Concept explainers

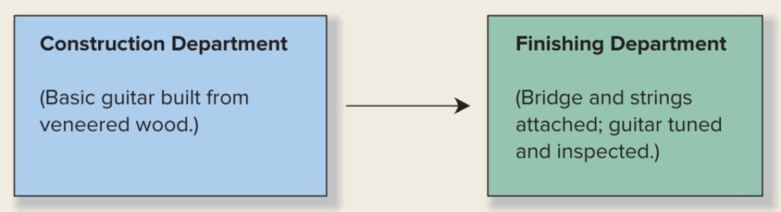

Springsteen Company manufactures guitars. The company uses a standard,

Each finished guitar contains seven pounds of veneered wood. In addition, one pound of wood is typically wasted in the production process. The veneered wood used in the guitars has a standard price of $12 per pound. The other parts needed to complete each guitar, such as the bridge and strings, cost $15 per guitar. The labor standards for Springsteen’s two production departments are as follows:

Construction Department: 6 hours of direct labor at $20 per hour

Finishing Department: 3 hours of direct labor at $15 per hour

The following pertains to the month of July.

- 1. There were no beginning or ending work-in-process inventories in either production department.

- 2. There was no beginning finished-goods inventory.

- 3. Actual production was 500 guitars, and 300 guitars were sold on account for $400 each.

- 4. The company purchased 6,000 pounds of veneered wood at a price of $12.50 per pound.

- 5. Actual usage of veneered wood was 4,500 pounds of the wood purchased during July.

- 6. Enough parts (bridges and strings) to finish 600 guitars were purchased at a cost of $9,000.

- 7. The Construction Department used 2,850 direct-labor hours. The total direct-labor cost in the Construction Department was $54,150.

- 8. The Finishing Department used 1,570 direct-labor hours. The total direct-labor cost in that department was $25,120.

- 9. There were no direct-material variances in the Finishing Department.

Required:

- 1. Prepare

journal entries to record all of the events listed for Springsteen Company during July. Specifically, these journal entries should reflect the following events.- a. Purchase of direct material.

- b. Use of direct material.

- c. Incurrence of direct-labor costs.

- d. Addition of production costs to the Work-in-Process Inventory account for each department.

- e. Incurrence of all variances.

- f. Completion of 500 guitars.

- g. Sale of 300 guitars.

- h. Closing of all variance accounts into Cost of Goods Sold.

- 2. Draw T-accounts, and

post the journal entries prepared in requirement (1). Assume the beginning balance in all accounts is zero.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- What is this firm debt equity ratio? General accountingarrow_forwardhow much long-term debt did the firm have? general accountingarrow_forwardAssume that 5% of the L.L. Bean boots are returned by customers for various reasons. L. Bean has a 100% refund policy for returns, no matter what the reason. What would the journal entry be to accrue L.L. Bean's sales returns for this one pair of boots? (Note: L.L. Bean most likely will make monthly/quarterly adjusting entries for the total sales returns accruals, but here we will just look at the accrual associated with the sale of one pair of boots.)arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College