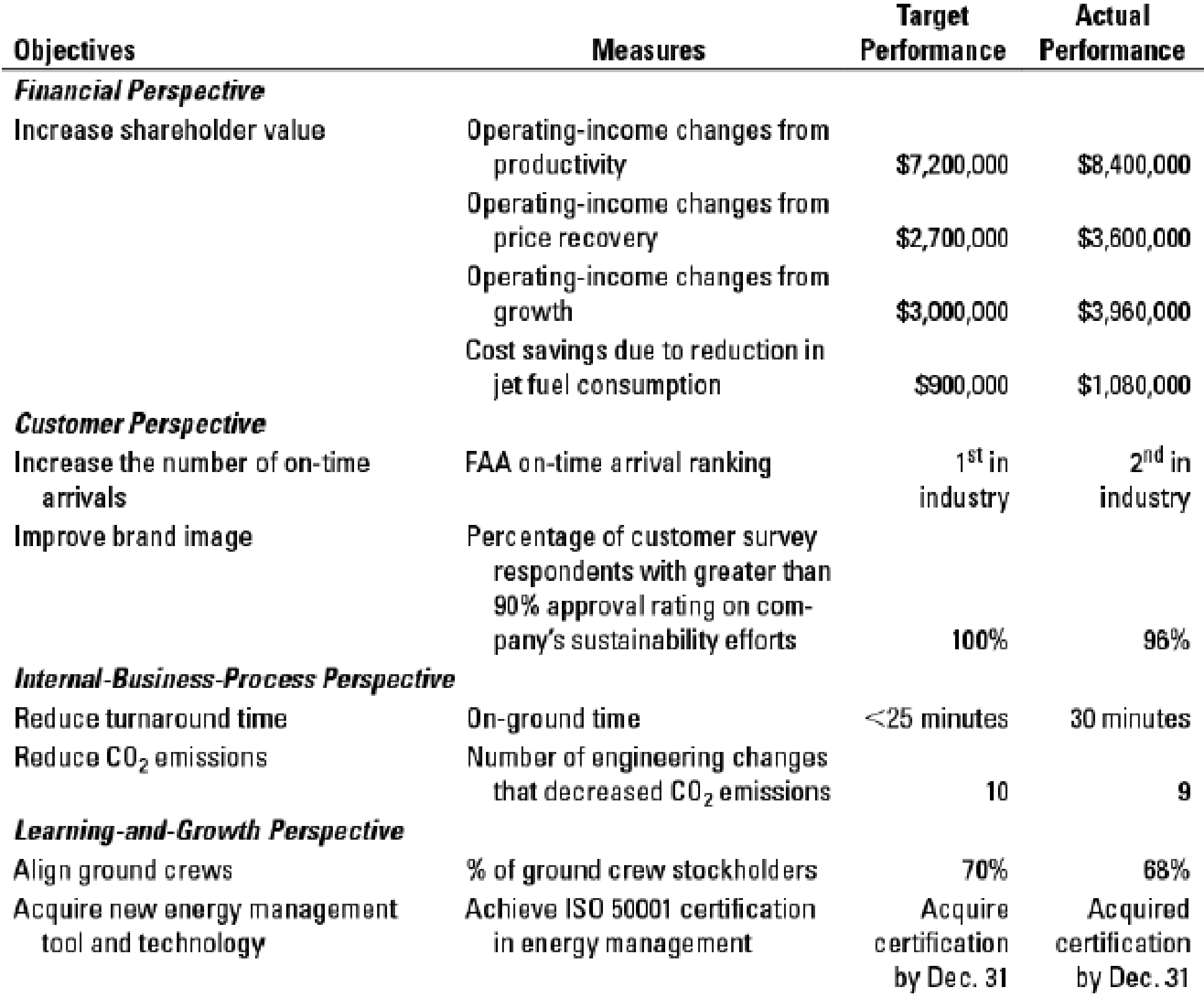

Balanced scorecard, environmental, and social performance. WrightAir is a no-frills airline that services the Midwest. Its mission is to be the only short-haul, low-fare, high-frequency point-to-point carrier in the Midwest. However, there are several large commercial carriers offering air transportation, and WrightAir knows that it cannot compete with them based on the services those carriers provide. WrightAir has chosen to reduce costs by not offering many inflight services, such as food and entertainment options. Instead, the company is dedicated to providing the highest quality transportation at the lowest fare. WrightAir’s balanced scorecard measures (and actual results) for 2017 follow:

- 1. What is WrightAir’s strategy? Was WrightAir successful in implementing its strategy in 2017? Explain your answer.

Required

- 2. Draw a strategy map as in Figure 12-2 for WrightAir describing the cause-and-effect relationships among the strategic objectives described in the balanced scorecard. Identify what you believe are any (a) strong ties, (b) focal points, (c) trigger points, and (d) distinctive objectives. Comment on your structural analysis of the strategy map.

- 3. Based on the strategy identified in requirement 1 above, what role does the price-recovery component play in explaining the success of WrightAir?

- 4. Would you have included customer-service measures in the customer perspective? Why or why not? Explain briefly.

- 5. Would you have included some measure of employee satisfaction and employee training in the learning-and-growth perspective? Would you consider this objective critical to WrightAir for implementing its strategy? Why or why not? Explain briefly.

- 6. Why do you think Wright Air has introduced environmental measures in its balanced scorecard? Is the company meeting its performance objectives in this area?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

- general accountingarrow_forwardWhat is its ROE?arrow_forwardAssume that a company is choosing between two alternatives-lease a piece of equipment for five years or buy a piece of equipment and sell it in five years. The costs associated with the two alternatives are summarized as follows: LeaseBuyPurchase cost of equipment $ 60,000Annual operating costs $ 6,000Immediate deposit$ 25,000 Annual lease payments$ 18,000 Salvage value (5 years from now) $ 8,000 If the company chooses the lease option, it will have to pay an immediate deposit of $25,000 to cover any future damages to the equipment. The deposit is refundable at the end of the lease term. The annual lease payments are made at the end of each year. Based on a net present value analysis with a discount rate of 24%, what is the financial advantage (disadvantage) of buying the equipment rather than leasing it? Multiple Choice $(8,687) S(4,877) $(7,857) S(7,367)arrow_forward

- Sheffield Corp. sells its product for $75 per unit. During 2016, it produced 70,000 units and sold 55000 units (there was no beginning inventory). Costs per unit are: direct materials $16, direct labor $15, and variable overhead $4. Fixed costs are: $910,000 manufacturing overhead, and $93,000 selling and administrative expenses. The per-unit manufacturing cost under absorption costing is__.arrow_forwardNeed help me this question general accountingarrow_forwardPlease give me true answer this financial accounting questionarrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning