Concept explainers

Fixed

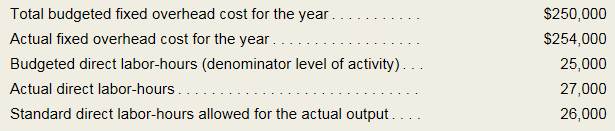

Primara Corporation has a

Required:

- Compute the fixed portion of the predetermined overhead rate for the year.

- Compute the fixed overhead

budget variance and volume variance.

1

Fixed portion of the predetermined overhead rate of the year.

Introduction: Fixed overhead volume variances mean a measure that defines the difference between budgeted fixed overhead costs and actual cost of fixed overhead costs. This explains the units produced based on the standard hours allowed and standard fixed rate.

Answer to Problem 10A.1E

Explanation of Solution

2

Fixed overhead budget variance and volume variance.

Introduction: Fixed overhead volume variances mean a measure that defines the difference between budgeted fixed overhead costs and actual cost of fixed overhead costs. This explains the units produced based on the standard hours allowed and standard fixed rate.

Answer to Problem 10A.1E

Budgeted variances is $4,000U and volume variances is $10,000F

Explanation of Solution

Want to see more full solutions like this?

Chapter 10A Solutions

MANAGERIAL ACCOUNTING F/MGRS.

- Hii expert please given correct answer general Accounting questionarrow_forwardOn 1st May, 2024 you are engaged to audit the financial statement of Giant Pharmacy for the period ending 30th December 2023. The Pharmacy is located at Mgeni Nani at the outskirts of Mtoni Kijichi in Dar es Salaam City. Materiality is judged to be TZS. 200,000/=. During the audit you found that all tests produced clean results. As a matter of procedures you drafted an audit report with an unmodified opinion to be signed by the engagement partner. The audit partner reviewed your file in October, 2024 and concluded that your audit complied with all requirements of the international standards on auditing and that; sufficient appropriate audit evidence was in the file to support a clean audit opinion. Subsequently, an audit report with an unmodified opinion was issued on 1st November, 2024. On 18th January 2025, you receive a letter from Dr. Fatma Shemweta, the Executive Director of the pharmacy informing you that their cashier who has just absconded has been arrested in Kigoma with TZS.…arrow_forwardNonearrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning