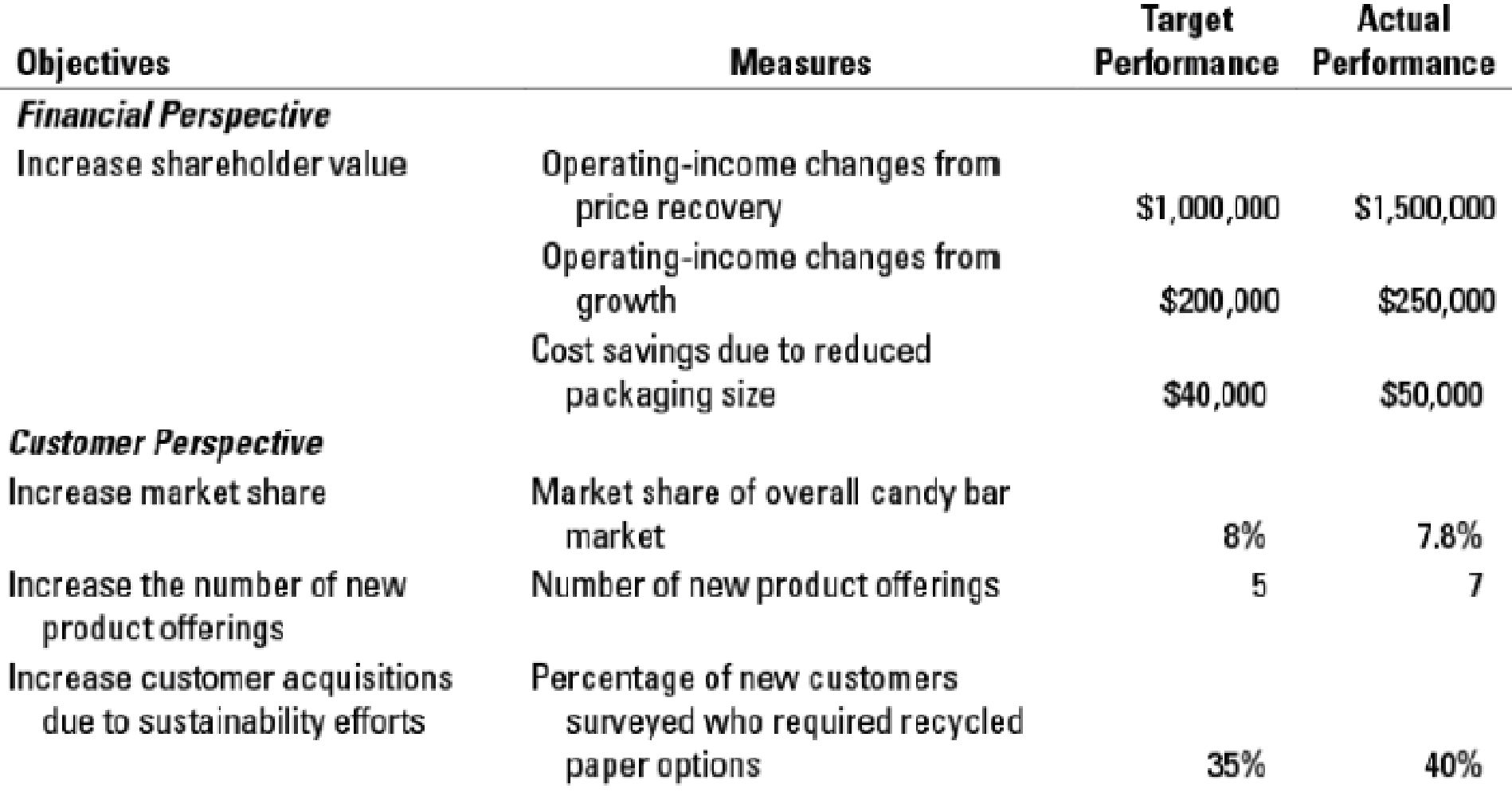

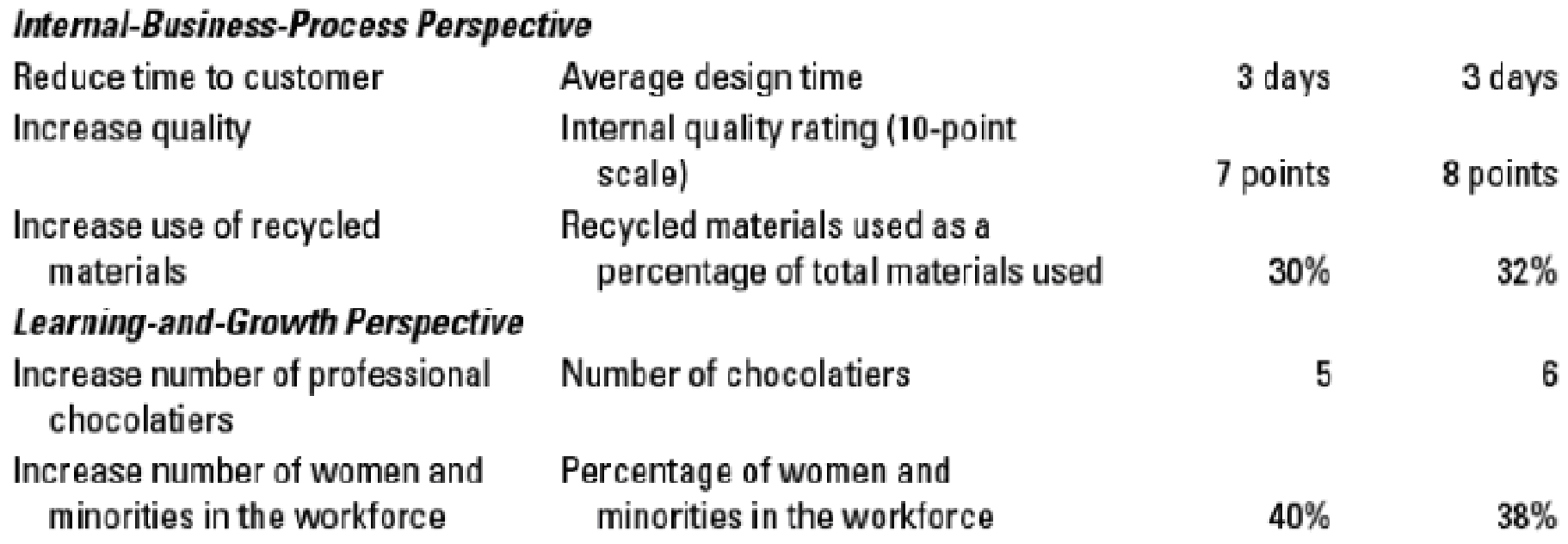

Balanced scorecard, environmental, and social performance. Gardini Chocolates makes custom-labeled, high-quality, specialty candy bars for special events and advertising purposes. The company employs several chocolatiers who were trained in Germany. The company offers many varieties of chocolate, including milk, semi-sweet, white, and dark chocolate. It also offers a variety of ingredients, such as coffee, berries, and fresh mint. The real appeal for the company’s product, however, is its custom labeling. Customers can order labels for special occasions (for example, wedding invitation labels) or business purposes (for example, business card labels). The company’s balanced scorecard for 2017 follows. For brevity, the initiatives taken under each objective are omitted.

- 1. Was Gardini successful in implementing its strategy in 2017? Explain your answer.

Required

- 2. Would you have included some measure of customer satisfaction in the customer perspective? Are these objectives critical to Gardini for implementing its strategy? Why or why not? Explain briefly.

- 3. Explain why Gardini did not achieve its target market share in the candy bar market but still exceeded its financial targets. Is “market share of overall candy bar market” a good measure of market share for Gardini’? Explain briefly.

- 4. Do you agree with Gardini’s decision not to include measures of changes in operating income from productivity improvements under the financial perspective of the balanced scorecard? Explain briefly.

- 5. Why did Gardini include balanced scorecard standards relating to environmental and social performance? Is the company meeting its performance objectives in these areas?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

- What distinguishes information hierarchy from data collection? (a) All data holds equal importance (b) Structured relationships determine reporting significance (c) Collection methods define value (d) Hierarchies create confusionarrow_forwardGeneral Accountarrow_forwardOn January 1, 2013, R Corporation leased equipment to Hela Company. The lease term is 9 years. The first payment of $452,000 was made on January 1, 2013. Remaining payments are made on December 31 each year, beginning with December 31, 2013. The equipment cost R Corporation $2,457,400. The present value of the minimum lease payments is $2,697,400. The lease is appropriately classified as a sales-type lease. Assuming the interest rate for this lease is 12%, what will be the balance reported as a liability by Hela in the December 31, 2014, balance sheet?arrow_forward

- 1.25.12-Pacific Coast Hotel's laundry department uses load optimization tracking. Each washer has 25kg capacity. Today's loads averaged: Morning 22kg, Afternoon 19kg, Evening 23kg. What is the unutilized capacity percentage? Accountingarrow_forwardThe actual cost of direct materials is $48.25 per pound, while the standard cost per pound is $50.75. During the current period, 4,800 pounds were used in production. What is the direct materials price variance?arrow_forwardRitter return on assets? General accountingarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education