International Accounting

5th Edition

ISBN: 9781260466492

Author: Doupnik, Timothy

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 7EP

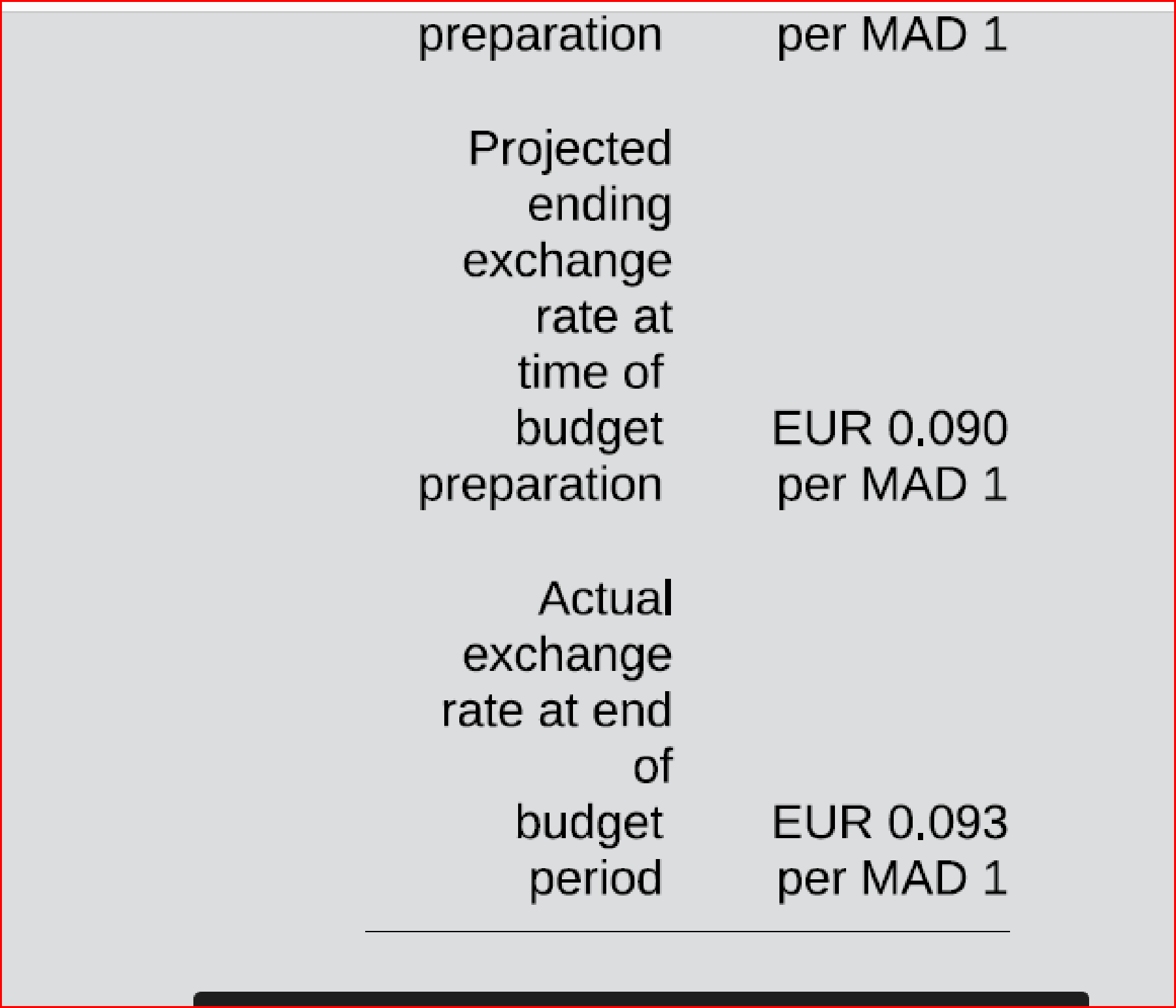

Philadelphia, Inc. (a Greek company) has a foreign subsidiary in Morocco, whose manager is evaluated on the basis of profit in euros (EUR). In the current year, the foreign subsidiary was budgeted to generate a profit of 1,000,000 Moroccan dirham (MAD), and actual profit for the year was MAD 1,050,000. Philadelphia’s corporate management has calculated an unfavorable total

Required:

- a. Identify the combination of exchange rates (see Exhibit 10.10) used by Philadelphia’s corporate management in translating budget and actual amounts that results in the total budget variance of EUR 11,650.

- b. Determine the portion of the total budget variance calculated by Philadelphia’s corporate management that is caused by a change in the exchange rate between the EUR and the MAD. (There are three possible correct responses to this requirement.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Lionel Corporation manufactures pharmaceutical products sold through a network of sales agents in the United States and Canada.

The agents are currently paid an 18% commission on sales; that percentage was used when Lionel prepared the following budgeted

income statement for the fiscal year ending June 30, 2022:

Lionel Corporation

Budgeted Income Statement

For the Year Ending June 30, 2022

($000 omitted)

Sales

$ 30,000

Cost of goods sold

$ 13,500

3,600

Variable

Fixed

17,100

Gross profit

Selling and administrative costs

$ 12,900

Commissions

$ 5,400

Fixed advertising cost

900

Fixed administrative cost

2,400

8,700

Operating income

$ 4,200

Fixed interest cost

750

$ 3,450

1,035

$ 2,415

Income before income taxes

Income taxes (30%)

Net income

Since the completion of the income statement, Lionel has learned that its sales agents are requiring a 5% increase in their commission

rate (to 23%) for the upcoming year. As a result, Lionel's president has decided to investigate the possibility of…

Alya Sdn Bhd. manufactures and supplies granite pots and pans with glass lids to a company in Japan. The new manager, Rushdi, wants to monitor the quarterly budgets for the quarter ending 30th September 2021 to ensure the sales targeted can be executed as planned even with the current economic condition. The following information is available:

(see the photo)

Variable manufacturing overhead cost is RM384,000, while fixed factory overhead is RM214,000 per quarter (including the non-cash expenditure of RM156,000) and is allocated on total units produced.

Financial information follows:

Beginning cash balance is RM1,800,000

Sales are on credit and are collected 50 percent in the current period and the remainder in the next period. Last quarter’s sales were RM8,400,000. There are no bad debts.

Purchases of direct materials and labor costs are paid for in the quarter acquired.

Manufacturing overhead expenses are paid in the quarter incurred.

Selling and administrative expenses are all…

Alya Sdn Bhd. manufactures and supplies granite pots and pans with glass lids to a company in Japan. The new manager, Rushdi, wants to monitor the quarterly budgets for the quarter ending 30th September 2021 to ensure the sales targeted can be executed as planned even with the current economic condition. The following information is available:

(see the photo)

Variable manufacturing overhead cost is RM384,000, while fixed factory overhead is RM214,000 per quarter (including the non-cash expenditure of RM156,000) and is allocated on total units produced.

Financial information follows:

Beginning cash balance is RM1,800,000

Sales are on credit and are collected 50 percent in the current period and the remainder in the next period. Last quarter’s sales were RM8,400,000. There are no bad debts.

Purchases of direct materials and labor costs are paid for in the quarter acquired.

Manufacturing overhead expenses are paid in the quarter incurred.

Selling and administrative expenses are all…

Chapter 10 Solutions

International Accounting

Ch. 10 - Prob. 1QCh. 10 - What makes calculation of NPV for a foreign...Ch. 10 - How does the evaluation of a potential foreign...Ch. 10 - Prob. 4QCh. 10 - How does an ethnocentric organizational structure...Ch. 10 - Prob. 6QCh. 10 - When might it be appropriate to evaluate the...Ch. 10 - Prob. 8QCh. 10 - Prob. 9QCh. 10 - How can a local currency operating budget and...

Ch. 10 - Prob. 11QCh. 10 - What is the advantage of using a projected future...Ch. 10 - Prob. 3EPCh. 10 - Prob. 4EPCh. 10 - Imogdi Corporation (a U.S-based company) has a...Ch. 10 - Philadelphia, Inc. (a Greek company) has a foreign...Ch. 10 - Fitzwater Limited (an Irish company) has a foreign...Ch. 10 - Prob. 9EPCh. 10 - Viking Corporation (a U.S.-based company) has a...Ch. 10 - Duncan Street Company (DSC), a British company, is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Tokyo Division of Toy King manufactures “Togo Toy” and sells them in the Japanese market for P6,000 each. The following data are from the Tokyo Division’s 2018 budget: Variable Cost P3,800 per unit Fixed Overhead P6,080,000 Total Assets P12,500,000 Toy King has instructed the Tokyo Division to budget a rate of return on total assets (before taxes) of 20%. The Tokyo Division is considering adjustments in the budget to reach the desired 20% rate of return on total assets: a. How many units must be sold to obtain the desired return if no other part of the budget is changed? b. Suppose sales cannot be increased beyond 3,400 units. How much must total assets be reduced to obtain the desired return? Assume that for every P1,000 decrease in total assets, fixed costs decrease by P100.arrow_forwardThe marketing team of a small company had a budget of 2900 euros to spend on events in the prior year, and underspent by 6%. This year, owing to budget cuts, the marketing team can only spend 5/8 of last year's spend.To the nearest euro, what is this year's marketing budgetarrow_forwardPittman Company is a small but growing manufacturer of telecommunications equipment. The company has no sales force of its own; rather, it relies completely on independent sales agents to market its products. These agents are paid a sales commission of 19% for all items sold.Barbara Cheney, Pittman�s controller, has just prepared the company�s budgeted income statement for next year. The statement follows:Pittman CompanyBudgeted Income StatementFor the Year Ended December 31Sales $ 19,900,000Manufacturing expenses:Variable $ 7,850,000Fixed overhead 2,860,000 10,710,000Gross margin 9,190,000Selling and administrative expenses:Commissions to agents 3,781,000Fixed marketing expenses 250,000*Fixed administrative expenses 2,450,000 6,481,000Net operating income $ 2,709,000Fixed interest expenses 670,000Income before income taxes 2,039,000Income taxes (20%) 407,800Net income 1,631,200*Primarily depreciation on storage facilities.As Barbara handed the statement to…arrow_forward

- Below are estimates related to Sando's 2022 budget, a company that specializes in crafting unique ornaments for the Caribbean: Selling Price: $2500 Variable Cost per Ornament: $1625 Fixed Annual Cost: $140,000 Net Profit (After Tax): $600,000 Income Tax Rate: 25% Upon reviewing the income statement mid-year, it was evident that sales did not meet the expected levels. For the first half of the year up to June 2022, 360 units were sold at the projected selling price with variable costs aligning with the plan. However, achieving the projected 2022 net profit appears unlikely without management intervention. Several mutually exclusive options have been presented for consideration: a) Option 1: Reduce the selling price by $180. This adjustment would enable the sale of 1700 units for the remainder of the year. Both the budgeted fixed costs and variable costs per unit will remain unchanged. b) Option 2: Lower the variable cost per unit by $60 by sourcing more cost-effective…arrow_forwardStuart Corporation, which has three divisions, is preparing its sales budget. Each division expects a different growth rate because economic conditions vary in different regions of the country. The growth expectations per quarter are 4 percent for Cummings Division, 2 percent for Springfield Division, and 6 percent for Douglas Division. Required a. Complete the sales budget by filling in the missing amounts. b. Determine the amount of sales revenue that the company will report on its quarterly pro forma income statements. Complete this question by entering your answers in the tabs below. Required A Required B Complete the sales budget by filling in the missing amounts. Note: Round your final answers to the nearest whole dollar amount. Division First Quarter Second Third Quarter Quarter Fourth Quarter Cummings Division $ 100,000 Springfield Division 400,000 Douglas Division 220,000arrow_forwardFinch Corporation, which has three divisions, is preparing its sales budget. Each division expects a different growth rate because economic conditions vary in different regions of the country. The growth expectations per quarter are 4 percent for Cummings Division, 2 percent for Springfield Division, and 6 percent for Douglas Division. Required a. Complete the sales budget by filling in the missing amounts. b. Determine the amount of sales revenue that the company will report on its quarterly pro forma income statements. Complete this question by entering your answers in the tabs below. Required A Required B Complete the sales budget by filling in the missing amounts. Note: Round your final answers to the nearest whole dollar amount. Division Cummings Division Springfield Division Douglas Division First Quarter $ 200,000 350,000 240,000 Second Quarter Third Quarterarrow_forward

- Gibson Corporation, which has three divisions, is preparing its sales budget. Each division expects a different growth rate because economic conditions vary in different regions of the country. The growth expectations per quarter are 4 percent for Cummings Division, 2 percent for Springfield Division, and 6 percent for Douglas Division. Required a. Complete the sales budget by filling in the missing amounts. b. Determine the amount of sales revenue that the company will report on its quarterly pro forma income statements. Complete this question by entering your answers in the tabs below. Required A Required B Complete the sales budget by filling in the missing amounts. Note: Round your final answers to the nearest whole dollar amount. Division First Quarter Second Quarter Third Quarter Fourth Quarter Cummings Division $ 160,000 Springfield Division 390,000 Douglas Division 260,000 Required A Required B >arrow_forwardSolve this accounting problemarrow_forwardThe Camping Division of JA Company is operated as a profit center. Sales for the division were budgeted for 2020 at $694,000, The only variable costs budgeted for the division were cost of goods sold ($342,000) and selling and administrative ($48,000). Fixed costs were budgeted at $79,000 for cost of goods sold, $71,000 for selling and administrative, and $68,000 for noncontrollable fixed costs. Actual results for these items were: Sales $673,000 Cost of goods sold Variable 318,000 Fixed 84,000 Selling and administrative Variable 49,000 Fixed 52,000 Noncontrollable fixed 68,000arrow_forward

- QC Corp has the following budget amounts for the current year: $1,100,000 for prevention costs and $880,000 for appraisal costs. Internal failure equals $100 per failed item and external failure has a total budget of $660,000. The Product Testing department has proposed a new method of testing products. If management decides to implement the new method, $2.20 per unit of appraisal costs will be saved, up to a level of 150,000 tests. No additional savings are expected past the 150,000 level. The new method involves $104,500 in training costs and $71,500 in yearly testing supplies. If the new testing method is implemented what is the revised budget for appraisal costs, assuming 550,000 units are tested during the current year?arrow_forwardKK ENTERPRISE was set up by a man and his with some few years ago. The trade in a lot of products. They don’t have enough knowledge in accounting for decision making. They need professional assistance to prepare budgets for the period October to December 2020. The following information has been provided to assist in the budgeting process: · Budgeted monthly sales revenue for 2020 is as follows: October GH¢ 40,000, November GH¢ 70,000, December GH¢ 50,000, January 2018 45,000. Sales are 20% cash and 80% credit. Credit sales are collected over a three- month period, 15% in the month of sale, 70% in the month following sale and 15% in the second month following sale. Total sales revenue in August amounts to GH¢30,000 and September’s total sales revenue amounts to GH¢36,000. Cost of sales is expected to amount to 60% of sales revenue each month. The business maintains its closing inventory levels at 75% of the following month’s cost of sales. Inventory at the beginning of October is…arrow_forwardBrodrick Company expects to produce 21,800 units for the year ending December 31. A flexible budget for 21,800 units of production reflects sales of $610,400; variable costs of $65,400; and fixed costs of $142,000. 1a) If the company instead expects to produce and sell 27,100 units for the year, calculate the expected level of income from operations. 1b)Assume that actual sales for the year are $711,800 (27,100 units), actual variable costs for the year are $113,200, and actual fixed costs for the year are $138,000.Prepare a flexible budget performance report for the year. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Securities Markets and Transactions Pt1; Author: Larry Byerly;https://www.youtube.com/watch?v=v0ClVlaxWFY;License: Standard Youtube License