and earnings quality for a company in the restaurant industry)

Note: This case is part of The Cheesecake Factory serial case contained in every chapter in this textbook.

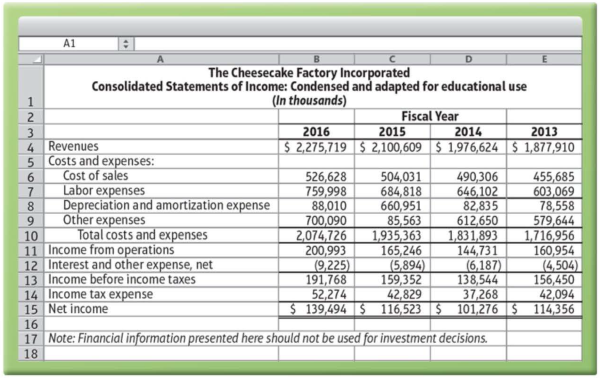

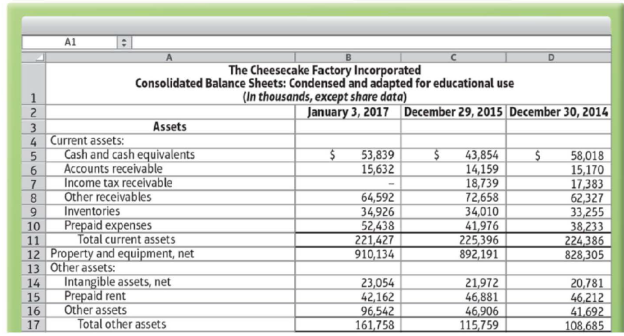

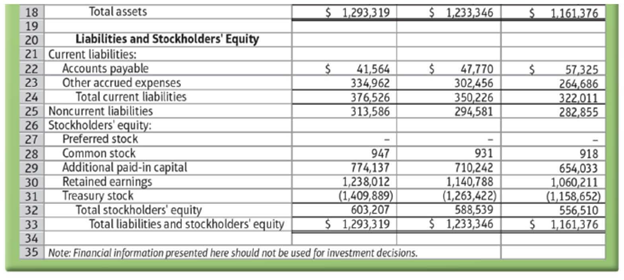

To follow are The Cheesecake Factory Incorporated's financial statements from its 2016 Form 10-K.

Data from the US. Securities and Exchange Commission EDGAR Company filings, www.sec.gov

Data from the U.S. Securities and Exchange Commission EDGAR Company filings, www.sec.gov

The preceding financial statements have been condensed and adapted for educational use and should not be used for investment decisions.

Requirements

1. Calculate The Cheesecake Factory’s net

2. Calculate The Cheesecake Factory’s

3. Calculate The Cheesecake Factory’s quick ratio for 2015 and 2016. Did the quick ratio improve or deteriorate?

4. How would you assess The Cheesecake Factory’s overall ability to pay its current liabilities? Explain.

5. Calculate inventory turnover for 2016. Next, calculate days' inventory outstanding. What does this number mean?

6. Calculate

7. Calculate accounts payable turnover for 2016. Next. calculate days’ payable outstanding. What does this number mean?

8. Calculate the cash conversion cycle (in days). Explain what this cash conversion cycle number means.

9. Calculate the debt ratio for 2016 and for 2015. Has the debt ratio increased or decreased?

10. Calculate the times-interest-earned ratio for 2016. Use “interest and other expense, net” as interest expense. What does this ratio mean?

11. Calculate the following profitability ratios for 2016:

- a. Gross margin percentage

- b. Operating income percentage

- c.

Rate of return on sales - d. Rate of return on assets

12. Comment on The Cheesecake Factory’s profitability in 2016 based on the profitability ratios you just calculated.

13. How would you evaluate the company’s earnings quality?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

- What are annual credit sales ? General accountingarrow_forwardThe next dividend payment by Skippy Inc. will be $3.45. The dividends are anticipated to maintain a growth rate of 4.2% forever. If the stock currently sells for $37.95 per share, what is the required rate of return? Comprehensive Holdings just paid a dividend of $2.95 per share on its stock. The dividends are expected to grow at a constant rate of 4.8% forever. If investors require a return of 12% on the stock, what is the current price? What will be the price in 3 years? In 7 years? Citibank expects to pay a dividend of $2 per share on its common stock at the end of this year. The growth rate of the dividend is 8% for the next 2 years. After that, the dividends are expected to grow at a constant growth rate of 5% per year forever. The required rate of return on the company’s stock is 11%. What is the price of Citibank stock today? A firm pays a current dividend of $3, which is expected to grow at a rate of 4% indefinitely. If the current value of the firm’s shares is $53,…arrow_forwardGeneral accountingarrow_forward

- The stock P/E ratio.??arrow_forwardprovide correct answer mearrow_forwardHyundai Company had beginning raw materials inventory of $29,000. During the period, the company purchased $115,000 of raw materials on account. If the ending balance in raw materials was $18,500, the amount of raw materials transferred to work in process inventory is?arrow_forward

- Computing the gross profit percentage Edible Art earned net sales revenue of $75,050,000 in 2019. The cost of goods sold was $55,650,000, and net income reached $13,000,000, the company s highest ever. Compute the company s gross profit percentage for 2019.arrow_forwardcorrect answer pleasearrow_forwardComputing the gross profit percentage Edible Art earned net sales revenue of $75,050,000 in 2019. The cost of goods sold was $55,650,000, and net income reached $13,000,000, the company s highest ever. Compute the company s gross profit percentage for 2019. Answerarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning