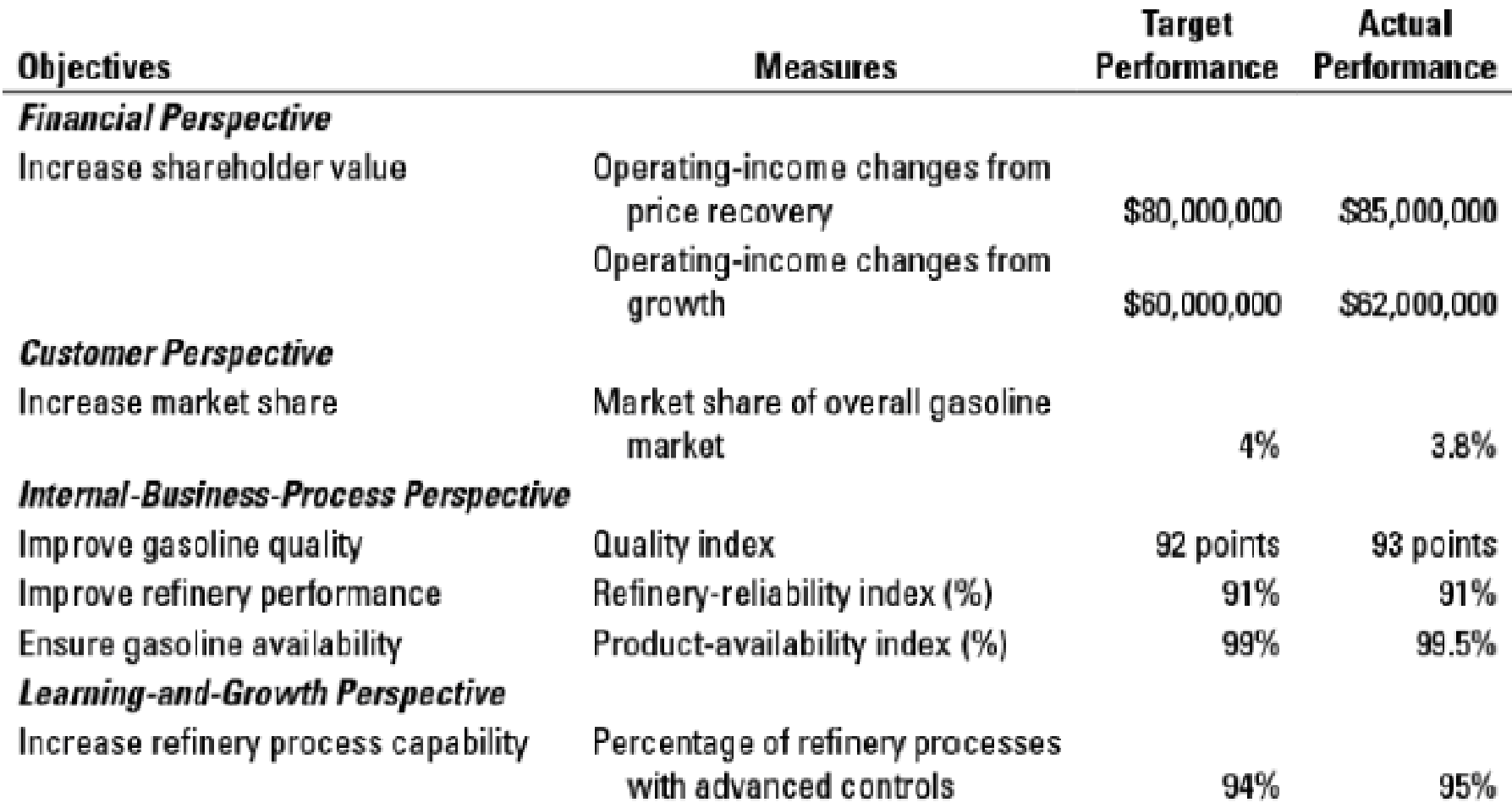

Balanced scorecard. (R. Kaplan, adapted) Petrocal, Inc., refines gasoline and sells it through its own Petrocal gas stations. On the basis of

- 1. Was Petrocal successful in implementing its strategy in 2017? Explain your answer.

- 2. Would you have included some measure of employee satisfaction and employee training in the learning-and-growth perspective? Are these objectives critical to Petrocal for implementing its strategy? Why or why not? Explain briefly.

- 3. Explain how Petrocal did not achieve its target market share in the total gasoline market but still exceeded its financial targets. Is ‘‘market share of overall gasoline marker the correct measure of market share? Explain briefly.

- 4. Is there a cause-and-effect linkage between improvements in the measures in the internal-business-process perspective and the measure in the customer perspective? That is, would you add other measures to the internal-business-process perspective or the customer perspective? Why or why not? Explain briefly.

- 5. Do you agree with Petrocal’s decision not to include measures of changes in operating income from productivity improvements under the financial perspective of the balanced scorecard? Explain briefly.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

- Luxe Inc., a chain of gasoline service stations, has a strategy of charging premium prices for its gasoline by providing excellent service such as attendants to pump gas, clean restrooms, and free air for tire inflation. Its balanced scorecard performance measures include: Increase in operating income through cost reduction (Financial); market share in the overall gasoline market (Customer); wait-time at the pump (Internal Business Processes); and employee bonus based on number of customers served (Learning and Growth). Indicate whether each of these performance measures is appropriate, given Luxes strategy.arrow_forwardBasic Inc., a chain of gasoline service stations, has a strategy of charging discount prices for its gasoline by providing very little service and charging relatively high prices for the goods in its attached mini-market. Its balanced scorecard performance measures include: Increase in operating income through cost reduction (Financial); market share in the overall gasoline market (Customer); wait-time at the pump (Internal Business Processes); and store manager and employee bonus based on number of customers served (Learning and Growth). Indicate whether each of these performance measures is appropriate, given Basics strategy.arrow_forwardDarren Mack owns the Gas n’ Go convenience store and gasstation. After hearing a marketing lecture, he realizes thatit might be possible to draw more customers to his high-margin convenience store by selling his gasoline at a lowerprice. However, the Gas n’ Go is unable to qualify for volumediscounts on its gasoline purchases, and therefore cannot sellgasoline for profit if the price is lowered. Each new pump willcost $95,000 to install, but will increase customer traffic in thestore by 1,000 customers per year. Also, because the Gas n’Go would be selling its gasoline at no profit, Darren plans onincreasing the profit margin on convenience store items in-crementally over the next five years. Assume a discount rateof 8 percent. The projected convenience store sales per cus-tomer and the projected profit margin for the next five yearsare as follows: a. What is the NPV of the next five years of cash flows ifDarren had four new pumps installed?b. If Darren required a payback period of four…arrow_forward

- Hazlett & Family is organized into two geographic markets Northern and Southern. The company makes an off-road vehicle for recreation and agricultural use. The vehicle is sold in three models, depending on the power and options. The three models, from least expensive to most expensive, are the H-L, H-LX, and H-LXS. The company's financial staff has prepared the following forecasted income statement for the upcoming fiscal year (in thousands of dollars): Sales revenue Cost of goods sold Gross margin Marketing costs Administrative costs Total marketing and administrative Operating profits Management has expressed special concern with the Southern market because of the extremely poor return on sales. This market was entered a year ago because it seemed like the best opportunity for growth. Hazlett & Family knew that it would take some time to build profitability in the market, but there has been no noticeable change in the low returns over time. H-L H-LX H-LXS The financial staff has also…arrow_forwardHazlett & Family is organized into two geographic markets Northern and Southern. The company makes an off-road vehicle for recreation and agricultural use. The vehicle is sold in three models, depending on the power and options. The three models, from least expensive to most expensive, are the H-L, H-LX, and H-LXS. The company's financial staff has prepared the following forecasted income statement for the upcoming fiscal year (in thousands of dollars): Sales revenue Cost of goods sold. Gross margin Marketing costs. Administrative costs Total marketing and administrative. Operating profits H-L H-LX H-LXS Management has expressed special concern with the Southern market because of the extremely poor return on sales. This market was entered a year ago because it seemed like the best opportunity for growth. Hazlett & Family knew that it would take some time to build profitability in the market, but there has been no noticeable change in the low returns over time. The financial staff has…arrow_forwardKroft Food Products is attempting to decide whether it should introduce a new line of salad dressings called Special Choices. The company can test market the salad dressings in selected geographic areas or bypass the test market and introduce the product nationally. The cost of the test market is $150,000. If the company conducts the test market, it must wait to see the results before deciding whether to introduce the salad dressings nationally. The probability of a positive test market result is estimated to be 0.6. Alternatively, the company can decide not to conduct the test market and go ahead and make the decision to introduce the dressings or not. If the salad dressings are introduced nationally and are a success, the company estimates that it will realize an annual profit of $1.6 million, whereas if the dressings fail, it will incur a loss of $700,000. The company believes the probability of success for the salad dressings is 0.50, if they are introduced without the test market.…arrow_forward

- A trader wants to open an oil shop in the area with a choice of the B City, J Cityor D City. Each of these area options has a local supplier providingThe price quote for the oil is detailed in the table below. Area Fixed Cost Variabel Cost B City 5,500,000 55,470,000 J City 11,500,000 35,500 D City 21,500,000 15,500 How much volume must be met in order to obtain economic value per area? Determine the volume range for each area AND Sketch a crossover chart that illustrates these conditions!arrow_forwardDarren Mack owns the "Gas n' Go" convenience store and gas station. After hearing a marketing lecture, he realizes that it might be possible to draw more customers to his high-margin convenience store by selling his gasoline at a lower price. However, the "Gas n' Go' is unable to qualify for volume discounts on its gasoline purchases, and therefore cannot sell gasoline for profit if the price is lowered. Each new pump will cost $95,000 to install, but will increase customer traffic in the store by 14,000 customers per year. Also, because the "Gas n' Go" would be selling its gasoline at no profit Darren plans on increasing the profit margin on convenience store items incrementally over the next five years. Assume a discount rate of 7 percent. The projected convenience store sales per customer and the projected profit margin for the next five years are given in the table below. Year 1 2 3 4 5 Projected Convenience Store Sales Per Customer $4 $5.50 $7 $8 $9 Projected Profit Margin 15% 20%…arrow_forwardDarren Mack owns the "Gas n' Go" convenience store and gas station. After hearing a marketing lecture, he realizes that it might be possible to draw more customers to his high-margin convenience store by selling his gasoline at a lower price. However, the "Gas n' Go' is unable to qualify for volume discounts on its gasoline purchases, and therefore cannot sell gasoline for profit if the price is lowered. Each new pump will cost $95,000 to install, but will increase customer traffic in the store by 13,000 customers per year. Also, because the "Gas n' Go" would be selling its gasoline at no profit, Darren plans on increasing the profit margin on convenience store items incrementally over the next five years. Assume a discount rate of 8 percent. The projected convenience store sales per customer and the projected profit margin for the next five years are given in the table below. i Year 1 23 $5 $5.50 $7 $9 $11 a. What is the NPV of the next five years of cash flows if Darren had four new…arrow_forward

- Darren Mack owns the Gas n’ Go convenience store and gas station. After hearing a marketing lecture, he realizes that it might be possible to draw more customers to his high-margin convenience store by selling his gas at a lower price. However, the Gas n’ Go is unable to qualify for volume discounts on its gas purchases, and therefore, cannot sell gas for profit if the price is lowered. Each new pump will cost $95,000 to install but will increase customer traffic in the store by 12,000 customers per year. Also, because the Gas n’ Go would be selling its gasoline at no profit, Darren plans on increasing the profit margin on convenience store items incrementally over the next 5 years. Assume a discount rate of 7%. The projected convenience store sales per customer and the projected profit margin for the next 5 years are as follows: Year Projected Convenience Store Sales Per Customer Projected Profit Margin 1 $5.00 20% 2 $6.50 25% 3 $8.00 30% 4…arrow_forwardDarren Mack owns the "Gas n' Go" convenience store and gas station. After hearing a marketing lecture, he realizes that it might be possible to draw more customers to his high-margin convenience store by selling his gasoline at a lower price. However, the "Gas n' Go' is unable to qualify for volume discounts on its gasoline purchases, and therefore cannot sell gasoline for profit if the price is lowered. Each new pump will cost $130,000 to install, but will increase customer traffic in the store by 13,000 customers per year. Also, because the "Gas n' Go" would be selling its gasoline at no profit, Darren plans on increasing the profit margin on convenience store items incrementally over the next five years. Assume a discount rate of 8 percent. The projected convenience store sales per customer and the projected profit margin for the next five years are given in the table below. Year Projected Convenience Store Sales Per Customer Projected Profit Margin 1…arrow_forwardDrain Your Brain, a local video arcade, is considering the addition of a new virtual reality system. Several different vendors have been contacted. The owner of the arcade, affectionately referred to by patrons as Wizard, has narrowed his selection to one of three choices (mutually exclusive alternatives). The data below describes the three systems under evaluation. Annual costs are based on electricity consumed, replacement parts based on use, and preventive maintenance. Revenue estimates are provided by the vendors based on regional data and relative thrill as compared to other arcade games and a cost of $1.00 per play. a) Which method (PW, AW, FW, IRR) would be best (easiest) to use to select the preferred alternative? b) What is the implicit study period for this problem? c) Which alternative should be selected when MARR is 15%? (AWA=$ ?)arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,