Applications and Investigations in Earth Science (9th Edition)

9th Edition

ISBN: 9780134746241

Author: Edward J. Tarbuck, Frederick K. Lutgens, Dennis G. Tasa

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

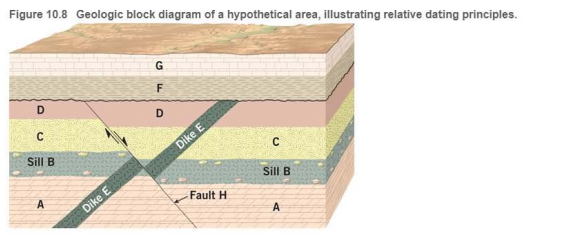

Chapter 10.3, Problem 3A

Is fault H older or younger than sedimentary layers F and G?

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule07:52

Students have asked these similar questions

A food processing company is considering replacing essential

machinery. Cost and relevant cash flow details are provided in

the table at the right. The company requires an 11% return on

its capital.

a) What is the present value of the yearly cash flows? Use a

Time Value of Money function for full credit. (round to nearest

dollar)

b) What is the net present value of the project? (round to

nearest dollar)

c) What is the internal rate of return of the project? Use a

Time Value of Money function for full credit. (round to two

decimal places)

what is the firms' weighted average cost of capital? please show me weight calculation for each capital source.

A small manufacturer is considering an equipment replacement

project. The new equipment would have an installed cost of

$125,000 and would replace existing equipment that was

purchased 3 years ago at an installed cost of $80,000. If the

company moves forward with the replacement, it could sell the

old equipment for $25,000. Purchasing the new equipment

would result in the company's current assets increasing by

$12,000 and current liabilities increasing by $9,000. The

company uses the 5-year MACRS table for depreciation, and is taxed at

21%.

a) What is the accumulated depreciation of the old equipment?

b) What is the current book value of the old equipment?

c) What is the amount of depreciation recapture/recovery?

d) What is the tax on the sale of the old equipment?

e) What are the after-tax proceeds from the sale of the old

equipment?

f) What is the change in Net Working Capital?

g) What is the initial investment for the project?

Chapter 10 Solutions

Applications and Investigations in Earth Science (9th Edition)

Ch. 10.1 - Prob. 1ACh. 10.1 - In your own words, briefly distinguish between...Ch. 10.2 - Prob. 1ACh. 10.2 - Were you able to place all of the cards in...Ch. 10.2 - Prob. 3ACh. 10.3 - Prob. 1ACh. 10.3 - Is fault H older or younger than rock layers A- D?Ch. 10.3 - Is fault H older or younger than sedimentary...Ch. 10.3 - Did fault H occur before or after dike E? Explain...Ch. 10.3 - What evidence supports the conclusion that the...

Ch. 10.4 - Prob. 1ACh. 10.4 - Identify the types of unconformities in Figure...Ch. 10.5 - Prob. 1ACh. 10.5 - Is rock layer I older or younger than layer H?...Ch. 10.5 - Is fault L older or younger than rock layer D?...Ch. 10.5 - Is igneous intrusion J older or younger than...Ch. 10.5 - Is the igneous intrusion labeled dike K older or...Ch. 10.5 - List the entire sequence of events, in order from...Ch. 10.6 - Prob. 1ACh. 10.7 - Prob. 1ACh. 10.7 - What is the geologic range of Lepidodendron, an...Ch. 10.7 - Imagine that you have discovered an outcrop of...Ch. 10.7 - What is the geologic range of the fossils shown in...Ch. 10.7 - What is the geologic range of the fossil shown in...Ch. 10.7 - Imagine that you have discovered a rock outcrop...Ch. 10.8 - If you had conducted this experiment 10 times and...Ch. 10.8 - What percentage of the original parent isotope...Ch. 10.8 - Prob. 4ACh. 10.8 - Determine the numerical ages of rock samples that...Ch. 10.9 - Prob. 1ACh. 10.9 - Prob. 2ACh. 10.9 - Prob. 3ACh. 10.9 - Prob. 4ACh. 10.9 - Prob. 5ACh. 10.10 - Prob. 1ACh. 10.10 - Prob. 2ACh. 10.10 - Prob. 3ACh. 10 - Place the lettered features in proper sequence,...Ch. 10 - What type of unconformity separates layer G from...Ch. 10 - Which principle of relative dating did you apply...Ch. 10 - Which principle of relative dating did you use to...Ch. 10 - Explain how you can determine whether fault N is...Ch. 10 - If rock layer F is 150 million years old, and...Ch. 10 - The analysis of samples from layers G and F...Ch. 10 - What time interval is represented by the...Ch. 10 - Prob. 9LR

Additional Science Textbook Solutions

Find more solutions based on key concepts

8. At what speed does a 1000 kg compact car have the same kinetic energy as a 20,000 kg truck going 25 km/h?

College Physics: A Strategic Approach (3rd Edition)

In humans, hemophilia A (OMIM 306700) is an X-linked recessive disorder that affects the gene for factor VIII p...

Genetic Analysis: An Integrated Approach (3rd Edition)

Your microbiology lab maintains reference bacterial cultures, which are regularly transferred to new nutrient a...

Laboratory Experiments in Microbiology (12th Edition) (What's New in Microbiology)

How do food chains and food webs differ? Which is the more accurate representation of feeding relationships in ...

Biology: Life on Earth (11th Edition)

Distinguish between the concepts of sexual differentiation and sex determination.

Concepts of Genetics (12th Edition)

Explain the role of gene flow in the biological species concept.

Campbell Biology (11th Edition)

Knowledge Booster

Similar questions

- Last year Lewis Bank paid an annual dividend of $7 per share. The bank expects the growth of its dividends to be stable at 2% per year going forward. a) If investors require an 8% return, what is the current value of Lewis Bank's stock? (round to nearest cent) b) If the stock currently trades at $124.55 per share, what is the dividend growth rate investors expect? (round to nearest percent)arrow_forwardA food processing company is considering replacing essential machinery. Cost and relevant cash flow details are provided in the table at the right. The company requires an 11% return on its capital. a) What is the present value of the yearly cash flows? Use a Time Value of Money function for full credit. (round to nearest dollar) b) What is the net present value of the project? (round to nearest dollar) c) What is the internal rate of return of the project? Use a Time Value of Money function for full credit. (round to two decimal places)arrow_forwardBarnsa is planning to raise a total of $5,000,000 with a bond issue. Each of the bonds has a face (par) value of $1,000 and coupon rate of 4%. The company's applicable tax rate is 21%. a) What is the annual coupon payment, per bond, that investors expect to receive? b) What is the total after-tax annual interest expense to Barnsa?arrow_forward

- A team of analysts is using a two-stage variable growth model to estimate the value of GNC's common stock. The most recent annual dividend paid by GNC was $4 per share. The analysts expect dividends to increase 7% per year for the next 3 years and then drop to 3% starting in year 4 and remain at that rate for the foreseable future. The required rate of return used for the analysis is 8%. a) What are the expected dividends for the next 4 years? b) What is the value of the stock attributable to the first 3 years of dividends? (use NPV function) c) What is the value of the stock at the end of year 3? (use constant-growth model) Use a cell reference in the numerator to get an unrounded, more precise, answer figure. d) What is the value of the stock attributable to years 4 and beyond? (use pv function, where answer to part C is the fv) e) What is the total value of GNC stock?arrow_forwardAn investor is buying a bond that pays semi-annual interest. The par value is $900 and the coupon rate is 6%. The investor plans to hold the bond to its maturity, which is 5 years from now. If her typical required rate of return is 7%, what is the most the investor should pay for the bond? Use a Time Value of Money function for full credit. (round to nearest cent)arrow_forwardIRR: Mutually exclusive projects Nile Inc. wants to choose the better of two mutually exclusive projects that expand warehouse capacity. The projects' cash flows are shown in the following table: The cost of capital is 18%. a. Calculate the IRR for each of the projects. Assess the acceptability of each project on the basis of the IRRs. b. Which project is preferred? a. The internal rate of return (IRR) of project X is %. (Round to two decimal places.) Is project X acceptable on the basis of IRR? (Select the best answer below.) Yes No The internal rate of return (IRR) of project Y is %. (Round to two decimal places.) Is project Y acceptable on the basis of IRR? (Select the best answer below.) ○ Yes Ο No b. Which project is preferred? (Select the best answer below.) A. Project X B. Project Y C. Neitherarrow_forward

- A preferred stock has a par value of $105 and pays an annual dividend of 3% of par. If similar investments have an annual rate of return of 5%, what is the current value of this preferred stock. (round to nearest cent)arrow_forwardCommon stock value-Variable growth Lawrence Industries' most recent annual dividend was $1.82 per share (Do = $1.82), and the firm's required return is 15%. Find the market value of Lawrence's shares when dividends are expected to grow at 30% annually for 3 years, followed by a 6% constant annual growth rate in years 4 to infinity. The market value of Lawrence's shares is $ (Round to the nearest cent.)arrow_forwardDepreciation A firm is evaluating the acquisition of an asset that costs $68,400 and requires $3,990 in installation costs. If the firm depreciates the asset under MACRS, using a five-year recovery period (see table |), determine the depreciation charge for each year. The annual depreciation expense for year 1 will be $ The annual depreciation expense for year 2 will be $ The annual depreciation expense for year 3 will be $ The annual depreciation expense for year 4 will be $ The annual depreciation expense for year 5 will be $ The annual depreciation expense for year 6 will be $ (Round to the nearest dollar.) (Round to the nearest dollar.) (Round to the nearest dollar.) (Round to the nearest dollar.) (Round to the nearest dollar.) (Round to the nearest dollar.)arrow_forward

- Integrative Risk and valuation Giant Enterprises' stock has a required return of 15.9%. The company, which plans to pay a dividend of $2.22 per share in the coming year, anticipates that its future dividends will increase at an annual rate consistent with that experienced over 2016-2022 period, when the following dividends were paid: a. If the risk-free rate is 6%, what is the risk premium on Giant's stock? b. Using the constant-growth model, estimate the value of Giant's stock. (Hint: Round the computed dividend growth rate to the nearest whole percent.) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock. a. If the risk-free rate is 6%, the risk premium on Giant's stock is %. (Round to one decimal place.) (Round to the nearest cent.) b. Using the constant-growth model, the value of Giant's stock is $ c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock. (Select from the drop-down…arrow_forwardBond valuation-Semiannual interest Find the value of a bond maturing in 4 years, with a $1,000 par value and a coupon interest rate of 9% (4.5% paid semiannually) if the required return on similar-risk bonds is 13% annual interest. The present value of the bond is $ (Round to the nearest cent.)arrow_forwardYield to maturity The relationship between a bond's yield to maturity and coupon interest rate can be used to predict its pricing level. For the bond listed below, state whether the price of the bond will be at a premium to par, at par, or at a discount to par. Coupon interest rate 6% Yield to maturity 11% What is the price of the bond in relation to its par value? (Select the best answer below.) ○ A. The bond sells at a discount to par. B. The bond sells at a premium to par. OC. The bond sells at par.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning