Concept explainers

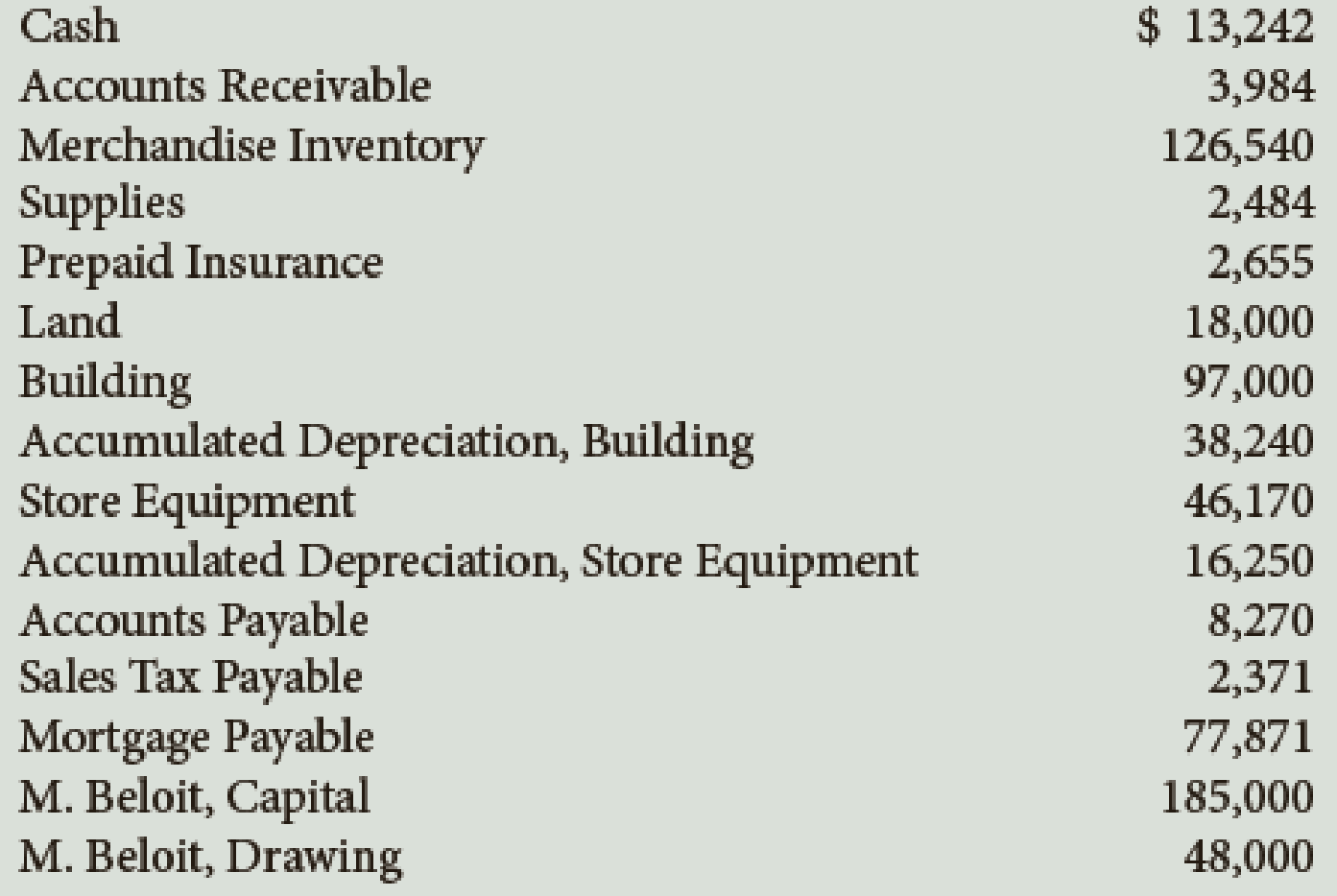

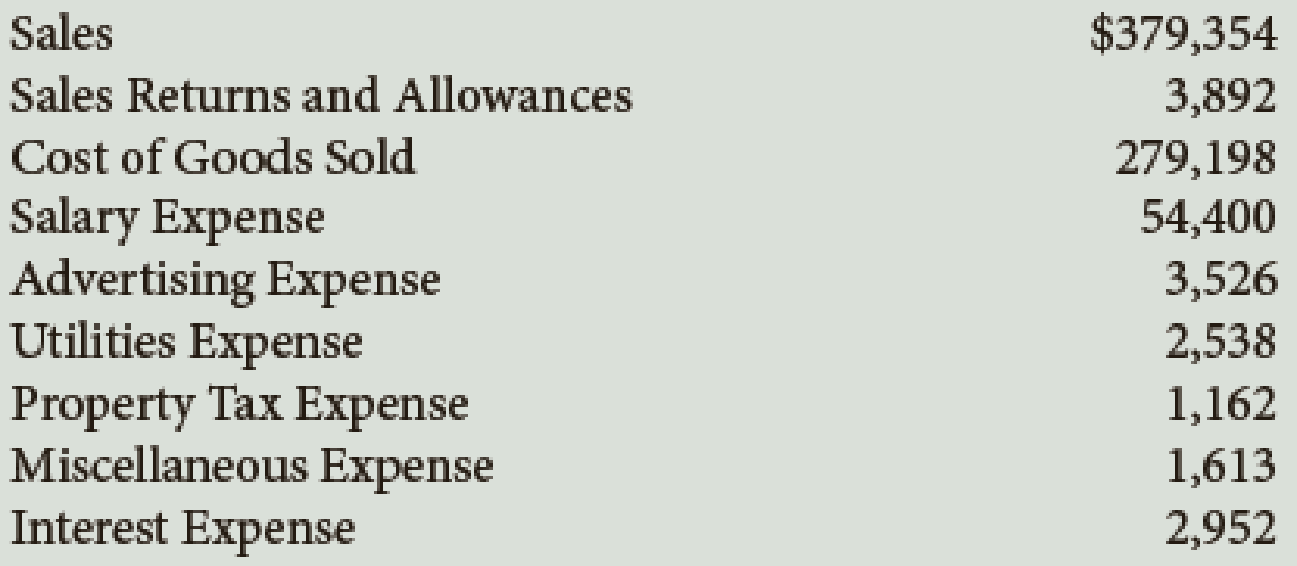

Here are the accounts in the ledger of Misha’s Jewel Box, with the balances as of December 31, the end of its fiscal year.

Here are the data for the adjustments. Assume that Misha’s Jewel Box uses the perpetual inventory system.

a. Merchandise Inventory at December 31, $124,630.

b. Insurance expired during the year, $1,294.

c.

d. Depreciation of store equipment, $6,470.

e. Salaries accrued at December 31, $2,470.

f. Store supplies inventory (on hand) at December 31, $1,959.

Required

- 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL.

- 2. Journalize the

adjusting entries . If using manual working papers, record adjusting entries on journal page 63.

Trending nowThis is a popular solution!

Chapter 11 Solutions

College Accounting - With Quickbooks 2015 CD and Access

Additional Business Textbook Solutions

Fundamentals of Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

- General accounting questionarrow_forwardHamilton Biotech has a profit margin of 8% and an equity multiplier of 2.8. Its sales are $150 million, and it has total assets of $60 million. What is Hamilton Biotech's Return on Equity (ROE)? Round your answer to two decimal places.arrow_forwardMAX's Auto Repair, a proprietorship, started the year with total assets of $72,000 and total liabilities of $48,500. During the year, the business recorded $120,600 in repair revenues, $65,400 in expenses, and MAX Grant, the owner, withdrew $12,500. MAX’s capital balance at the end of the year?arrow_forward

- Over the past four years, the Dow Jones Industrial Average (DJIA) delivered annual returns of 12%, -3%, 18%, and 9%. What is the arithmetic average annual return per year? a) 10.25% b) 8.50% c) 9.00% d) 9.75%arrow_forwardMAX's Auto Repair, a proprietorship, started the year with total assets of $72,000 and total liabilities of $48,500. During the year, the business recorded $120,600 in repair revenues, $65,400 in expenses, and MAX Grant, the owner, withdrew $12,500. MAX’s capital balance at the end of the year?arrow_forwardPeterson Company estimates that overhead costs for the next year will be $3,600,000 for indirect labor and $910,000 for factory utilities. The company uses machine hours as its overhead allocation base. If 110,000 machine hours are planned for this next year, what is the company's plantwide overhead rate? a) $41.00 per machine hour b) $32.30 per machine hour c) $0.03 per machine hour d) $8.27 per machine hour e) $0.12 per machine hourarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning