Concept explainers

Compute the total cost for each aggregate plan using these unit costs:

Regular output = $40

Overtime = $50

Subcontract = $60

Average Balance Inventory = $10

a.

b.

c. (Refer to part b) After complaints from some workers about working overtime every month during the first half of the year, the manager is now considering adding some temporary workers for the second half of the year, which would increase regular output to a steady 350 units a month, not using any overtime, and using subcontracting to make up needed output. Determine the total cost of that plan.

a)

To compute: The total cost for each aggregate plan

Introduction: The aggregate plan is the output of sales and operations planning. The major concern of aggregate planning is the production time and quantity for the intermediate future. Aggregate planning would encompass a time prospect of approximately 3 to 18 months.

Answer to Problem 1P

Explanation of Solution

Given information:

Regular output is $40, overtime is $50, subcontract is $60, and average balance inventory is $10.

In addition to this, the following information is given:

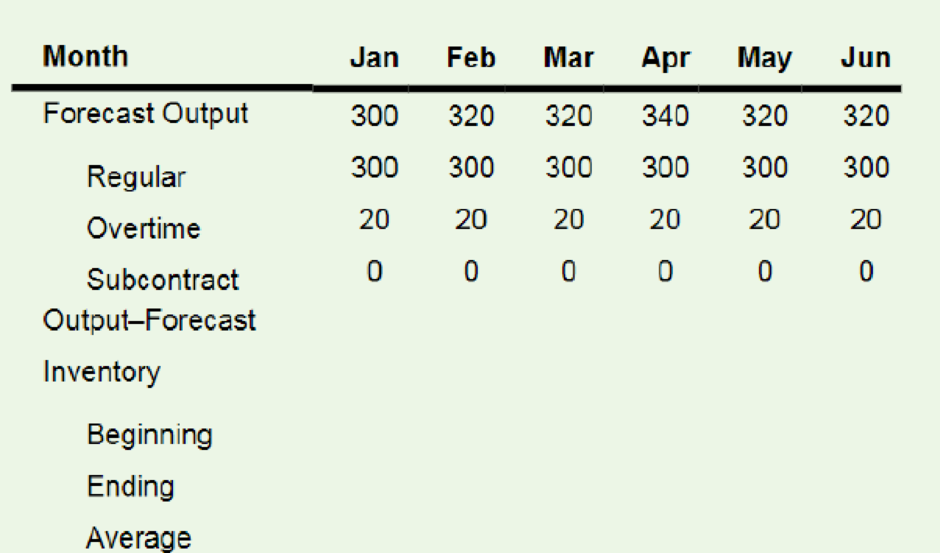

| Month | January | February | March | April | May | June |

| Forecast | 300 | 320 | 320 | 340 | 320 | 320 |

| Regular | 300 | 300 | 300 | 300 | 300 | 300 |

| Overtime | 20 | 20 | 20 | 20 | 20 | 20 |

| Subcontract | 0 | 0 | 0 | 0 | 0 | 0 |

Determine the aggregate plan to compute total cost:

| Month | January | February | March | April | May | June | Total | |

| Forecast | 300 | 320 | 320 | 340 | 320 | 320 | 1,920 | |

| Output | ||||||||

| Regular | 300 | 300 | 300 | 300 | 300 | 300 | 1,800 | |

| Part-time | ||||||||

| Overtime | 20 | 20 | 20 | 20 | 20 | 20 | 120 | |

| Subcontract | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Difference | 20 | 0 | 0 | -20 | 0 | 0 | 0 | |

| Inventory | ||||||||

| Beginning | 0 | 20 | 20 | 20 | 0 | 0 | 60 | |

| Ending | 20 | 20 | 20 | 0 | 0 | 0 | 60 | |

| Average | 10 | 20 | 20 | 10 | 0 | 0 | 60 | |

| Backlog | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Costs | ||||||||

| Regular | 40 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $72,000 |

| Part-time | ||||||||

| Overtime | 50 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $6,000 |

| Subcontract | 60 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Hire/Layoff | ||||||||

| Inventory | 10 | $100 | $200 | $200 | $100 | $0 | $0 | $600 |

| Backorders | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| $13,100 | $13,200 | $13,200 | $13,100 | $13,000 | $13,000 | $78,600 |

Supporting calculation:

Forecast, regular time units, overtime, and subcontract units were given.

Calculate the difference of month January:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 20 units.

Calculate the difference of month February:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 0 units.

Calculate the difference of month March:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 0 units.

Note: The calculation repeats for all the months.

Beginning inventory:

The initial inventory is given as 0. For the remaining months, ending inventory of previous month would be the beginning inventory of present month.

Ending inventory for the month of January:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 20 units.

Ending inventory for the month of February:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 20 units.

Ending inventory for the month of March:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 20 units.

Note: The calculation repeats for all the months.

Average inventory for the month of January:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 10 units.

Average inventory for the month of February:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 20 units.

Average inventory for the month of March:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 20 units.

Note: The calculation repeats for all the months.

Calculate the regular time cost for the month of January:

Regular time cost per unit is given as $40 and regular time unit is given as 300. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $12,000.

Calculate the regular time cost for the month of February:

Regular time cost per unit is given as $40 and regular time unit is given as 300. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $12,000.

Calculate the regular time cost for the month of March:

Regular time cost per unit is given as $40 and regular time unit is given as 300. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $12,000.

Note: The calculation repeats for all the months.

Calculate the total regular time cost:

It is calculated by adding the regular time cost of all the months.

Hence, the total regular time cost is $72,000.

Calculate the overtime cost for the month of January:

Overtime cost per unit is given as $50 and overtime unit is given as 20. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $1,000.

Calculate the overtime cost for the month of February:

Overtime cost per unit is given as $50 and overtime unit is given as 20. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $1,000.

Calculate the overtime cost for the month of March:

Overtime cost per unit is given as $50 and overtime unit is given as 20. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $1,000.

Note: The calculation repeats for all the months.

Calculate the total overtime cost:

It is calculated by adding the overtime cost of all the months.

Hence, the total overtime cost is $6,000.

Calculate the subcontract cost for the month of January:

Subcontract cost per unit is given as $60 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of February:

Subcontract cost per unit is given as $60 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of March:

Subcontract cost per unit is given as $60 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Note: The calculation repeats for all the months.

Calculate the total subcontract cost:

It is calculated by adding the subcontract cost of all the months.

Hence, the total subcontract cost is $0.

Calculate the inventory cost for the month of January:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $100.

Calculate the inventory cost for the month of February:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $200.

Calculate the inventory cost for the month of March:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $200.

Note: The calculation repeats for all the months.

Calculate the total inventory cost:

It is calculated by adding the inventory cost of all the months.

Hence, the total inventory cost is $600.

Calculate the total cost of the plan:

It is calculated by adding the total regular time cost, overtime cost, subcontract cost, and inventory cost.

Hence, the total cost of the plan is $78,600.

b)

To compute: The total cost for each aggregate plan.

Introduction:The aggregate plan is the output of sales and operations planning. The major concern of aggregate planning is the production time and quantity for the intermediate future. Aggregate planning would encompass a time prospect of approximately 3 to 18 months.

Answer to Problem 1P

Explanation of Solution

Given information:

Regular output is $40, overtime is $50, subcontract is $60, and average balance inventory is $10.

In addition to this, the following information is given:

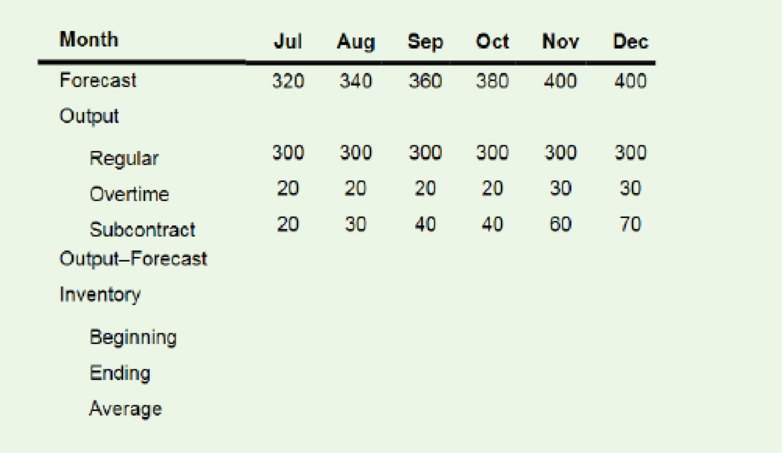

| Month | July | August | September | October | November | December |

| Forecast | 320 | 340 | 360 | 380 | 400 | 400 |

| Regular | 300 | 300 | 300 | 300 | 300 | 300 |

| Overtime | 20 | 20 | 20 | 20 | 30 | 30 |

| Subcontract | 20 | 30 | 40 | 40 | 60 | 70 |

Determine the aggregate plan to compute total cost:

| Month | July | August | September | October | November | December | Total | |

| Forecast | 320 | 340 | 360 | 380 | 400 | 400 | 2,200 | |

| Output | ||||||||

| Regular | 300 | 300 | 300 | 300 | 300 | 300 | 1,800 | |

| Part-time | ||||||||

| Overtime | 20 | 20 | 20 | 20 | 30 | 30 | 140 | |

| Subcontract | 20 | 30 | 40 | 40 | 60 | 70 | 260 | |

| Difference | 20 | 10 | 0 | -20 | -10 | 0 | 0 | |

| Inventory | ||||||||

| Beginning | 0 | 20 | 30 | 30 | 10 | 0 | 90 | |

| Ending | 20 | 30 | 30 | 10 | 0 | 0 | 90 | |

| Average | 10 | 25 | 30 | 20 | 5 | 0 | 90 | |

| Backlog | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Costs | ||||||||

| Regular | 40 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $72,000 |

| Part-time | ||||||||

| Overtime | 50 | $1,000 | $1,000 | $1,000 | $1,000 | $1,500 | $1,500 | $7,000 |

| Subcontract | 60 | $1,200 | $1,800 | $2,400 | $2,400 | $3,600 | $4,200 | $15,600 |

| Hire/Layoff | ||||||||

| Inventory | 10 | $100 | $250 | $300 | $200 | $50 | $0 | $900 |

| Backorders | ||||||||

| $14,300 | $15,050 | $15,700 | $15,600 | $17,150 | $17,700 | $95,500 |

Supporting calculation:

Forecast, regular time units, overtime, and subcontract units were given.

Calculate the difference of month July:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 20 units.

Calculate the difference of month August:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 10 units.

Calculate the difference of month September:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 0 units.

Note: The calculation repeats for all the months.

Beginning inventory:

The initial inventory is given as 0. For the remaining months, ending inventory of previous month would be the beginning inventory of present month.

Ending inventory for the month of July:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 20 units.

Ending inventory for the month of August:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 20 units.

Ending inventory for the month of September:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 20 units.

Note: The calculation repeats for all the months.

Average inventory for the month of July:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 10 units.

Average inventory for the month of August:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 25 units.

Average inventory for the month of September:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 30 units.

Note: The calculation repeats for all the months.

Calculate the regular time cost for the month of July:

Regular time cost per unit is given as $40 and regular time unit is given as 300. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $12,000.

Calculate the regular time cost for the month of August:

Regular time cost per unit is given as $40 and regular time unit is given as 300. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $12,000.

Calculate the regular time cost for the month of September:

Regular time cost per unit is given as $40 and regular time unit is given as 300. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $12,000.

Note: The calculation repeats for all the months.

Calculate the total regular time cost:

It is calculated by adding the regular time cost of all the months.

Hence, the total regular time cost is $72,000.

Calculate the overtime cost for the month of July:

Overtime cost per unit is given as $50 and overtime unit is given as 20. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $1,000.

Calculate the overtime cost for the month of August:

Overtime cost per unit is given as $50 and overtime unit is given as 20. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $1,000.

Calculate the overtime cost for the month of September:

Overtime cost per unit is given as $50 and overtime unit is given as 20. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $1,000.

Note: The calculation repeats for all the months.

Calculate the total overtime cost:

It is calculated by adding the overtime cost of all the months.

Hence, the total overtime cost is $6,000.

Calculate the subcontract cost for the month of July:

Subcontract cost per unit is given as $60 and subcontract unit is given as 20. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $1,200.

Calculate the subcontract cost for the month of August:

Subcontract cost per unit is given as $60 and subcontract unit is given as 30. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $1,800.

Calculate the subcontract cost for the month of September:

Subcontract cost per unit is given as $60 and subcontract unit is given as 40. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $2,400.

Note: The calculation repeats for all the months.

Calculate the total subcontract cost:

It is calculated by adding the subcontract cost of all the months.

Hence, the total subcontract cost is $15,600.

Calculate the inventory cost for the month of July:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $100.

Calculate the inventory cost for the month of August:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $250.

Calculate the inventory cost for the month of September:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $300.

Note: The calculation repeats for all the months.

Calculate the total inventory cost:

It is calculated by adding the inventory cost of all the months.

Hence, the total inventory cost is $900.

Calculate the total cost of the plan:

It is calculated by adding the total regular time cost, overtime cost, subcontract cost, and inventory cost.

Hence, the total cost of the plan is $95,500.

c)

To compute: The total cost for each aggregate plan.

Introduction:The aggregate plan is the output of sales and operations planning. The major concern of aggregate planning is the production time and quantity for the intermediate future. Aggregate planning would encompass a time prospect of approximately 3 to 18 months.

Answer to Problem 1P

Explanation of Solution

Given information:

Regular output is $40, overtime is $50, subcontract is $60, and average balance inventory is $10.

In addition to this, the following information is given:

| Month | July | August | September | October | November | December |

| Forecast | 320 | 340 | 360 | 380 | 400 | 400 |

| Regular | 350 | 350 | 350 | 350 | 350 | 350 |

| Overtime | 0 | 0 | 0 | 0 | 0 | 0 |

It is given that subcontract can be used whenever necessary.

Determine the aggregate plan to compute total cost:

| Month | July | August | September | October | November | December | Total | |

| Forecast | 320 | 340 | 360 | 380 | 400 | 400 | 2,200 | |

| Output | ||||||||

| Regular | 350 | 350 | 350 | 350 | 350 | 350 | 2,100 | |

| Part-time | ||||||||

| Overtime | ||||||||

| Subcontract | 50 | 50 | ||||||

| Difference | 30 | 10 | -10 | -30 | 0 | 0 | 0 | |

| Inventory | ||||||||

| Beginning | 0 | 30 | 40 | 30 | 0 | 0 | 100 | |

| Ending | 30 | 40 | 30 | 0 | 0 | 0 | 100 | |

| Average | 15 | 35 | 35 | 15 | 0 | 0 | 100 | |

| Backlog | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Costs | ||||||||

| Regular | 40 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $14,000 | $84,000 |

| Part-time | ||||||||

| Overtime | 50 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subcontract | 60 | $0 | $0 | $0 | $0 | $3,000 | $3,000 | $6,000 |

| Hire/Layoff | ||||||||

| Inventory | 10 | $150 | $350 | $350 | $150 | $0 | $0 | $1,000 |

| Backorders | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| $14,150 | $14,350 | $14,350 | $14,150 | $17,000 | $17,000 | $91,000 |

Supporting calculation:

Forecast, regular time units, overtime, and subcontract units were given.

Calculate the difference of month July:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 30 units.

Calculate the difference of month August:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is 10 units.

Calculate the difference of month September:

It is the calculation of difference between forecast and output. Hence, it can be calculated by subtracting the forecast from the output. Hence, the difference is -10 units.

Note: The calculation repeats for all the months.

Beginning inventory:

The initial inventory is given as 0. For the remaining months, ending inventory of previous month would be the beginning inventory of present month.

Ending inventory for the month of July:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 30 units.

Ending inventory for the month of August:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 40 units.

Ending inventory for the month of September:

Ending inventory can be determined by adding the beginning inventory and difference between output and forecast. Hence, the ending inventory is 20 units.

Note: The calculation repeats for all the months.

Average inventory for the month of July:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 15 units.

Average inventory for the month of August:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 35 units.

Average inventory for the month of September:

It is calculated by taking an average of beginning inventory and ending inventory. Hence, the average inventory is 35 units.

Note: The calculation repeats for all the months.

Calculate the regular time cost for the month of July:

Regular time cost per unit is given as $40 and regular time unit is given as 350. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $14,000.

Calculate the regular time cost for the month of August:

Regular time cost per unit is given as $40 and regular time unit is given as 350. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $14,000.

Calculate the regular time cost for the month of September:

Regular time cost per unit is given as $40 and regular time unit is given as 350. Regular time cost is calculated by multiplying regular time unit and regular time cost per unit. Hence, the regular time cost is $14,000.

Note: The calculation repeats for all the months.

Calculate the total regular time cost:

It is calculated by adding the regular time cost of all the months.

Hence, the total regular time cost is $84,000.

Calculate the overtime cost for the month of July:

Overtime cost per unit is given as $50 and overtime unit is given as 0. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $0.

Calculate the overtime cost for the month of August:

Overtime cost per unit is given as $50 and overtime unit is given as 0. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $0.

Calculate the overtime cost for the month of September:

Overtime cost per unit is given as $50 and overtime unit is given as 0. Overtime cost is calculated by multiplying overtime unit and overtime cost per unit. Hence, the overtime cost is $0.

Note: The calculation repeats for all the months.

Calculate the total overtime cost:

It is calculated by adding the overtime cost of all the months.

Hence, the total overtime cost is $0.

Calculate the subcontract cost for the month of July:

Subcontract cost per unit is given as $60 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of August:

Subcontract cost per unit is given as $60 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Calculate the subcontract cost for the month of September:

Subcontract cost per unit is given as $60 and subcontract unit is given as 0. Subcontract cost is calculated by multiplying subcontract unit and subcontract cost per unit. Hence, the subcontract cost is $0.

Note: The calculation repeats for all the months. As there are backlogs in the month of November and December, there would be 50 units of subcontracting in those months.

Calculate the total subcontract cost:

It is calculated by adding the subcontract cost of all the months.

Hence, the total subcontract cost is $15,600.

Calculate the inventory cost for the month of July:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $150.

Calculate the inventory cost for the month of August:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $350.

Calculate the inventory cost for the month of September:

It is calculated by average balance inventory cost and the average inventory units. Hence, the inventory cost is $350.

Note: The calculation repeats for all the months.

Calculate the total inventory cost:

It is calculated by adding the inventory cost of all the months.

Hence, the total inventory cost is $1,000.

Calculate the total cost of the plan:

It is calculated by adding the total regular time cost, overtime cost, subcontract cost, and inventory cost.

Hence, the total cost of the plan is $91,000.

Want to see more full solutions like this?

Chapter 11 Solutions

EBK OPERATIONS MANAGEMENT

- I need to forecast using a 3-Period-Moving-Average-Monthly forecasting model which I did but then I need to use my forecast numbers to generate a Master Production Schedule (MPS) I have to Start with actual sales (my own test data numbers) for August-2022 Oct-2022 i need to create MPS to supply demand starting November-2022 April 2023 I just added numbers without applying formulas to the mps on the right side of the spreadsheet because I do not know how to do it. The second image is the example of what it should look like. Thank You.arrow_forwardSolve the following Question 1. How do volume and variety affect the process selection and layout types? Discuss 2. How is the human resource aspect important to operation function? Discuss 3. Discuss the supply network design and its impact on the overall performance of the organization.arrow_forwardHelp with question?arrow_forward

- What are some good examples of bullet points on a resume for a Christian Elementary School?arrow_forwardWhat is an example of a cover letter for a Christian School Long-Term Substitute Teaching position?arrow_forwardThe supply chain is a conventional notion, but organizations are only really interested in making products that they can sell to customers. Provided they have reliable supplies of materials and reasonable transport for finished products, logistics is irrelevant. Do you think this is true? If yes, explain, and if no, clearly explain as well.arrow_forward

- working as a program operations managerarrow_forward12 X1, X230 1 x =0x2 write the Following linear Programming model by 1- general Form Canonical Forms Canonical formY 2- Standard Form Max Z=35X+ 4 X 2 +6 X3 ST. X+2X2-5x3 = 40 3X, + 6X2 + 7x 3 = 30 7x, +lox2 x3 = 50 X3 X 2 X 3 <0arrow_forwarda/ a Minimum cost assign each worker for one job at Jobs J1 12 33 WI 2 4 6 W2 5 W3 5 33 6 7arrow_forward

- وبة واضافة هذه القيمة الى القيم Ex: Assign each job for each worker at minimum total Cost عمل لكل عامل وبأقل كلفة ممكنة obs الأعمال Workors العمال J1 J2 J3 J4 W₁ 15 13 14 12 W2 11 12 15 13 W3 13 12 10 11 W4 15 17 14 16arrow_forwardThe average completion time (flow time) for the sequence developed using the FCFS rule = 11.75 days (round your response to two decimal places). The percentage utilization for the sequence developed using the FCFS rule = 42.55 % (enter your response as a percentage rounded to two decimal places). b) Using the SPT (shortest processing time) decision rule for sequencing the jobs, the order is (to resolve a tie, use the order in which the jobs were received): An Alabama lumberyard has four jobs on order, as shown in the following table. Today is day 205 on the yard's schedule. In what sequence would the jobs be ranked according to the decision rules on the left: Job Due Date A 212 B 209 C 208 D 210 Duration (days) 6 3 3 8 Sequence 1 Job B 2 3 4 A D The average tardiness (job lateness) for the sequence developed using the SPT rule = 5.00 days (round your response to two decimal places). The average completion time (flow time) for the sequence developed using the SPT rule = 10.25 days…arrow_forwardWith the aid of examples, fully discuss any five (5) political tactics used in organisations.arrow_forward