Concept explainers

(a)

Calculate the forward rate of zero-coupon bond with 11% yield to maturity and 2 years maturity.

Answer to Problem 40PS

The forward rates obtained for 2nd year is 12.01% and for 3rd year is 14.035, the yield to maturity for 3rd year is 13.02% and the expected return for three year bond is 10%.

Explanation of Solution

Given Information:

| Maturity(years) | Y TM |

| 1 | 10% |

| 2 | 11% |

| 3 | 12% |

Implied forward rates refer to the expected future movement of the interest rates by the market.

the

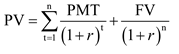

Yield to maturity of the bond can be calculated using the following formula:

The following information goes with all the parts of this question:

Table showing the current yield curve for zero-coupon bond:

| Maturity(years) | Y TM |

| 1 | 10% |

| 2 | 11% |

| 3 | 12% |

Calculate the forward rate of zero-coupon bond with 12% yield to maturity and 3 years maturity

Thus, the forward rates obtained for 2nd year is 12.01% and for 3rd year is 14.035

(b)

Calculate the YTM of the zero coupon bond 2nd years.

Answer to Problem 40PS

Theyield to maturity for 3rd year is 13.02%

Explanation of Solution

m:math>

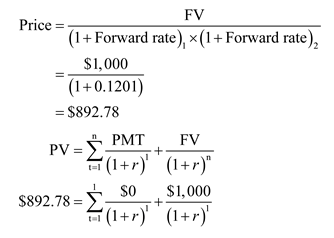

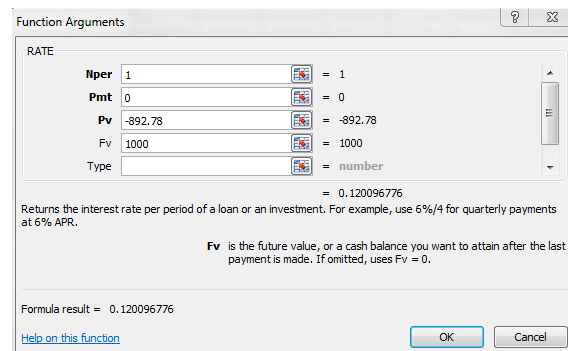

Using RATE function in excel, Calculate the effective yield to maturity.

Enter the corresponding value in the field as below:

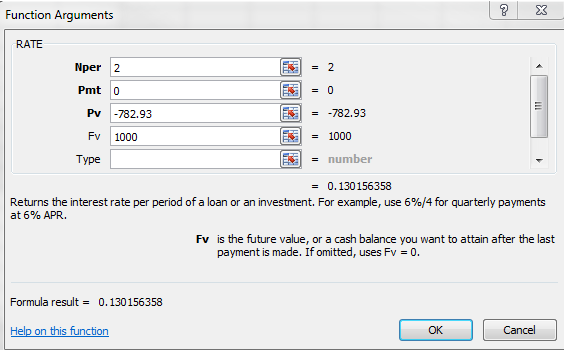

Calculate the YTM of the zero coupon bond 3rd years.

Using RATE function in excel, Calculate the effective yield to maturity.

Enter the corresponding value in the field as below:

Hence, the yield to maturity for 3rd year is 13.02%.

Thus, from the calculate it can be seen that the yieldcurve is increasing and upward sloping, and it implies that according to hypothesis expectationthere is a shift upward in the curve of the next year.

(c)

Calculate the price of the bond with 10% yield to maturity.

Answer to Problem 40PS

The expected return for three year bond is 10%.

Explanation of Solution

Calculate the price of the bond with 12% yield to maturity.

Calculate the price of the bond with 13% yield to maturity.

Calculate the total expected rate of return.

In the next year, the two year zero bond will be the one year zero bond, and thus it will sell for

In a similar manner the three year zero bond will become a two year bond and thus it will sell for $782.93 as calculate in part (b).

Expected return for two year bond is as below:

Thus, expected return for two year bond is 10%

Expected return for three year bond is as below:

Thus, expected return for three year bond is 10%.

Want to see more full solutions like this?

Chapter 10 Solutions

ESSENTIALS OF INVESTMENTS SELECT CHAPT

- 9. Calculating Payments [LO3] The Bandon Pine Corporation's purchases from suppliers in a quarter are equal to 75 percent of the next quarter's forecast sales. The payables period is 60 days. Wages, taxes, and other expenses are 20 percent of sales, and interest and dividends are $110 per quarter. No capital expenditures are planned. Projected quarterly sales are shown here: Sales Q1 $2,250 Q2 $2,730 Sales for the first quarter of the following year are projected at $2,475. Calculate the company's cash outlays by completing the following: Payment of accounts Wages, taxes, other expenses Long-term financing expenses (interest and dividends) Total Q3 $2,390 Q4 $2,190 Q1 Q2 Q3 Q4arrow_forwardThe average daily net transaction accounts of a local bank during the most recent reserve computation period is $341 million. The amount of average daily reserves at the Fed during the reserve maintenance period is $26.20 million, and the average daily vault cash corresponding to the maintenance period is $5.8 million. (Example13-2). a. Under the rules effective in 2020, what is the average daily reserve balance required to be held by the bank during the maintenance period? b. Is the bank in compliance with the reserve requirements?arrow_forwardWhat are the LSS and characteristics of LSS tools used in a research study? What is Lean Six Sigma and what is the possible benefits of using Lean Six Sigma? What are the seven LSS tools, could you please explain the characteristics of each tool, and state how the tool would be used to in a case study? How Lean Six Sigma brings a hint of all three traditional types of research (qualitative, quantitative, and mixed methods) to bear on Case Study research and business solutions?arrow_forward

- Select a real-world case situation. Use this case which you either know about already or have identifiedthrough research and address the following questions in essay format:.i. Outline and discuss what “triggered” the regulatory body to intervene? ii. How effective do you think the response was to such a crisis? iii. Outline and discuss two ways that could be used to strengthen the current regulatoryarrow_forwardle Shema actencial de theophile cautionarrow_forwardYou plan to purchase a $200,000 house using either a 30-year mortgage obtained from your local savings bank with a rate of 7.25 percent, or a 15-year mortgage with a rate of 6.50 percent. You will make a down payment of 20 percent of the purchase price. Calculate the amount of interest and, separately, principal paid on each mortgage. What is the difference in interest paid? Calculate your monthly payments on the two mortgages. What is the difference in the monthly payment on the two mortgages?arrow_forward

- Problem 2-21 Financial Statements Use the following information for Ingersoll, Incorporated. Assume the tax rate is 23 percent. 2020 2021 Sales Depreciation $ 19,073 $17,436 1,811 1,886 Cost of goods sold 4,729 4,857 Other expenses 1,021 899 Interest 870 1,001 Cash 6,292 6,916 Accounts receivable 8,190 9,877 Short-term notes payable 1,320 1,297 Long-term debt 20,770 25,011 Net fixed assets 51,218 54,723 Accounts payable 4,624 5,094 Inventory 14,538 15,438 1,700 1,768 Dividends Prepare a balance sheet for this company for 2020 and 2021. (Do not round intermediate calculations.) Cash Assets Accounts receivable Inventory INGERSOLL, INCORPORATED Balance Sheet as of December 31 2020 2021 $ 6,292 $ 6,916 8,190 9,877 14,538 15,438 Drov 14 of 20 Nearrow_forwardProblem 6-35 Financial Break-Even Analysis The technique for calculating a bid price can be extended to many other types of problems. Answer the following questions using the same technique as setting a bid price; that is, set the project NPV to zero and solve for the variable in question. Martin Enterprises needs someone to supply it with 152,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you've decided to bid on the contract. It will cost $1,920,000 to install the equipment necessary to start production; you'll depreciate this cost straight-line to zero over the project's life. You estimate that, in five years, this equipment can be salvaged for $162,000. Your fixed production costs will be $277,000 per year, and your variable production costs should be $10.60 per carton. You also need an initial investment in net working capital of $142,000. The tax rate is 22 percent and you require a return of 12 percent on your investment.…arrow_forwardYou plan to purchase a $100,000 house using a 30-year mortgage obtained from your local credit union. The mortgage rate offered to you is 8.25 percent. You will make a down payment of 20 percent of the purchase price. Calculate the amount of interest and, separately, principal paid in the 225th payment. Calculate the amount of interest paid over the life of this mortgage.arrow_forward

- What are the back ground of Sears problem, and what are the general of the problem statements? How to Create problem statements and applicable research questions? What are the lessons learned from Sears that business people or organization should avoid?arrow_forwardWhat are the research assumptions, and the research limitations, please give examples for each one, and explain how the limitation in the example might be mitigated? What are the research delimitations and give one example please. Hhow Biblical principles are related to reliability and validity.arrow_forwardWhat are the six sources of data collection and please help to explain the qualitative data collection methods. What is the thematic analysis? How to anticipated themes in a research proposal?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education