Concept explainers

The

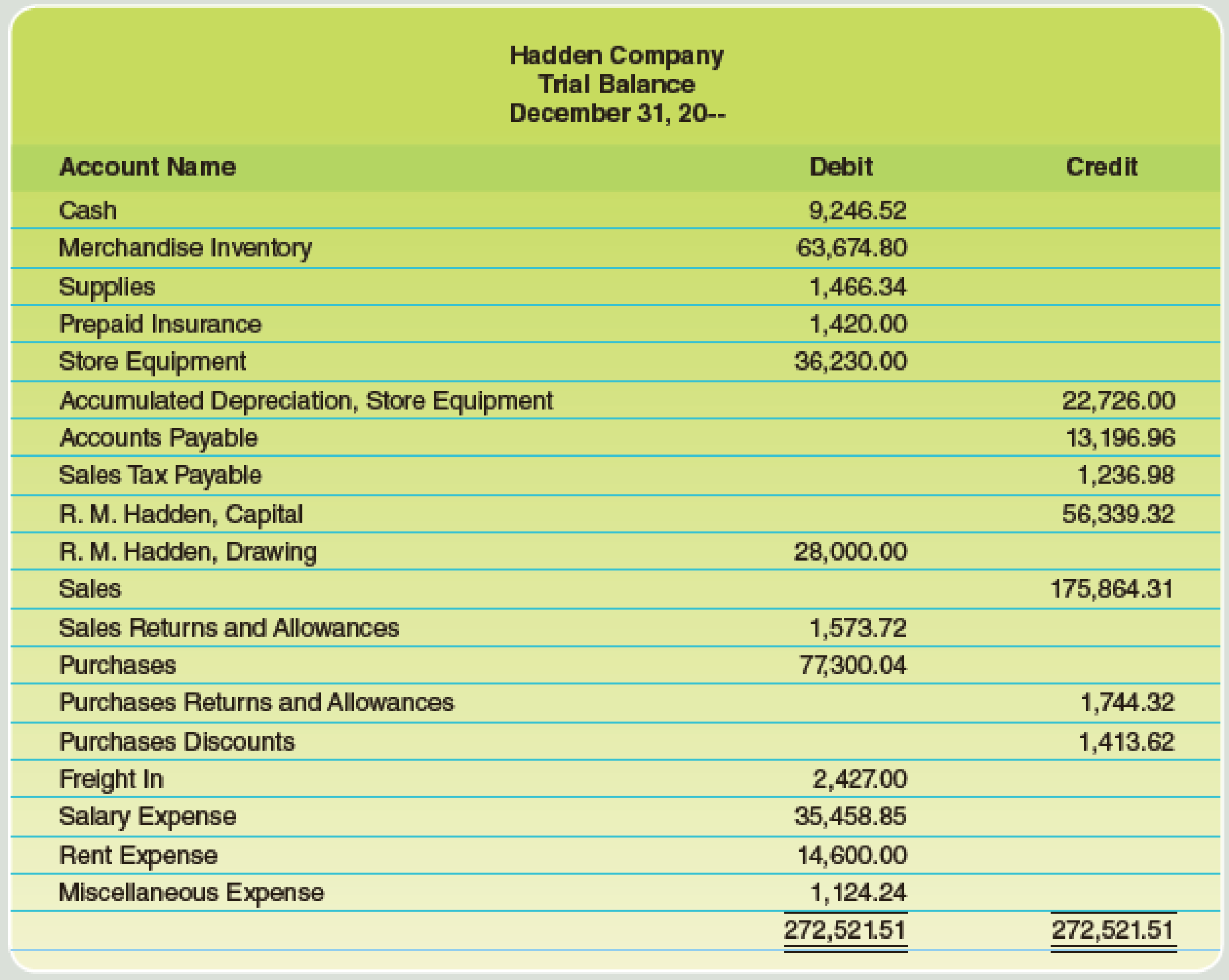

Here are the data for the adjustments.

a–b. Merchandise Inventory at December 31, $64,742.80.

c. Store supplies inventory (on hand), $420.20.

d. Insurance expired, $738.

e. Salaries accrued, $684.50.

f. Depreciation of store equipment, $3,620.

Required

Complete the work sheet after entering the account names and balances onto the work sheet.

Trending nowThis is a popular solution!

Chapter 11 Solutions

EBK COLLEGE ACCOUNTING: A CAREER APPROA

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

MARKETING:REAL PEOPLE,REAL CHOICES

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Foundations of Financial Management

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Marketing: An Introduction (13th Edition)

- What is the company's return on equity on these financial accounting question?arrow_forwardIn the Crane CompanyS, indirect labor is budgeted for $86,000, and factory supervision is budgeted for $43,000 at a normal capacity of 120,000 direct labor hours. If 138,000 direct labor hours are worked, the flexible budget total for these costs is: a. $136,500.55 b. $141,904.60 c. $130,500.23arrow_forwardI want to correct answer accounting questionsarrow_forward

- Differential Chemical produced 18,000 gallons of Preon and 39,000 gallons of Paron. Joint costs incurred in producing the two products totaled $8,500. At the split-off point, Preon has a market value of $11 per gallon and Paron $3.5 per gallon. Compute the portion of the joint costs to be allocated to Preon if the value basis is used.arrow_forwardHello.tutor please given correct answer general Accountingarrow_forwardWhat is the amount of total assetsarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning