Translation

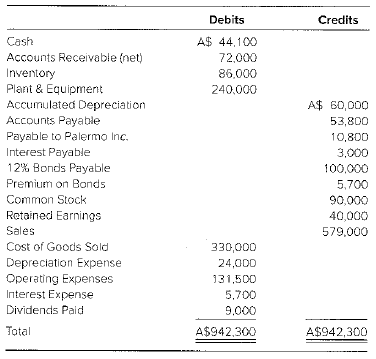

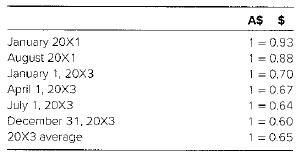

Palermo Inc. purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (AS) was A$200,000, and A$40,000 of the differential was allocated lo plant and equipment, which is amortized over a 10-year period. The remainder of the differential was attributable to a Patent. Palermo Inc. amortizes the patent over 10 years. Salina Ranching’s

Additional Information

1. Salina Ranching uses average cost for cost of goods sold. Inventory increased by A$20,000 during the year. Purchases were made uniformly during 20X3. The ending inventory was acquired at the average exchange rate for the year.

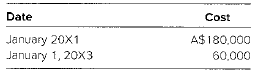

2. Plain and equipment were acquired as follows:

3. Plant and equipment are

4. The payable to Palermo is in Australian dollars. Palermo’s books show a receivable from Salina Ranching of $6,480.

5. The 10−year bonds were issued on July 1, 20X3, for A$106,000. The premium is amortized on a straight−line basis. The interest is paid on April 1 and October 1,

6. The dividends were declared arid paid on April 1.

7. Exchange rates were as follows:

Required

a. Prepare a schedule translating the December 31, 20X3, trial balance of Salina Ranching from Australian dollars to U.S. dollars.

b. Prepare a schedule providing a proof of the translation adjustment.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

ADVANCED FIN. ACCT. LL W/ACCESS>CUSTOM<

- The next dividend payment by Skippy Inc. will be $3.45. The dividends are anticipated to maintain a growth rate of 4.2% forever. If the stock currently sells for $37.95 per share, what is the required rate of return? Comprehensive Holdings just paid a dividend of $2.95 per share on its stock. The dividends are expected to grow at a constant rate of 4.8% forever. If investors require a return of 12% on the stock, what is the current price? What will be the price in 3 years? In 7 years? Citibank expects to pay a dividend of $2 per share on its common stock at the end of this year. The growth rate of the dividend is 8% for the next 2 years. After that, the dividends are expected to grow at a constant growth rate of 5% per year forever. The required rate of return on the company’s stock is 11%. What is the price of Citibank stock today? A firm pays a current dividend of $3, which is expected to grow at a rate of 4% indefinitely. If the current value of the firm’s shares is $53,…arrow_forwardGeneral accountingarrow_forwardThe stock P/E ratio.??arrow_forward

- provide correct answer mearrow_forwardHyundai Company had beginning raw materials inventory of $29,000. During the period, the company purchased $115,000 of raw materials on account. If the ending balance in raw materials was $18,500, the amount of raw materials transferred to work in process inventory is?arrow_forwardComputing the gross profit percentage Edible Art earned net sales revenue of $75,050,000 in 2019. The cost of goods sold was $55,650,000, and net income reached $13,000,000, the company s highest ever. Compute the company s gross profit percentage for 2019.arrow_forward

- correct answer pleasearrow_forwardComputing the gross profit percentage Edible Art earned net sales revenue of $75,050,000 in 2019. The cost of goods sold was $55,650,000, and net income reached $13,000,000, the company s highest ever. Compute the company s gross profit percentage for 2019. Answerarrow_forwardNeed help this questionarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College