1.

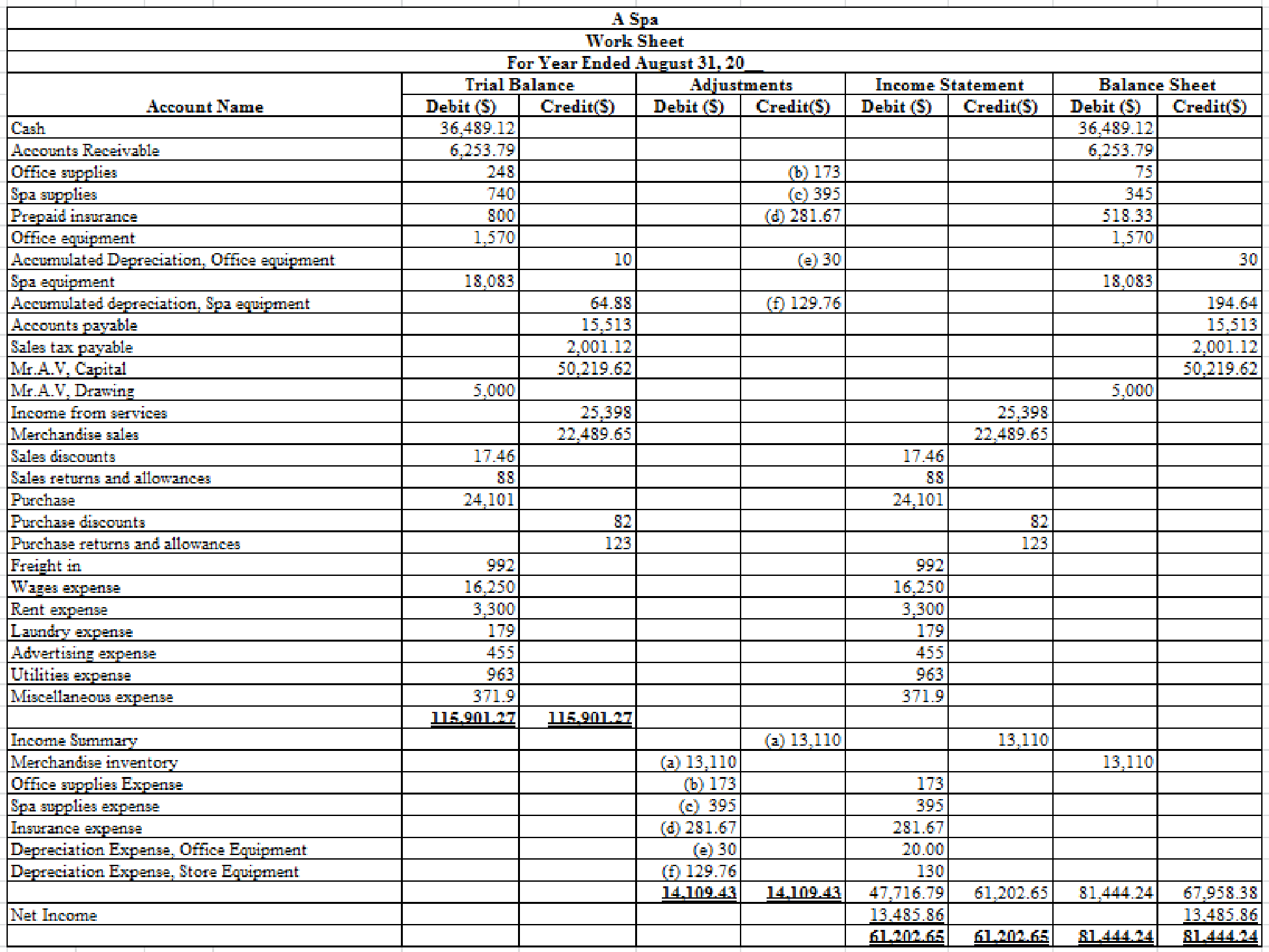

Prepare worksheet for A Spa as of August.

1.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare worksheet for A Spa.

Table (1)

2.

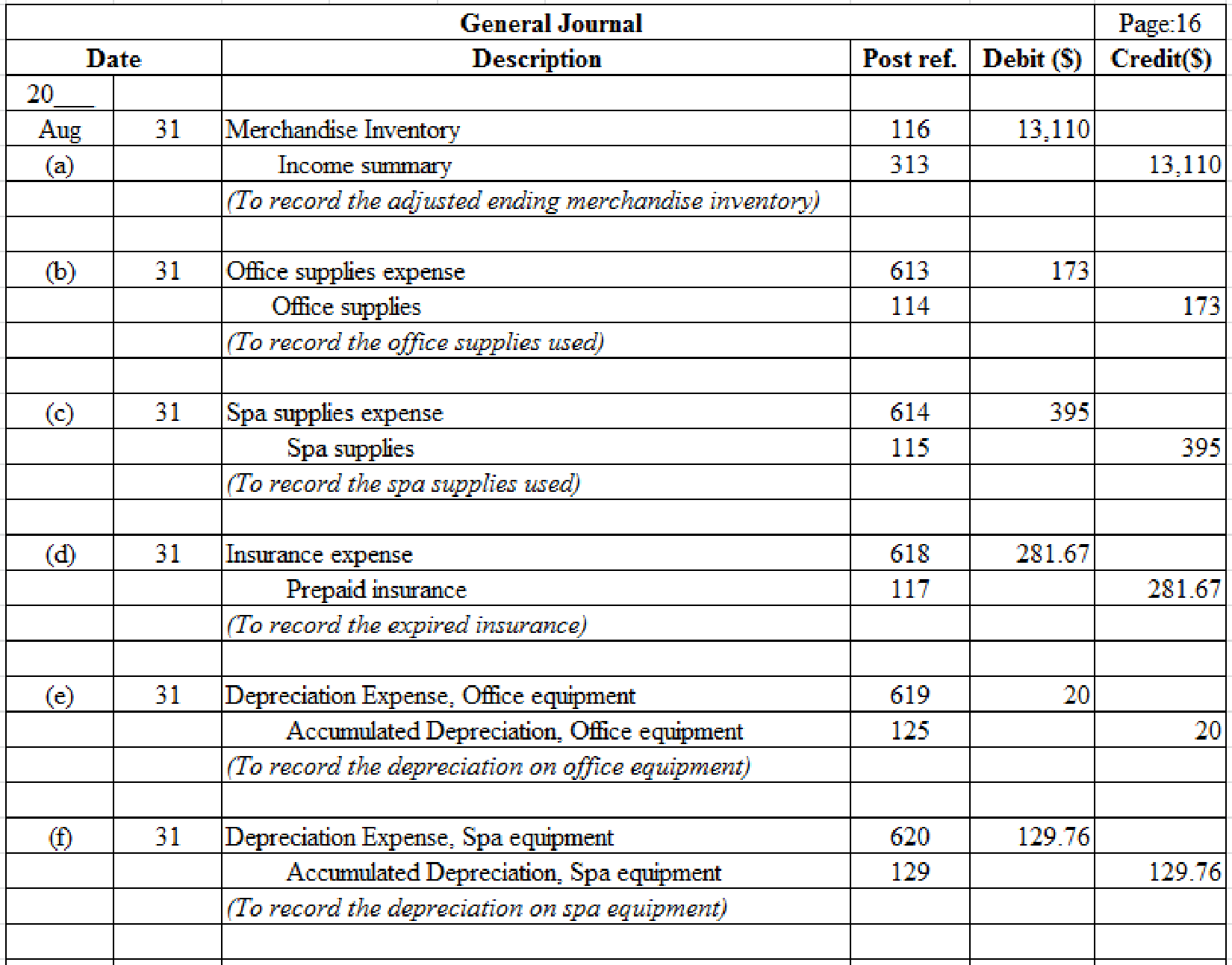

Journalize the

2.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

General journal: This is a journal used to record infrequent transactions like adjusting entries, closing entries, accounting errors, sale of assets, or

Journalize the adjusting entries.

Table (2)

Description:

- (a) Merchandise Inventory is an asset (current) account and it is increased. Therefore, debit the merchandise inventory. Income summary is a temporary account and it is closed. Therefore, credit the income summary.

- (b) Office supplies expense is an expense account and it is increased. Therefore, debit the Office supplies expense. Office supplies are a liability account and it is increased. Therefore, credit the Office supplies.

- (c) Spa supplies expense is revenue account and it is increased. Therefore, debit the Spa supplies expense. Spa supplies (on hand) are an asset (current) account and it is decreased. Therefore, credit the Spa supplies (on hand).

- (d) Insurance expense is an expense (operating) account and it is increased. Therefore, debit the insurance expense. Prepaid insurance is an asset (current) account and it is decreased. Therefore, credit the prepaid insurance.

- (e)

Depreciation expense (on office equipment) is an expense account and it is increased. Therefore, debit the depreciation expense.Accumulated depreciation (on office equipment) is a contra asset account and it is decreased. Therefore, credit the accumulated depreciation. - (f) Depreciation expense (on spa equipment) is an expense account and it is increased. Therefore, debit the depreciation expense. Accumulated depreciation (on spa equipment) is a contra asset account and it is decreased. Therefore, credit the accumulated depreciation.

3.

Post the adjusting entries to the general ledger.

3.

Explanation of Solution

Posting of transaction: The process of transferring the journalized transactions into the accounts of the ledger is known as posting of transaction.

Post the adjusting entries to the general ledger:

| General ledger | |||||||

| Account: Cash | Account No: 111 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 36,489.12 | ||||

| Account: Accounts receivable | Account No: 113 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 6,253.79 | ||||

| Account: Office supplies | Account No: 114 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 248 | ||||

| Adjusting | J16 | 173 | 75 | ||||

| Account: Spa supplies | Account No: 115 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 740 | ||||

| Adjusting | J16 | 395 | 345 | ||||

| Account: Merchandise inventory | Account No: 116 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 13,110 | 13,110 | ||

| Account: Prepaid insurance | Account No: 117 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 800 | ||||

| Adjusting | J16 | 281.67 | 518.33 | ||||

| Account: Office equipment | Account No: 124 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 1,570 | ||||

| Account: Accumulated depreciation, Office equipment | Account No: 125 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 10 | ||||

| Adjusting | J11 | 20 | 30 | ||||

| Account: Spa equipment | Account No: 128 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 18,083 | ||||

| Account: Accumulated depreciation, Spa equipment | Account No: 129 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 64.88 | ||||

| Adjusting | J16 | 129.76 | 194.64 | ||||

| Account: Accounts payable | Account No: 211 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 15,513 | ||||

| Account: Wages payable | Account No: 212 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | ||||||

| Account: sales tax payable | Account No: 215 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 2,001.1 | ||||

| Account: Mr. A.V, capital | Account No: 311 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 50,219.62 | ||||

| Account: Mr. A.V, Drawing | Account No: 312 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 4,500 | ||||

| Account: Income summary | Account No: 313 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 13,110 | 13,110 | ||

| Account: Income from services | Account No: 411 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 25,398 | ||||

| Account: Merchandise sales | Account No: 412 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 22,489.65 | ||||

| Account: Sales discount | Account No: 413 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 17.46 | ||||

| Account: Sales returns and allowances | Account No: 414 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 88 | ||||

| Account: Purchase | Account No: 511 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 24,101 | ||||

| Account: Purchase discount | Account No: 512 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 82 | ||||

| Account: Purchase returns and allowances | Account No: 513 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 123 | ||||

| Account: Freight in | Account No: 515 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 992 | ||||

| Account: Wages expense | Account No: 611 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 16,250 | ||||

| Account: Rent expense | Account No: 612 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 3,300 | ||||

| Account: Office supplies expense | Account No: 613 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 173 | 173 | ||

| Account: Spa supplies expense | Account No: 614 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 395 | 395 | ||

| Account: Laundry expense | Account No: 615 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 179 | ||||

| Account: Advertising expense | Account No: 616 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 455 | ||||

| Account: Utilities expense | Account No: 617 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 963 | ||||

| Account: Insurance expense | Account No: 618 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 281.67 | 281.67 | ||

| Account: Depreciation expense, Office equipment | Account No: 619 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 20 | 20 | ||

| Account: Depreciation expense, Spa equipment | Account No: 620 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 129.67 | 129.67 | ||

| Account: Promotional expense | Account No: 630 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 371.9 | ||||

Table (3)

4.

Prepare a trail balance for 31st August.

4.

Explanation of Solution

Prepare a trial balance.

| A Spa | ||

| Trail balance (Adjusted) | ||

| August 31, 20__ | ||

| Account name | Debit ($) | Credit($) |

| Cash | 36,489.12 | |

| Accounts receivable | 6,253.79 | |

| Office supplies | 75 | |

| Spa supplies | 345 | |

| Merchandise inventory | 13,110 | |

| Prepaid insurance | 518.33 | |

| Office equipment | 1,570 | |

| Accumulated depreciation, office equipment | 30 | |

| Spa equipment | 18,083 | |

| Accumulated depreciation, spa equipment | 194.64 | |

| Accounts payable | 15,513 | |

| Sales tax payable | 2,001.12 | |

| Mr. A.V, capital | 50,219.62 | |

| Mr. A.V, drawings | 5,000 | |

| Income summary | 13,110 | |

| Income from services | 25,398 | |

| Merchandise sales | 22,489.65 | |

| Sales discounts | 17.46 | |

| Sales returns and allowances | 88 | |

| Purchases | 24,101 | |

| Purchases discounts | 82 | |

| Purchases returns and allowances | 123 | |

| Freight in | 992 | |

| Wages expense | 16,250 | |

| Rent expense | 3,300 | |

| Office supplies expense | 173 | |

| Spa supplies expense | 395 | |

| Laundry expense | 179 | |

| Advertising expense | 455 | |

| Utilities expense | 963 | |

| Insurance expense | 281.67 | |

| Depreciation expense, office equipment | 20 | |

| Depreciation expense, spa equipment | 129.76 | |

| Miscellaneous expense | 371.9 | |

| Total | 129,161.03 | 129,161.03 |

Table (4)

Want to see more full solutions like this?

Chapter 11 Solutions

College Accounting - With Quickbooks 2015 CD and Access

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning