Principles of Cost Accounting

17th Edition

ISBN: 9781305692862

Author: Edward J. Vanderbeck; Maria R. Mitchell

Publisher: Cengage Learning US

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 8P

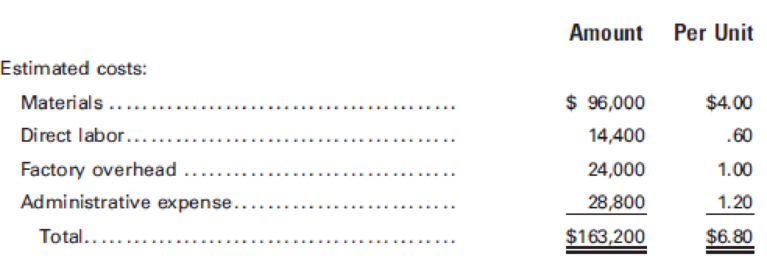

The production of a new product required Zion Manufacturing Co. to lease additional plant facilities. Based on studies, the following data have been made available: Estimated annual sales—24,000 units

Selling expenses are expected to be 5% of sales, and net income is to amount to $2.00 per unit.

Required:

- 1. Calculate the selling price per unit. (Hint: Let “X” equal the selling price and express selling expense as a percentage of “X.”)

- 2. Prepare an absorption costing income statement for the year ended December 31, 2016.

- 3. Calculate the break-even point expressed in dollars and in units, assuming that administrative expense and factory

overhead are all fixed but other costs are fully variable.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I am searching for the accurate solution to this general accounting problem with the right approach.

Please provide the accurate answer to this general accounting problem using valid techniques.

Please show me the correct approach to solving this financial accounting question with proper techniques.

Chapter 10 Solutions

Principles of Cost Accounting

Ch. 10 - What is the difference between absorption costing...Ch. 10 - Distinguish between product costs and period...Ch. 10 - What effect will applying variable costing have on...Ch. 10 - What are the advantages and disadvantages of using...Ch. 10 - Prob. 5QCh. 10 - What is the difference between gross margin and...Ch. 10 - Why are there objections to using absorption...Ch. 10 - What are common costs?Ch. 10 - How is a contribution margin determined, and why...Ch. 10 - What are considered direct costs in segment...

Ch. 10 - What is cost-volume-profit analysis?Ch. 10 - Prob. 12QCh. 10 - What steps are required in constructing a...Ch. 10 - What is the difference between the contribution...Ch. 10 - What impact does income tax have on the break-even...Ch. 10 - Define differential analysis, differential...Ch. 10 - Prob. 17QCh. 10 - Prob. 18QCh. 10 - What are distribution costs?Ch. 10 - What is the purpose of the analysis of...Ch. 10 - In cost analysis, what determines which costs...Ch. 10 - Yellowstone Fabricators uses a process cost system...Ch. 10 - Using the information presented in E10-1, prepare...Ch. 10 - The chief executive officer of Acadia, Inc....Ch. 10 - The following production data came from the...Ch. 10 - A company had income of 50,000, using variable...Ch. 10 - The fixed overhead budgeted for Ranier Industries...Ch. 10 - Columbia Products Inc. has two divisions, Salem...Ch. 10 - The sales price per unit is 13 for the Voyageur...Ch. 10 - Teton, Inc. sells its only product for 50 per...Ch. 10 - A new product is expected to have sales of...Ch. 10 - Augusta Industries manufactures and sells two...Ch. 10 - A company has sales of 1,000,000, variable costs...Ch. 10 - Prob. 13ECh. 10 - A company has prepared the following statistics...Ch. 10 - Prob. 15ECh. 10 - Prob. 16ECh. 10 - Redwood Industries needs 20,000 units of a certain...Ch. 10 - Prob. 18ECh. 10 - Biscayne Industries has determined the cost of...Ch. 10 - Roosevelt Enterprises has determined the cost of...Ch. 10 - Prob. 3PCh. 10 - Prob. 4PCh. 10 - Prob. 5PCh. 10 - Arctic Software Inc. has two product lines. The...Ch. 10 - Prob. 7PCh. 10 - The production of a new product required Zion...Ch. 10 - Grand Canyon Manufacturing Inc. produces and sells...Ch. 10 - Prob. 10PCh. 10 - Emerald Island Company is considering building a...Ch. 10 - Royale Aluminum desires an after-tax income of...Ch. 10 - Deuce Sporting Goods manufactures a high-end model...Ch. 10 - Prob. 14PCh. 10 - Prob. 15PCh. 10 - Prob. 1MCCh. 10 - Denali Company manufactures household products...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help solving this general accounting question with the proper methodology.arrow_forwardUsing the weighted- average method of process costing , the cost per equivalent unit of direct material is:arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forward

- What is the cost of goods manufactured for the period?arrow_forwardCan you explain the process for solving this financial accounting question accurately?arrow_forwardFallon Manufacturing Company measures its activity in terms of machine hours. Last month, the budgeted level of activity was 2,300 machine hours and the actual level of activity was 2,450 machine hours. The cost formula for maintenance expenses is $4.25 per machine hour plus $18,500 per month. The actual maintenance expense was $29,600. Last month, the spending variance for maintenance expenses was _.arrow_forward

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License