Concept explainers

Cost Allwat ion: Direct Method

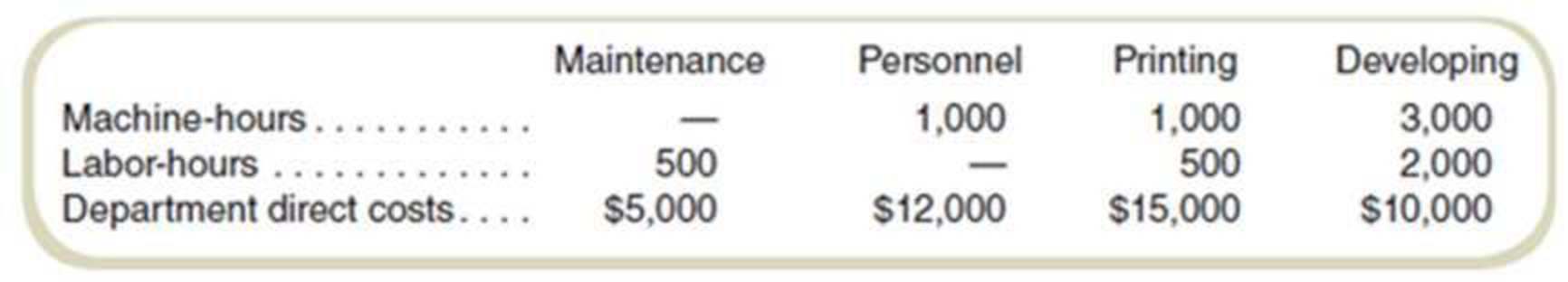

University Printers has two service departments (Maintenance and Personnel) and two operating departments (Printing and Developing). Management has decided to allocate maintenance costs on the basis of machine-hours in each department and personnel costs on the basis of labor-hours worked by the employees in each.

The following data appear in the company records for the current period:

Required

Use the direct method to allocate these service department costs to the operating departments.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Fundamentals of Cost Accounting

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Anderson Technologies has 40,000,000 shares outstanding with a current market PPS of $30.25. If the firm has total assets of $750M, total liabilities of $250M, and net income of $480M, it would have a P/E of _ and a Market-to-Book ratio of _. General Accounting problem 2.4arrow_forwardThe first-quarter tax return needs to be filed for Prevosti Farms and Sugarhouse by April 30, 2023. For the taxes, assume the second February payroll amounts were duplicated for the March 10 and March 24 payroll periods, and the new benefit elections went into effect as planned. The form was completed and signed on April 11, 2023. Benefit Information Exempt Federal FICA Health Insurance Yes Yes Life Insurance Yes Yes Long-term Care Yes Yes FSA Yes Yes 401(k) Yes No Gym No No Owner's name Address Phone Number of employees Gross quarterly wages (exclusive of fringe benefits) Federal income tax withheld 401(k) contributions Section 125 withheld Gym Membership (add to all taxable wages, not included above) Month 1 Deposit Month 2 Deposit Toni Prevosti 820 Westminster Road, Bridgewater, VT 05520. 802-555-3456 8 $ 36,673.30 $ 510.00 $ 1,427.46 $ 4,080.00 $ 90.00 $ 0.00 $ 2,171.62 Month 3 Deposit Required: $ 3,338.93 Complete Form 941 for Prevosti Farms and Sugarhouse. Prevosti Farms and…arrow_forwardAnderson Technologies has 40,000,000 shares outstanding with a current market PPS of $30.25. If the firm has total assets of $750M, total liabilities of $250M, and net income of $480M, it would have a P/E of _ and a Market-to-Book ratio of _. Accurate Answerarrow_forward

- Anderson Technologies has 40,000,000 shares outstanding with a current market PPS of $30.25. If the firm has total assets of $750M, total liabilities of $250M, and net income of $480M, it would have a P/E of _ and a Market-to-Book ratio of _. Question 5arrow_forwardKindly help me with accounting questionsarrow_forwardWhat is the dollar amount of interest accounting questionarrow_forward

- In the current year, Palmer Industries incurred $180,000 in actual manufacturing overhead cost. The Manufacturing Overhead account showed that overhead was overapplied in the amount of $9,000 for the year. If the predetermined overhead rate was $10.00 per direct labor-hour, how many hours were worked during the year? ANSWER?arrow_forwardWhat is the cost of goods manufactured for 2023 ??arrow_forwardAt the beginning of the year, manufacturing overhead for the year was estimated to be $315,840. At the end of the year, actual direct labor-hours for the year were 25,800 hours, the actual manufacturing overhead for the year was $308,700, and manufacturing overhead for the year was overapplied by $14,500. If the predetermined overhead rate is based on direct labor-hours, then what must have been the estimated direct labor-hours at the beginning of the year used in the predetermined overhead rate?arrow_forward

- At the beginning of the year, manufacturing overhead for the year was estimated to be $800,000. At the end of the year, actual labor hours for the year were 40,000 hours, the actual manufacturing overhead for the year was $775,000, and the manufacturing overhead for the year was overapplied by $25,000. If the predetermined overhead rate is based on direct labor hours, then the estimated labor hours at the beginning of the year used in the predetermined overhead rate must have been ___ Hours.arrow_forwardMason Corporation issued its own $15,000, 120-day, non-interest-bearing note to a bank. The only payment Mason will ever make to the bank will be for $15,000 at the maturity date of the loan, as the bank discounts the note at 8%. The proceeds to Mason are: Ans.arrow_forwardThe future earnings, dividends, and common stock price of Square Technologies Inc. are expected to grow at a rate of 5% per year. The company’s common stock is currently selling for $30 per share and its last dividend was $4. What is the company’s cost of common equity? If the firm’s beta is 1.25, the risk-free rate is 6%, and the market rate of return is 14%, what will be the cost of common equity using the CAPM approach? If you have equal confidence in the inputs used for the two approaches, what is your estimate of the company’s cost of common equity? Berger Paints Corporation has a target capital structure of 35% debt and 65% common equity. Its before tax cost of debt is 9% and the marginal tax rate is 30%. The company’s stock is currently selling at $23 per share and the last dividend was $3. If dividends are expected to grow at a constant rate of 5%, what is the company’s cost of common equity and WACC?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning