College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666184

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 6SEA

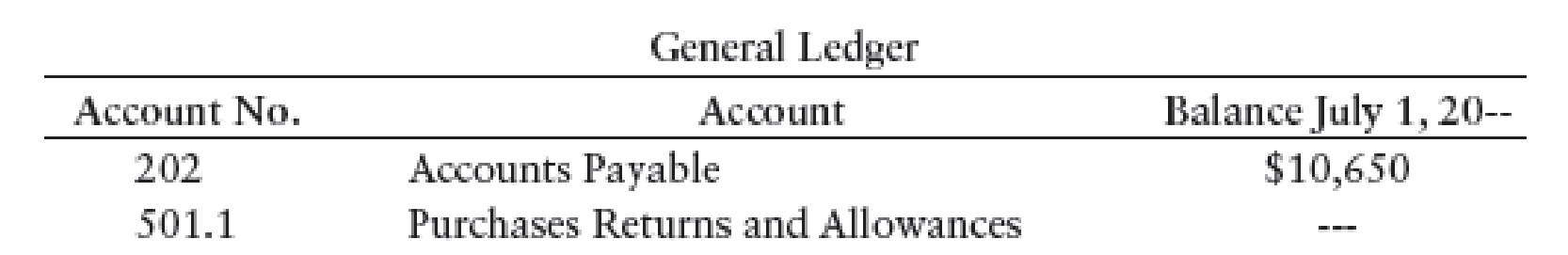

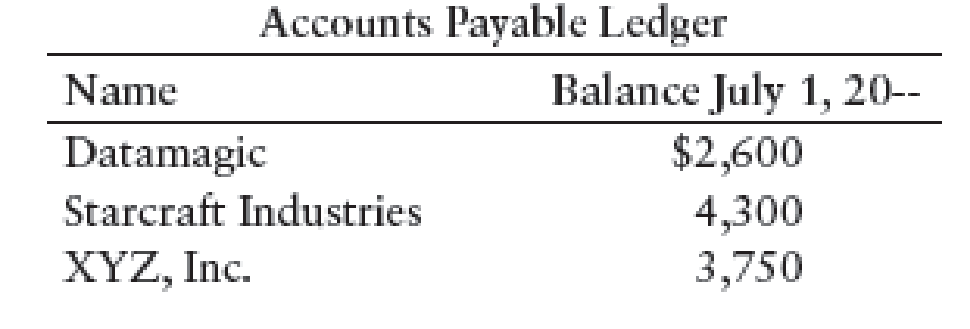

JOURNALIZING PURCHASES RETURNS AND ALLOWANCES AND POSTING TO GENERAL LEDGER AND ACCOUNTS PAYABLE LEDGER Using page 3 of a general journal and the following general ledger and accounts payable ledger accounts, journalize and post the following transactions:

July 7 Returned merchandise to Starcraft Industries, $700.

15 Returned merchandise to XYZ, Inc., $450.

27 Returned merchandise to Datamagic, $900.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please give me true answer this financial accounting question

Can you please give me correct solution this general accounting question?

Michael McDowell Co. establishes a $108 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2026. Also, at the end of 2025, the company has $54 million of temporary differences due to excess depreciation for tax purposes, $7.56 million of which will reverse in 2026.

The enacted tax rate for all years is 20%, and the company pays taxes of $34.56 million on $172.80 million of taxable income in 2025. McDowell expects to have taxable income in 2026.

Assuming that the only deferred tax account at the beginning of 2025 was a deferred tax liability of $5,400,000, draft the income tax expense portion of the income statement for 2025, beginning with the line "Income before income taxes." (Hint: You must first compute (1) the amount of temporary difference underlying the beginning $5,400,000 deferred tax liability, then (2) the amount of temporary differences…

Chapter 11 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

Ch. 11 - Prob. 1TFCh. 11 - Prob. 2TFCh. 11 - A trade discount is a reduction from the list or...Ch. 11 - Prob. 4TFCh. 11 - FOB shipping point means that transportation...Ch. 11 - Prob. 1MCCh. 11 - In the income statement, Freight-In is (a) added...Ch. 11 - Prob. 3MCCh. 11 - The difference between merchandise available for...Ch. 11 - Prob. 5MC

Ch. 11 - Prob. 1CECh. 11 - Prob. 2CECh. 11 - Prob. 3CECh. 11 - Prob. 4CECh. 11 - Identify the major documents commonly used in the...Ch. 11 - Prob. 2RQCh. 11 - Describe how each of the following accounts is...Ch. 11 - How are cost of goods sold and gross profit...Ch. 11 - Prob. 5RQCh. 11 - Prob. 6RQCh. 11 - What steps are followed in posting purchases...Ch. 11 - What steps are followed in posting cash payments...Ch. 11 - Prob. 9RQCh. 11 - If the total of the schedule of accounts payable...Ch. 11 - Prob. 1SEACh. 11 - Prob. 2SEACh. 11 - Prob. 3SEACh. 11 - Prob. 4SEACh. 11 - JOURNALIZING PURCHASES TRANSACTIONS Journalize the...Ch. 11 - JOURNALIZING PURCHASES RETURNS AND ALLOWANCES AND...Ch. 11 - Prob. 7SEACh. 11 - SCHEDULE OF ACCOUNTS PAYABLE Ryans Express, a...Ch. 11 - PURCHASES TRANSACTIONS J. B. Speck, owner of...Ch. 11 - CASH PAYMENTS TR ANS ACTIONS Sam Santiago operates...Ch. 11 - PURCHASES AND CASH PAYMENTS TRANSACTIONS Emily...Ch. 11 - SCHEDULE OF ACCOUNTS PAYABLE Based on the...Ch. 11 - Prob. 1SEBCh. 11 - TRADE DISCOUNT AND CASH DISCOUNTS Merchandise was...Ch. 11 - PURCHASE TRANSACTIONS AND T ACCOUNTS Using T...Ch. 11 - COMPUTING GROSS PROFIT The following data were...Ch. 11 - JOURNALIZING PURCHASES TRANSACTIONS Journalize the...Ch. 11 - JOURNALIZING PURCHASES RETURNS AND ALLOWANCES AND...Ch. 11 - Prob. 7SEBCh. 11 - SCHEDULE OF ACCOUNTS PAYABLE Crystals Candles, a...Ch. 11 - PURCHASES TRANSACTIONS Ann Benton, owner of...Ch. 11 - CASH PAYMENTS TRANSACTIONS Kay Zembrowski operates...Ch. 11 - PURCHASES AND CASH PAYMENTS TRANSACTIONS Debbie...Ch. 11 - SCHEDULE OF ACCOUNTS PAYABLE Based on the...Ch. 11 - You are working as a summer intern at a rapidly...Ch. 11 - Prob. 1ECCh. 11 - Michelle French owns and operates Books and More,...Ch. 11 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer the following requirements a and b on these general accounting questionarrow_forwardGeneral Accountingarrow_forwardHarper, Incorporated, acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2023, for $210,000 in cash. The book value of Kinman's net assets on that date was $400,000, although one of the company's buildings, with a $60,000 carrying amount, was actually worth $100,000. This building had a 10-year remaining life. Kinman owned a royalty agreement with a 20-year remaining life that was undervalued by $85,000. Kinman sold Inventory with an original cost of $60,000 to Harper during 2023 at a price of $90,000. Harper still held $15,000 (transfer price) of this amount in Inventory as of December 31, 2023. These goods are to be sold to outside parties during 2024. Kinman reported a $40,000 net loss and a $20,000 other comprehensive loss for 2023. The company still manages to declare and pay a $10,000 cash dividend during the year. During 2024, Kinman reported a $40,000 net income and declared and paid a cash dividend of $12,000. It made additional inventory sales…arrow_forward

- Solve this general accounting question not use aiarrow_forwardPlease provide solution this general accounting questionarrow_forwardMichael McDowell Co. establishes a $108 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2026. Also, at the end of 2025, the company has $54 million of temporary differences due to excess depreciation for tax purposes, $7.56 million of which will reverse in 2026. The enacted tax rate for all years is 20%, and the company pays taxes of $34.56 million on $172.80 million of taxable income in 2025. McDowell expects to have taxable income in 2026. Assuming that the only deferred tax account at the beginning of 2025 was a deferred tax liability of $5,400,000, draft the income tax expense portion of the income statement for 2025, beginning with the line "Income before income taxes." (Hint: You must first compute (1) the amount of temporary difference underlying the beginning $5,400,000 deferred tax liability, then (2) the amount of temporary differences…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY