Fundamentals of Cost Accounting

6th Edition

ISBN: 9781260708783

Author: LANEN, William

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 70P

Findina Missing Data: Net Realizable Value

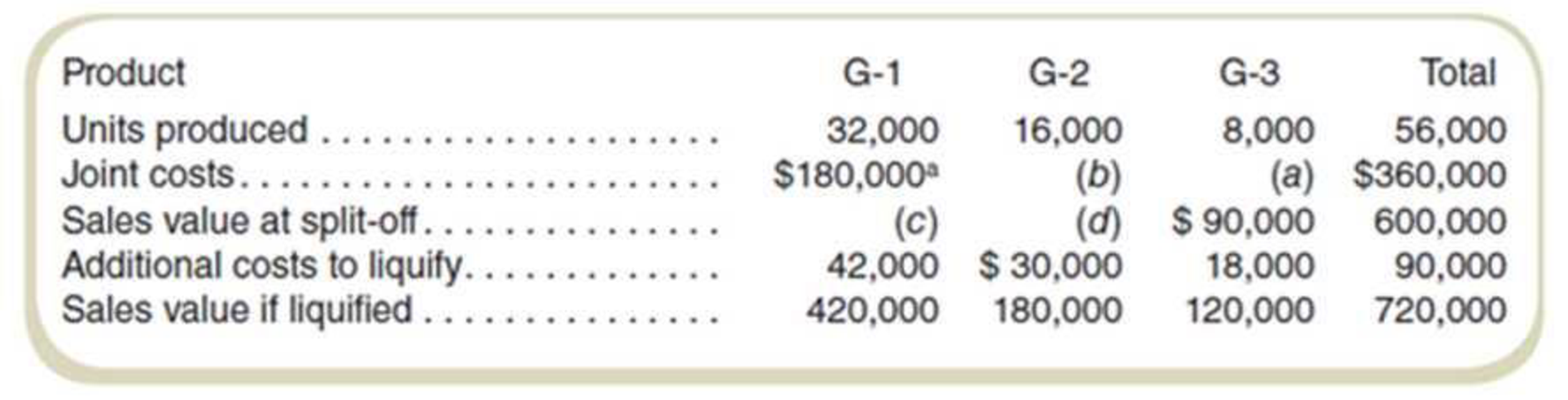

Spartan Chemicals manufactures G-1, G-2, and G-3 from a joint process. Each gas can be liquified and sold for a higher price. Data on the process are as follows:

a This amount is the portion of the total joint cost of $360,000 that had boon allocated to G-1 Required

Determine the value for each lettered item.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Pinakin Inc. has sales of $680,000 and costs of $305,000. Interest expense is $25,000 and depreciation is $53,000. The tax rate is 37%. What is the net income? Don't Use Ai

In 2011, It cost Parley Corp. $9 per unit to produce part T5. In 2012, it has increased to $12 per unit. In 2012, Southside Company has offered to provide Part T5 for $7 per unit to Westa. As it pertains to the make-or-buy decision, which statement is true? Need help

ABC is an all-equity firm that has 44,200 shares of stock outstanding at a market price of $14.70 per share. The firm is considering a capital structure with 53% debt at a rate of 5% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued.

Chapter 11 Solutions

Fundamentals of Cost Accounting

Ch. 11 - Why do companies allocate costs? What are some of...Ch. 11 - What are the three methods of allocating service...Ch. 11 - What are the similarities and differences among...Ch. 11 - What criterion should be used to determine the...Ch. 11 - What is a limitation of the direct method of...Ch. 11 - What is a limitation of the step method of...Ch. 11 - Prob. 7RQCh. 11 - Why would a number of accountants express a...Ch. 11 - Prob. 9RQCh. 11 - What is the basic difference between the...

Ch. 11 - Prob. 11RQCh. 11 - If cost allocations arc arbitrary and potentially...Ch. 11 - Prob. 13CADQCh. 11 - Prob. 14CADQCh. 11 - Prob. 15CADQCh. 11 - Prob. 16CADQCh. 11 - Prob. 17CADQCh. 11 - Prob. 18CADQCh. 11 - What are some of the factors that a company needs...Ch. 11 - Prob. 20CADQCh. 11 - Prob. 21CADQCh. 11 - Prob. 22CADQCh. 11 - How is joint cost allocation like service...Ch. 11 - Prob. 24CADQCh. 11 - In what ways is joint cost allocation similar to...Ch. 11 - Why Are Costs Allocated?Ethical Issues You are the...Ch. 11 - Cost Allocation: Direct Method Caro Manufacturing...Ch. 11 - Allocating Service Department Costs First to...Ch. 11 - Cost Allwat ion: Direct Method University Printers...Ch. 11 - Prob. 30ECh. 11 - Cost Allocation: Step Method

Refer to the data for...Ch. 11 - Cost Allocation: Reciprocal Method

Refer to the...Ch. 11 - Cost Allocation: Reciprocal Method, Two Service...Ch. 11 - Cost Allocation: Reciprocal Method

Refer to the...Ch. 11 - Prob. 35ECh. 11 - Prob. 36ECh. 11 - Prob. 37ECh. 11 - Prob. 38ECh. 11 - Prob. 39ECh. 11 - Prob. 40ECh. 11 - Net Realizable Value Method: Multiple Choice

Oak...Ch. 11 - Sell or Process Further: Multiple Choice

Refer to...Ch. 11 - Net Realizable Value Method Euclid Corporation...Ch. 11 - Estimated Net Realizable Value Method Blasto,...Ch. 11 - Net Realizable Value Method to Solve for Unknowns...Ch. 11 - Net Realizable Value Method Bixel Components...Ch. 11 - Net Realizable Value Method with By-Products...Ch. 11 - Net Realizable Value Method Deming Sons...Ch. 11 - Physical Quantities Method

Refer to the facts in...Ch. 11 - Sell or Process Further

Refer to the facts in...Ch. 11 - Physical Quantities Method The following questions...Ch. 11 - Physical Quantities Method; Sell or Process...Ch. 11 - Physical Quantities Method with By-Product...Ch. 11 - Step Method with Three Service Departments Model,...Ch. 11 - Comparison of Allocation Methods BluStar Company...Ch. 11 - Solve for Unknowns: Direct Method Franks Foods has...Ch. 11 - Solve for Unknowns: Step Method RT Renovations is...Ch. 11 - Cost Allocation: Step Method with Analysis and...Ch. 11 - Prob. 59PCh. 11 - Prob. 60PCh. 11 - Direct, Step, and Reciprocal Methods:...Ch. 11 - Cost Allocation: Step and Reciprocal Methods...Ch. 11 - Allocate Service Department Costs: Direct and Step...Ch. 11 - Prob. 64PCh. 11 - Prob. 65PCh. 11 - Prob. 66PCh. 11 - Prob. 67PCh. 11 - Prob. 68PCh. 11 - Fletcher Fabrication, Inc., produces three...Ch. 11 - Findina Missing Data: Net Realizable Value Spartan...Ch. 11 - Finding Missing Data: Net Realizable Value Blaine,...Ch. 11 - Joint Costing in a Process Costing Context:...Ch. 11 - Find Maximum Input Price: Estimated Net Realizable...Ch. 11 - Effect of By-Product versus Joint Cost Accounting...Ch. 11 - Prob. 75PCh. 11 - Prob. 76P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5 PTSarrow_forwardIn 2011, It cost Parley Corp. $9 per unit to produce part T5. In 2012, it has increased to $12 per unit. In 2012, Southside Company has offered to provide Part T5 for $7 per unit to Westa. As it pertains to the make-or-buy decision, which statement is true?arrow_forwardWhat is its ROEarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Incremental Analysis - Sell or Process Further; Author: Melissa Shirah;https://www.youtube.com/watch?v=7D6QnBt5KPk;License: Standard Youtube License