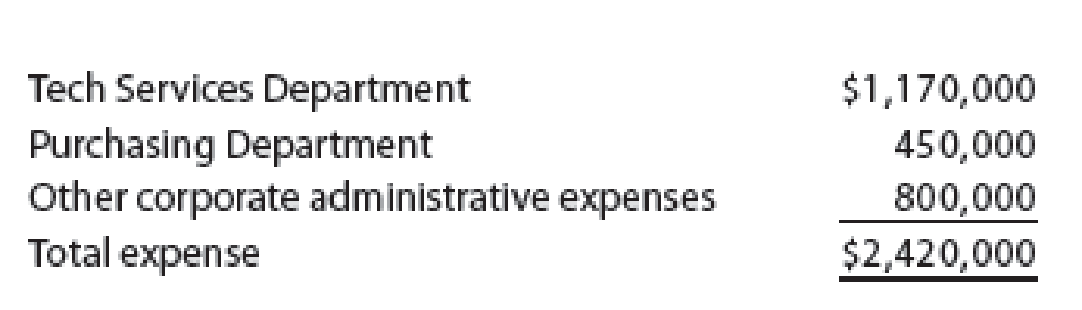

Horton Technology has two divisions, Consumer and Commercial, and two corporate support departments, Tech Services and Purchasing. The corporate expenses for the year ended December 31, 20Y7, are as follows:

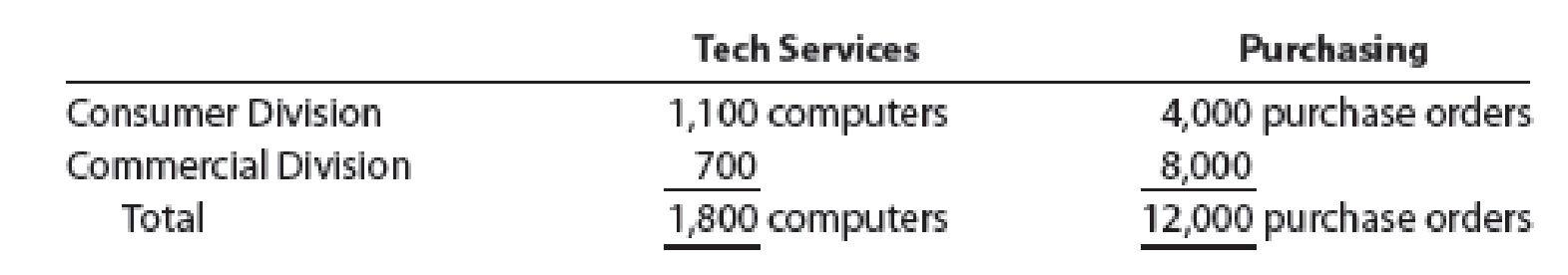

The other corporate administrative expenses include officers’ salaries and other expenses required by the corporation. The Tech Services Department allocates costs to the divisions based on the number of computers in the department, and the Purchasing Department allocates costs to the divisions based on the number of purchase orders for each department. The services used by the two divisions are as follows:

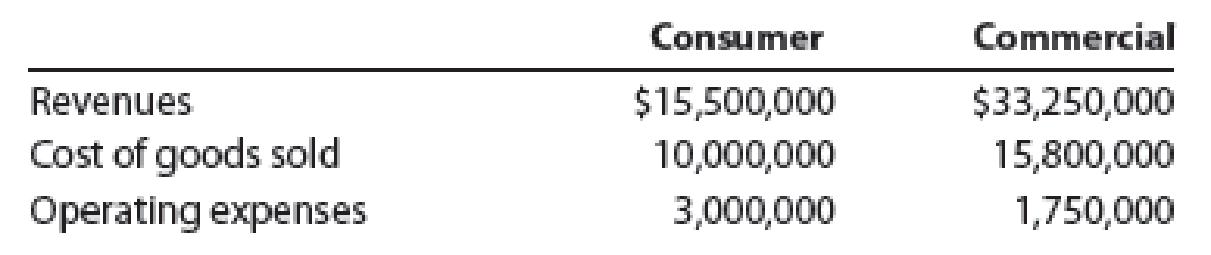

The support department allocations of the Tech Services Department and the Purchasing Department are considered controllable by the divisions. Corporate administrative expenses are not considered controllable by the divisions. The revenues, cost of goods sold, and operating expenses for the two divisions are as follows:

Prepare the divisional income statements for the two divisions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,