Concept explainers

Payroll accounts and year-end entries

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year:

| 211 Salaries Payable | — |

| 212 Social Security Tax Payable | $ 9,273 |

| 213 Medicare Tax Payable | 2,318 |

| 214 Employees Federal Income Tax Payable | 15,455 |

| 215 Employees State Income Tax Payable | 13,909 |

| 216 State |

1,400 |

| 217 Federal Unemployment Tax Payable | SOO |

| 218 Retirement Savings Deductions Payable | $3,400 |

| 219 Medical Insurance Payable | 27r000 |

| 411 Operations Salaries Expense | 950.000 |

| S11 Officers Salaries Expense | 600,000 |

| SI 2 Office Salaries Expense | 150.000 |

| S19 Payroll Tax Expense | 137,951 |

The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December:

| Dec. 2. | Issued Check No. 410 for 53,400 to Jay Bank to invest in a retirement savings account for employees. |

| 2. | Issued Check No. 411 to Jay Bank for 527,046, in payment of 59,273 of social security tax, 2,318 of Medicare tax, and $15,455 of employees’ federal income tax due. |

| 13 |

| Dec. 13. | Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account. |

| 13. | Journalized the entry to record payroll taxes on employees' earnings of December 13: social security tax. $4,632; Medicare tax, $1,158; state unemployment tax. $350; federal unemployment tax, $125. |

| 16. | Issued Check No. 424 to Jay Bank for $27,020. in payment of $9,264 of social security tax, $2,316 of Medicare tax, and $15,440 of employees' federal income tax due. |

| 19. | Issued Check No. 429 to Sims-Walker Insurance Company for $31,500, in payment of the semiannual premium on the group medical insurance policy. |

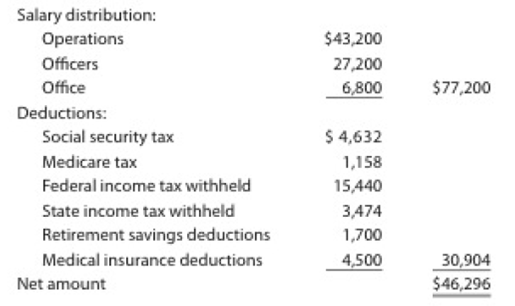

| 27. | Journalized the entry to record the biweekly payroll. A summary of the payroll |

| 27. | Issued Check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account. |

| 27. | Journalized the entry to record payroll taxes on employees' earnings of December 27: social security tax, $4,668; Medicare tax. $1,167: state unemployment tax, $225; federal unemployment tax, $75. |

| 27. | Issued Check No. 543 for $20,884 to State Department of Revenue in payment of employees' state income tax due on December 31. |

| 31. | Issued Check No. 545 to Jay Bank for $3400 to invest in a retirement savings account for employees. |

| 31. | Paid $45,000 to the employee pension plan. The annual pension cost is $60,000. (Record both the payment and unfunded pension liability.) |

Instructions

- 1. Journalize the transactions.

- 2. Journalize the following

adjusting entries on December 31:- a. Salaries accrued: operations salaries, $8,560; officers salaries, $5,600: office salaries, $1,400. The payroll taxes are immaterial and are not accrued.

- b. Vacation pay, $15,000.

1.

Payroll: The total payment that a company is required to pay to its employee for the services received is called as payroll.

Payroll withholding deduction: The amounts which the employer withheld from employees’ gross pay to deduct taxes such as federal income tax, state income tax, local income tax, and social security tax are called payroll withholding deduction.

To Prepare: journal entries for the transactions.

Explanation of Solution

Prepare journal entries for the transactions.

| Date | Accounts and Explanation | Post Ref | Debit ($) |

Credit ($) | |

| December | 2 | Bond Deductions Payable | 3,400 | ||

| Cash | 3,400 | ||||

| (To record investment in a retirement savings) | |||||

| December | 2 | Social Security Tax Payable | 9,273 | ||

| Medicare Tax Payable | 2,318 | ||||

| Employees Federal Income Tax Payable | 15,455 | ||||

| Cash | 27,046 | ||||

| (To record the payment of withholdings taxes) | |||||

| December | 13 | Operations Salaries Expense | 43,200 | ||

| Officers’ Salaries Expense | 27,200 | ||||

| Office Salaries Expense | 6,800 | ||||

| Social Security Tax Payable | 4,632 | ||||

| Medicare Tax Payable | 1,158 | ||||

| Employees Federal Income Tax Payable | 15,440 | ||||

| Employees State Income Tax Payable | 3,474 | ||||

| Bond Deductions Payable | 1,700 | ||||

| Medical Insurance Payable | 4,500 | ||||

| Salaries Payable | 46,296 | ||||

| (To record salaries expense and payroll deductions) | |||||

| December | 13 | Salaries Payable | 46,296 | ||

| Cash | 46,296 | ||||

| (To record the payment of salaries) | |||||

Table (1)

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |

| December | 13 | Payroll Tax Expense | 6,265 | ||

| Social Security Tax Payable | 4,632 | ||||

| Medicare Tax Payable | 1,158 | ||||

| State Unemployment Tax Payable | 350 | ||||

| Federal Unemployment Tax Payable | 125 | ||||

| (To record payroll taxes expense) | |||||

| December | 16 | Social Security Tax Payable | 9,264 | ||

| Medicare Tax Payable | 2,316 | ||||

| Employees Federal Income Tax Payable | 15,440 | ||||

| Cash | 27,020 | ||||

| (To record the payment of withholdings taxes) | |||||

| December | 19 | Medical Insurance Payable | 31,500 | ||

| Cash | 31,500 | ||||

| (To record the payment of medical insurance) | |||||

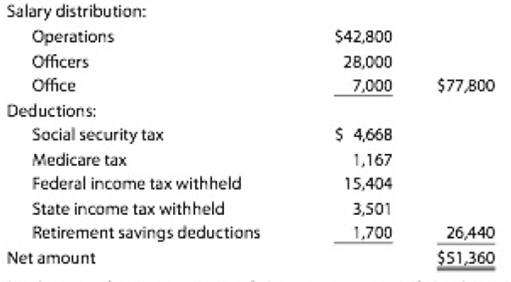

| December | 27 | Operations Salaries Expense | 42,800 | ||

| Officers’ Salaries Expense | 28,000 | ||||

| Office Salaries Expense | 7,000 | ||||

| Social Security Tax Payable | 4,668 | ||||

| Medicare Tax Payable | 1,167 | ||||

| Employees Federal Income Tax Payable | 15,404 | ||||

| Employees State Income Tax Payable | 3,501 | ||||

| Bond Deductions Payable | 1,700 | ||||

| Salaries Payable | 51,360 | ||||

| (To record salaries expense and payroll deductions) | |||||

| December | 27 | Salaries Payable | 51,360 | ||

| Cash | 51,360 | ||||

| (To record the payment of salaries) | |||||

| 27 | Payroll Tax Expense | 6,135 | |||

| Social Security Tax Payable | 4,668 | ||||

| Medicare Tax Payable | 1,167 | ||||

| State Unemployment Tax Payable | 225 | ||||

| Federal Unemployment Tax Payable | 75 | ||||

| (To record payroll taxes expense) | |||||

| December | 27 | Employees State Income Tax Payable | 20,884 | ||

| Cash | 20,884 | ||||

| (To record the payment of state income taxes) | |||||

Table (2)

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |

| December | 31 | Bond Deductions Payable | 3,400 | ||

| Cash | 3,400 | ||||

| (To record investment in a retirement savings) | |||||

| December | 31 | Pension Expense | 60,000 | ||

| Cash | 45,000 | ||||

| Unfunded Pension Liability | 15,000 | ||||

| (To record pension cost and unfunded liability) | |||||

Table (3)

2. a

To Journalize: The adjusting entry for accrued salaries on December 31.

Answer to Problem 11.5APR

Prepare adjusting entry for accrued salaries on December 31.

| Date | Accounts and Explanation | Post Ref |

Debit ($) | Credit ($) | |||

| December | 31 | Operations Salaries Expense | 8,560 | ||||

| Officers’ Salaries Expense | 5,600 | ||||||

| Office Salaries Expense | 1,400 | ||||||

| Salaries payable | 15,560 | ||||||

| (To record accrued salaries for the period) | |||||||

Table (4)

Explanation of Solution

- Operations salaries expense is an expense and it decreases the equity value. So, debit it by $8,560.

- Officers’ salaries expense is an expense and it decreases the equity value. So, debit it by $5,600.

- Office salaries expense is an expense and it decreases the equity value. So, debit it by $1,400.

- Salaries payable is a liability and it is increased. So, credit it by $15,560.

Want to see more full solutions like this?

Chapter 11 Solutions

Accounting (Text Only)

- helparrow_forwardBansai, age 66, retires and receives a $1,450 per month annuity from his employer's qualified pension plan. Bansai made $87,600 of after-tax contributions to the plan before retirement. Under the simplified method, Bansai's number of anticipated payments is 240. What is the amount includible in income in the first year of withdrawals assuming 12 monthly payments? A. $10,560 B. $12,540 C. $17,400 D. $8,220arrow_forwardWhat is the cost of goods sold?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning