Profitability Declines and the Statement of

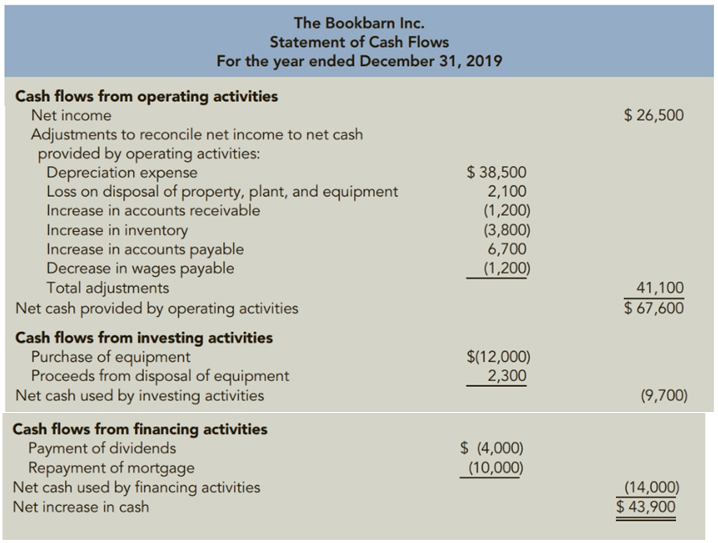

The Bookbarn Inc. is a retail seller of new books in a moderate-sized city. Although initially very successful, The Bookbarn’s sales volume has declined since the opening of two competing bookstores 2 years ago. The accountant for The Bookbarn prepared the following statement of cash flows at the end of the current year:

Your analysis suggests that The Bookbarn’s net income will continue to decline by $8,000 per year to $18,500 as sales continue to fall. Thereafter, you expect sales to stabilize.

Assume that equipment is nearly fully

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Cornerstones of Financial Accounting

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardNeed Help About this Financial Accounting Question With Correct Answer..arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardNo AI The accounting principle that requires matching revenues with related expenses is the:A. Going Concern PrincipleB. Matching PrincipleC. Cost PrincipleD. Full Disclosure Principlearrow_forwardRevenue is recognized in the accounting records when it is:A. CollectedB. EarnedC. DepositedD. Reportedarrow_forward

- The accounting principle that requires matching revenues with related expenses is the:A. Going Concern PrincipleB. Matching PrincipleC. Cost PrincipleD. Full Disclosure Principlearrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit RevenueCorrectarrow_forward

- If cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenuecorrectarrow_forwardGAP Corp. is a calendar year S corporation with three shareholders. George and Anna each own 49 percent of the stock. Peter owns 2 percent of the stock. The corporation was formed on January 2, Year 1, and has been an S corporation since its inception. Using the exhibits, prepare a schedule of GAP's income, gain, loss, and deduction items for Year 2. In column B, enter the amount for federal income tax purposes. In column C, enter the amount included in GAP's Form 1120S ordinary business income (OBI) or loss. In column D, enter the amount included on GAP's Schedule K as a taxable or deductible separately stated item. Each item may have amounts entered in ordinary business income, separately stated items, or both. Enter income and gain amounts as positive numbers. Enter losses and deductions as negative numbers. If the amount is zero, enter a zero (0). A B C D 1 Income, Gain, Loss, and Deduction Items Amount for Federal Income Tax Purposes Ordinary Business Income…arrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenue need helparrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning