Accounting (Text Only)

26th Edition

ISBN: 9781285743615

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 11.5BPR

Payroll accounts and year-end entries

The following accounts, with the balances indicated, appear in the ledger of Codigo Co. on December 1 of the current year:

| 101 Salaries Payable | — |

| 102 Social Security Tax Payable | 52,913 |

| 103 Medicare Tax Payable | 728 |

| 104 Employees Federa1 Income Tax Payable | 4,490 |

| 1 OS Employees State Income Tax Payable | 4,073 |

| T C-5 State |

1,260 |

| 107 Federal Unemployment Tax Payable | 360 |

| 108 Retirement Savings | |

| Deductions Payable | $ 2,300 |

| 109 Medical Insurance Payable | 2,520 |

| 201 Sales Salaries Expense | 700,000 |

| 301 Officers Salaries Expense | 340,00O |

| 401 Office Salaries Expense | 125,000 |

| 408 Payroll Tax Expense | 59,491 |

The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December:

| Dec. 1. | Issued Check No. 815 to Aberderas Insurance Company for $2,520, in payment of the semiannual premium on the group medical insurance policy. |

| 1, | Issued Check No. 816 to Alvarez. Bank for $8,131, in payment for $2,913 of social security tax, $728 of Medicare tax, and $4,490 of employees’ federal income tax due. |

| 2. | Issued Check No. 817 for $2,300 to Alvarez Bank to invest in a retirement savings account for employees. |

| 12 | |

|

|

| 12. | Issued Check No. 822 in payment of the net amount of the biweekly payroll to fund tile payroll bank account. |

| 12. | Journalized the entry to record payroll taxes on employees' earnings of December 12: social security tax, SI,452; Medicare tax, $363: state unemployment tax, $315: federal unemployment tax. $90. |

| 15. | Issued Check No. 830 to Alvarez Bank for $7,938, in payment of $2,904 of social security tax, $726 of Medicare tax, and $4,308 of employees' federal income tax due. |

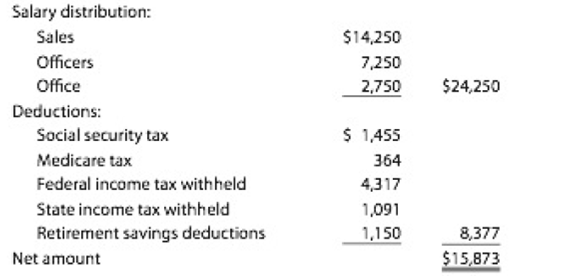

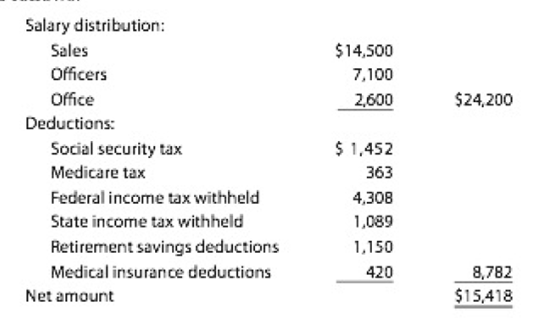

| 26. | Journalized the entry to record the biweekly payroll. A summary of the payroll record follows:

|

| Dec. 26. | Journalized the entry to record payroll taxes on employees' earnings of December 26: social security tax, SI,455; Medicare tax, $364; state unemployment tax, SI50; federal unemployment tax, S40. |

| 30. | Issued Check No. 851 for $6,258 to State Department of Revenue, in payment of employees' state income tax due on December 31. |

| 30. | Issued Check No. 852 to Alvarez Bank for $2,300 to invest in a retirement savings account for employees. |

| 31 | Paid $55,400 to the employee pension plan. The annual pension cost is $65,500. (Record both the payment and the unfunded pension liability.) |

Instructions

- 1. Journalize the transactions.

- 2. Journalize the following

adjusting entries on December 31:- a. Salaries accrued: sales salaries, $4,275; officers salaries, $2,175; office salaries, $825. The payroll taxes are immaterial and are not accrued.

- b. Vacation pay, $13,350.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's expenses, Gross margin, and Net income?

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?

Need answer general Accounting

Chapter 11 Solutions

Accounting (Text Only)

Ch. 11 - Does a discounted note payable provide credit...Ch. 11 - Employees are subject to taxes withheld from their...Ch. 11 - Prob. 3DQCh. 11 - Prob. 4DQCh. 11 - Prob. 5DQCh. 11 - Prob. 6DQCh. 11 - To match revenues and expenses properly, should...Ch. 11 - Prob. 8DQCh. 11 - When should the liability associated with a...Ch. 11 - Prob. 10DQ

Ch. 11 - Prob. 11.1APECh. 11 - Proceeds from notes payable On January 26, Nyree...Ch. 11 - Prob. 11.2APECh. 11 - Prob. 11.2BPECh. 11 - Prob. 11.3APECh. 11 - Prob. 11.3BPECh. 11 - Prob. 11.4APECh. 11 - Prob. 11.4BPECh. 11 - Prob. 11.5APECh. 11 - Prob. 11.5BPECh. 11 - Prob. 11.6APECh. 11 - Prob. 11.6BPECh. 11 - Prob. 11.7APECh. 11 - Estimated warranty liability Quantas Industries...Ch. 11 - Quick ratio Nabors Company reported the following...Ch. 11 - Quick ratio Adieu Company reported the following...Ch. 11 - Current liabilities Bon Nebo Co. sold 25,000...Ch. 11 - Entries for discounting notes payable Griffin...Ch. 11 - Evaluating alternative notes A borrower has two...Ch. 11 - Entries for notes payable A business issued a...Ch. 11 - Prob. 11.5EXCh. 11 - Prob. 11.6EXCh. 11 - Prob. 11.7EXCh. 11 - Calculate payroll An employee earns 32 per hour...Ch. 11 - Calculate payroll Diego Company has three...Ch. 11 - Summary payroll data In the following summary of...Ch. 11 - Prob. 11.11EXCh. 11 - Payroll entries The payroll register for Proctor...Ch. 11 - Payroll entries Widmer Company had gross wages of...Ch. 11 - Prob. 11.14EXCh. 11 - Prob. 11.15EXCh. 11 - Prob. 11.16EXCh. 11 - Prob. 11.17EXCh. 11 - Prob. 11.18EXCh. 11 - Prob. 11.19EXCh. 11 - Accrued product warranty General Motors...Ch. 11 - Prob. 11.21EXCh. 11 - Quick ratio Gmeiner Co. had the following current...Ch. 11 - Quick ratio The current assets and current...Ch. 11 - Liability transactions The following items were...Ch. 11 - Entries for payroll and payroll taxes The...Ch. 11 - Wage and tax statement data on employer FICA tax...Ch. 11 - Prob. 11.4APRCh. 11 - Payroll accounts and year-end entries The...Ch. 11 - Prob. 11.1BPRCh. 11 - Entries for payroll and payroll taxes The...Ch. 11 - Prob. 11.3BPRCh. 11 - Prob. 11.4BPRCh. 11 - Payroll accounts and year-end entries The...Ch. 11 - Prob. 11.3CPPCh. 11 - Ethics and professional conduct in business Tonya...Ch. 11 - Prob. 11.2CPCh. 11 - Prob. 11.3CPCh. 11 - Contingent liabilities Altria Group, Inc., has...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY