Engineering Economy (17th Edition)

17th Edition

ISBN: 9780134870069

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 32FE

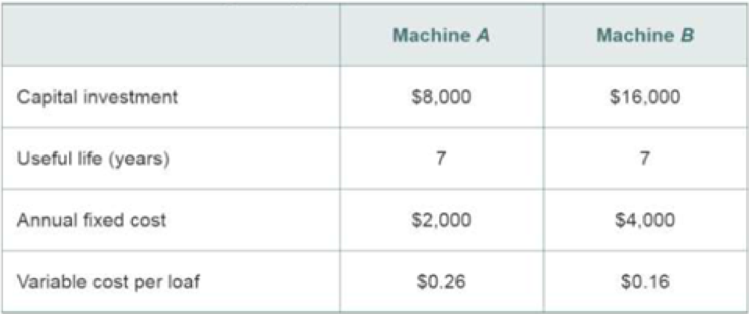

A supermarket chain buys loaves of bread from its supplier at $0.50 per loaf. The chain is considering two options to bake its own bread.

Neither machine has a market value at the end of seven years, and MARR is 12% per year. Use this information to answer Problems 11-32, 11-33, and 11-34. Select the closest answer.

11-32. What is the minimum number of loaves that must be sold per year to justify installing Machine A instead of buying the loaves from the supplier?

- a. 7,506

- b. 22,076

- c. 37,529

- d. 75,059

- e. 15,637

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

facebook (not Mark Zuckerberg) would do which action according the Circular Flow diagram?

Buys, but does not sell.

Does not sell nor buys.

Sell, but does not buy.

Sell and Buy (or Rent).

It would be impossible for this economy to produce?

dryers

100

90

C

80

70

A

60

50

D

B

40

30+

20-

10

10 20 30 40 50 60 70 80

OD

C

OA

B

washers

13

Perusahaan IKBP ingin mendirikan usaha restaurant makanan sehat di tawangmangu, dimana didalam perhitungannya ada beberapa biaya yang akan muncul dalam perhitungan usaha ini, diantaraya :

Biaya Tempat Usaha

Biaya Renovasi tempat sendiri senilai Rp 15.000.000,- (kondisi ini muncul jika IKBP memilih untuk tidak menyewa ruko tempat lain)

Biaya Sewa Tempat Senilai Rp 25.000.000,- (kondisi ini muncul jika IKBP memilih untuk menyewa tempat lain)

Di segala kondisi IKBP menganggarkan ada penyusuatan aktiva tetap sebesar 2.5%

Biaya Overhead untuk tempat Usaha dianggarkan Rp 2.000.000,- per bulan

Biaya Tenaga Kerja

Budget gaji karyawannya ada 2 dengan masing-masing gajinya per orang Rp 2.000.000,-/ bulan

Biaya Modal Usaha

Biaya bunga bank karena meminjam di perbankan sebesar 12% setahun (kondisi ini muncul jika ingin meminjam dari bank)

Biaya dari dana talangan pihak Yayasan sebesar 5% (kondisi biaya ini muncul jika tidak ingin memanfaatkan pinjaman dari perbankan)

Biaya dengan meminjam…

Chapter 11 Solutions

Engineering Economy (17th Edition)

Ch. 11 - Prob. 1PCh. 11 - Refer to Example 11-2. Assuming gasoline costs...Ch. 11 - Prob. 3PCh. 11 - Prob. 4PCh. 11 - Prob. 5PCh. 11 - Prob. 6PCh. 11 - Prob. 7PCh. 11 - Prob. 8PCh. 11 - Prob. 9PCh. 11 - Prob. 10P

Ch. 11 - Prob. 11PCh. 11 - Prob. 12PCh. 11 - Prob. 13PCh. 11 - Prob. 14PCh. 11 - Prob. 15PCh. 11 - Prob. 16PCh. 11 - Prob. 17PCh. 11 - Prob. 18PCh. 11 - Prob. 19PCh. 11 - A bridge is to be constructed now as part of a new...Ch. 11 - An aerodynamic three-wheeled automobile (the Dart)...Ch. 11 - Prob. 23PCh. 11 - Prob. 24SECh. 11 - Prob. 25SECh. 11 - Prob. 26SECh. 11 - Prob. 27SECh. 11 - Prob. 28SECh. 11 - Prob. 29SECh. 11 - Prob. 30FECh. 11 - Prob. 31FECh. 11 - A supermarket chain buys loaves of bread from its...Ch. 11 - A supermarket chain buys loaves of bread from its...Ch. 11 - Prob. 34FECh. 11 - Prob. 35FECh. 11 - Prob. 36FECh. 11 - Prob. 37FECh. 11 - Prob. 38FECh. 11 - Prob. 39FECh. 11 - Prob. 40FECh. 11 - Prob. 41FECh. 11 - Prob. 42FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A monopolist had the following fixed costs and marginal revenue and costs for each unit of production: 0 units where fixed costs are 10 1 unit where MR = 60 & MC = 20 & FC = 10 2 units where MR = 50 & MC = 30 & FC = 10 3 units where MR = 45 & MC = 38 & FC = 10 4 units where MR = 40 & MC = 40 & FC = 10 How many units should the firm produce and why?arrow_forwardRespond to this post. Hello Professor, A rise in consumption in the economy would cause an increase in aggregate demand. Therefore, when consumers spend money on everyday goods and services, it not only helps to stimulate economic growth, but it could also present potential issues like unsustainable debt levels or inflation. I believe that it would be beneficial to consider such factors and adopt a purchasing strategy to help navigate the challenges posed by inflation or unsustainable debt levels. First, do you think our business will be affected because inflation is rising? How? Yes, I do believe that the business will be affected because of inflationary pressures. Inflation rising will affect the cost of goods, services, and labor, which could lead to higher operating expenses. The potential reduction of profit margin because of inflation could lead to a smaller percentage of revenue being retained as profit. Therefore, inflation rising will force us to raise prices for…arrow_forwardNot use ai pleasearrow_forward

- Bzbsbsbdbdbdbdarrow_forwardRecent research indicates potential health benefits associated with coffee consumption, including a potential reduction in the incidence of liver disease. Simultaneously, new technology is being applied to coffee bean harvesting, leading to cost reductions in coffee production. How will these developmentsaffect the demand and supply of coffee? How will the equilibrium price and quantity of coffee change? Use both words and graphs to explain.arrow_forwardRecent research indicates potential health benefits associated with coffee consumption, including a potential reduction in the incidence of liver disease. Simultaneously, new technology is being applied to coffee bean harvesting, leading to cost reductions in coffee production. How will these developmentsaffect the demand and supply of coffee? How will the equilibrium price and quantity of coffee change? Use both words and graphs to explain.arrow_forward

- ► What are the 95% confidence intervals for the intercept and slope in this regression of college grade point average (GPA) on high school GPA? colGPA = 1.39 + .412 hsGPA (.33) (.094)arrow_forwardG Interpret the following estimated regression equations: wagehr = 0.5+ 2.5exper, where wagehr is the wage, measured in £/hour and exper is years of experience, colGPA = 1.39.412 hsGPA where colGPA is grade point average for a college student, and hsGPA is the grade point average they achieved in high school, cons 124.84 +0.853 inc where cons and inc are annual household consumption and income, both measured in dollars What is (i) the predicted hourly wage for someone with five years of experience? (ii) the predicted grade point average in college for a student whose grade point average in high school was 4.0, (iii) the predicted consumption when household income is $30000? =arrow_forward1. Solving the system of inequalities: I≥3 x+y1 2. Graph y=-2(x+2)(x-3) 3. Please graph the following quadratic inequalities Solve y≤ -1²+2+3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

The growing economy of the electric car industry; Author: TRT World;https://www.youtube.com/watch?v=Qh2jXn_akmk;License: Standard Youtube License