Concept explainers

Applying

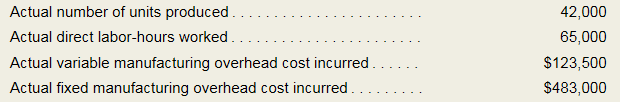

Lane Company manufactures a single product that requires a great deal of hand labor. Overhead cost is applied on the basis of standard direct labor-hours. The budgeted variable manufacturing overhead is $2 per direct labor-hour and the budgeted fixed manufacturing overhead is $480,000 per year.

The standard quantity of materials is 3 pounds per unit and the

Required:

- Compute the predetermined overhead rate for the year Break the rate down into variable and fixed elements.

- Prepare a standard cost card for the company’s product; show the details for all

manufacturing costs on your standard cost card. - Do the following:

- Compute the standard direct labor-hours allowed for the year’s production.

- Complete the following Manufacturing Overhead T-account for the year:

- Determine the reason for any underapplied or overapplied overhead for the year by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances.

- Suppose the company had chosen 65,000 direct labor-hours as the denominator activity rather than 60,000 hours. State which, if any, of the variances computed in (4) above would have changed, and explain how the variance(s) would have changed. No computations are necessary.

1

The predetermined overhead rate for the year. Break the rate down into variable and fixed elements.

Introduction: Overhead means the ongoing business expenses which are not directly incurred while producing product or service. Overhead is important while preparing budget but it is also used to determine the amount company must charge in order to incur profit.

Answer to Problem 10A.8P

Total direct labor cost is $10, variable overhead labor cost is $2, and Fixed overhead labor cost is $8.

Explanation of Solution

2

Prepare a standard cost card for the company’s product; show the details for all manufacturing cost on your standard cost card.

Introduction: Overhead means the ongoing business expenses which are not directly incurred while producing product or service. Overhead is important while preparing budget but it is also used to determine the amount company must charge in order to incur profit.

Answer to Problem 10A.8P

Standard labor cost per unit is $54

Explanation of Solution

3

Compute the standard direct-labor allowed for the year’s production and complete manufacturing overhead T-account of the year.

Introduction: Overhead means the ongoing business expenses which are not directly incurred while producing product or service. Overhead is important while preparing budget but it is also used to determine the amount company must charge in order to incur profit.

Answer to Problem 10A.8P

Standard direct labor hour is $63,000, under applied cost is $630,000, and over applied cost is $23,500

Explanation of Solution

Under applied cost is computed below:

Over applied cost is computed below:

4

The reason for any under applied and over applied overhead for the year.

Introduction: Overhead means the ongoing business expenses which are not directly incurred while producing product or service. Overhead is important while preparing budget but it is also used to determine the amount company must charge in order to incur profit.

Answer to Problem 10A.8P

Variable overhead rate variance is $6,500, Variable overhead efficiency variance is $4,000, Budget variance is $3,000, and volume variance is $24,000.

Explanation of Solution

5

Direct-labor hours changed from 60,000 to 65,000 hours. Give explanation for change in variances.

Introduction: Overhead means the ongoing business expenses which are not directly incurred while producing product or service. Overhead is important while preparing budget but it is also used to determine the amount company must charge in order to incur profit.

Answer to Problem 10A.8P

Change in direct labor hours changed few cost and variances like variable overhead labor cost, fixed overhead budget variance and fixed overhead volume variance.

Explanation of Solution

If direct-labor hours would have been changed from 60,000 to 65,000 as denominators activity then following cost will be changed such as variable overhead labor cost, fixed overhead budget variance and fixed overhead volume variance.

Want to see more full solutions like this?

Chapter 10A Solutions

MANAGERIAL ACCOUNTING F/MGRS.

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning