Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 4EB

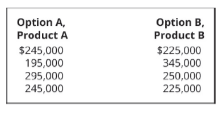

Assume a company is going to make an investment in a machine of $825,000 and the following are the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Given answer financial accounting question

What is the true answer? ?

None

Chapter 11 Solutions

Principles of Accounting Volume 2

Ch. 11 - Capital investment decisions often involve all of...Ch. 11 - Preference decisions compare potential projects...Ch. 11 - The third step for making a capital investment...Ch. 11 - You are explaining time value of money factors to...Ch. 11 - If you are saving the same amount each month in...Ch. 11 - You want to invest $8,000 at an annual Interest...Ch. 11 - Using the information provided, what transaction...Ch. 11 - Grummet Company is acquiring a new wood lathe with...Ch. 11 - The process that determines the present value of a...Ch. 11 - The process of reinvesting interest earned to...

Ch. 11 - The NPV method assumes that cash inflows...Ch. 11 - Which of the following does nor assign a value to...Ch. 11 - Which of the following discounts future cash flows...Ch. 11 - This calculation determines profitability or...Ch. 11 - The IRR method assumes that cash flows are...Ch. 11 - When using the NPV method for a particular...Ch. 11 - What are the steps involved in the process for...Ch. 11 - Why does a company evaluate both the money...Ch. 11 - What is the next thing a company needs to do after...Ch. 11 - What is the screening decision?Ch. 11 - Your supervisor is on the companys capital...Ch. 11 - Ekon owns a small tow-truck business that responds...Ch. 11 - What is the payback method used to determine?Ch. 11 - What are one advantage and one disadvantage of the...Ch. 11 - What are one advantage and one disadvantage of the...Ch. 11 - What is the equation to calculate the payback...Ch. 11 - What is the equation to calculate the accounting...Ch. 11 - What is future value and what is one example where...Ch. 11 - Why do businesses consider time value of money...Ch. 11 - What determines the anticipated interest rate...Ch. 11 - To calculate present value of a lump sum, which...Ch. 11 - What is the definition of present value?Ch. 11 - What is the difference between the discount rate...Ch. 11 - Briefly explain how NPV is computed and...Ch. 11 - What is the basic benefit of using IRR?Ch. 11 - How is the IRR determined if there are uneven cash...Ch. 11 - A fellow student studying managerial accounting...Ch. 11 - What are the strengths and weaknesses of NPV?Ch. 11 - What are the strengths and weaknesses of IRR?Ch. 11 - How does the size of the initial investment affect...Ch. 11 - Bobs Auto Repair has determined that it needs new...Ch. 11 - In practice, external factors can impact a capital...Ch. 11 - If a copy center is considering the purchase of a...Ch. 11 - Assume a company is going to make an investment of...Ch. 11 - If a garden center is considering the purchase of...Ch. 11 - The management of Kawneer North America is...Ch. 11 - A mini-mart needs a new freezer and the initial...Ch. 11 - You put $250 in the bank for S years at 12%. A. If...Ch. 11 - If you invest $12,000 today, how much will you...Ch. 11 - You have been depositing money into an account...Ch. 11 - How much would you invest today in order to...Ch. 11 - Your friend has a trust fund that will pay her the...Ch. 11 - Jullo Company is considering the purchase of a new...Ch. 11 - How much must be invested now to receive $30,000...Ch. 11 - Project A costs $5,000 and will generate annual...Ch. 11 - Project B cost $5,000 and will generate after-tax...Ch. 11 - Gardner Denver Company is considering the purchase...Ch. 11 - Consolidated Aluminum is considering the purchase...Ch. 11 - Redbird Company is considering a project with an...Ch. 11 - Towson Industries is considering an investment of...Ch. 11 - Cinemar Productions bought a piece of equipment...Ch. 11 - Margos Memories, a company that specializes in...Ch. 11 - Boxer Production, Inc., is in the process of...Ch. 11 - A restaurant is considering the purchase of new...Ch. 11 - Assume a company is going to make an investment in...Ch. 11 - A grocery store is considering the purchase of a...Ch. 11 - The management of Ryland International Is...Ch. 11 - An auto repair company needs a new machine that...Ch. 11 - You put $600 in the bank for 3 years at 15%. A. If...Ch. 11 - If you invest $15,000 today, how much will you...Ch. 11 - You have been depositing money into an account...Ch. 11 - How much would you invest today in order to...Ch. 11 - Your friend has a trust fund that will pay her the...Ch. 11 - Conestoga Plumbing plans to invest in a new pump...Ch. 11 - How much must be invested now to receive $50,000...Ch. 11 - Project X costs $10,000 and will generate annual...Ch. 11 - Project Y cost $8,000 and will generate net cash...Ch. 11 - Caduceus Company is considering the purchase of a...Ch. 11 - Garnette Corp is considering the purchase of a new...Ch. 11 - Wallace Company is considering two projects. Their...Ch. 11 - Taos Productions bought a piece of equipment for...Ch. 11 - Your company is planning to purchase a new log...Ch. 11 - Jasmine Manufacturing is considering a project...Ch. 11 - Use the tables in Appendix B to answer the...Ch. 11 - Ralston Consulting. Inc., has a $25,000 overdue...Ch. 11 - Falkland, Inc., is considering the purchase of a...Ch. 11 - There are two projects under consideration by the...Ch. 11 - There are two projects under consideration by the...Ch. 11 - Pompeiis Pizza has a delivery car that it uses for...Ch. 11 - Pitt Company is considering two alternative...Ch. 11 - The Ham and Egg Restaurant is considering an...Ch. 11 - Gallant Sports s considering the purchase of a new...Ch. 11 - A bookstore is planning to purchase an automated...Ch. 11 - Markoff Products is considering two competing...Ch. 11 - Use the tables in Appendix B to answer the...Ch. 11 - Chang Consulting. Inc., has a $15,000 overdue debt...Ch. 11 - Mason, Inc., is considering the purchase of a...Ch. 11 - There are two projects under consideration by the...Ch. 11 - Use the information from the previous exercise to...Ch. 11 - D**M Pizza has a delivery car that is uses for...Ch. 11 - Joliet Company is considering two alternative...Ch. 11 - Bouvier Restaurant is considering an investment in...Ch. 11 - What is the benefit(s) of the accountants...Ch. 11 - Austins cell phone manufacturer wants to upgrade...Ch. 11 - Would you rather have $7,500 today or at the end...Ch. 11 - Midas Corp. evaluated a potential investment and...Ch. 11 - Giorgio Co. is looking at an investment project...Ch. 11 - Dinaro Inc. is looking at an investment project...Ch. 11 - You begin a new job at Cabrera Medical Supplies....Ch. 11 - Fenton, Inc., has established a new strategic plan...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The security mispricing cost and issuance cost in the assessment project. Introduction: Issuance cost is the co...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

E8-16 Understanding internal control, components, procedures, and laws

Learning Objectives 1, 2, 3

Match ...

Horngren's Accounting (12th Edition)

Questions For Review

12-4. How is the concept of the value package useful in marketing to consumers and industr...

Business Essentials (12th Edition) (What's New in Intro to Business)

Using the numbers in the preceding question, what is the size of Ectenias labor force? a. 50 b. 60 c. 70 d. 80

Principles of Economics (MindTap Course List)

3. What is just-in-time inventory management? What are its potential advantages?

Financial Accounting: Tools for Business Decision Making, 8th Edition

Knowledge Booster

Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College