Activity-Based Costing of Customers

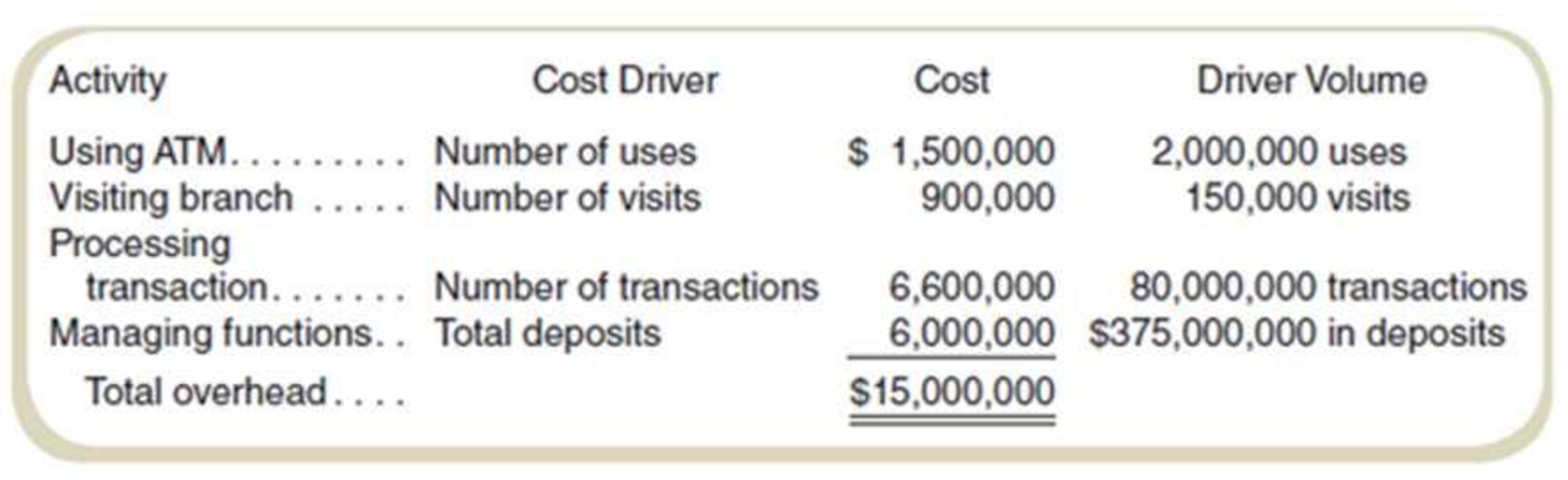

Rock Solid Bank and Trust (RSB&T) oilers only checking accounts. Customers can write checks and use a network of automated teller machines. RSB&T earns revenue by investing the money deposited; currently, it averages 5.2 percent annually on its investments of those deposits. To compete with larger banks. RSB&T pays depositors 0.5 percent on all deposits. A recent study classified the bank’s annual operating costs into four activities:

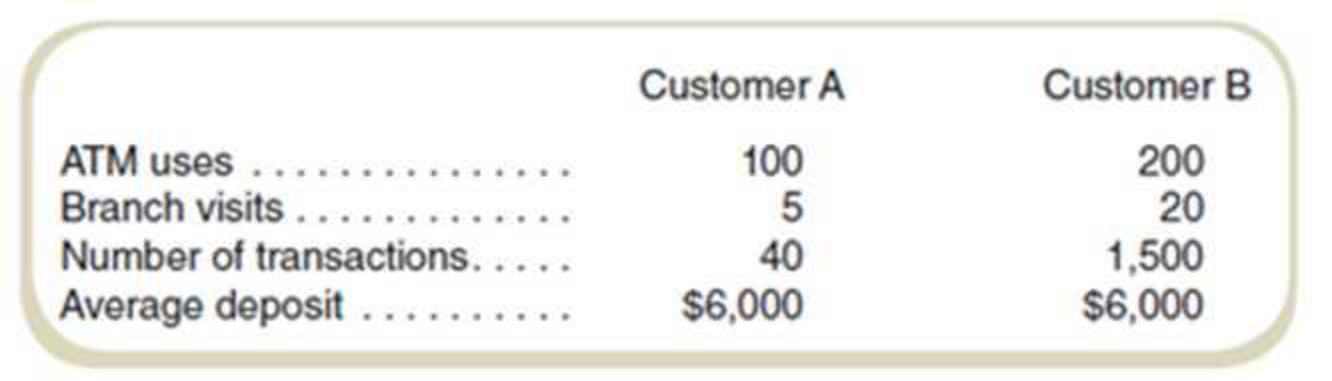

Data on two representative customers follow:

Required

- a. Compute RSB&T’s operating profits.

- b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs = 0.5 percent of deposits; operating costs are 4 percent (= $15,000,000/$375,000,000) of deposits.

- c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis.

a.

Compute the operating profit.

Explanation of Solution

Operating profit:

Operating profit is the amount retained by subtracting the total costs of operations occurred from the sales revenues earned.

Compute the operating profit:

| Particulars | Amount |

|

Sales revenue | $19,500,000 |

| Costs: | |

|

Interest on deposits | $1,875,000 |

| Operating costs | $15,000,000 |

|

Total costs | $16,875,000 |

|

Operating profit | $2,625,000 |

Table: (1)

b.

Compute the profit from customer A and customer B according to the information given in the question.

Explanation of Solution

Profit:

Profit is the amount retained by subtracting the total costs from the sales revenues earned.

Compute the customer profit of both the customers:

| Particulars | Customer A | Customer B |

|

Sales revenue | $312 | $312 |

|

Interest on deposits | $30 | $30 |

|

Operating costs | $240 | $240 |

|

Customer profit | $42 | $42 |

Table: (2)

Measures that are used for computation:

| Particulars | Details |

| Deposit of customer A | $6,000 |

| Deposit of customer B | $6,000 |

| Interest earned | 5.20% |

| Interests charged | 0.50% |

| Operating cost | 4.00% |

Table: (3)

c.

Compute the profit from customer A and customer B according to the information given in the question.

Explanation of Solution

Cost driver:

Cost driver refers to the factor that causes changes in the determination of the cost of the activity.

Compute the rates required for the computation of the customer profit:

| Activity | Cost driver |

Cost |

Driver volume |

Rate |

| Use ATM | Number of uses | $1,500,000 | 2,000,000 | 0.75 |

| Visit Branch | Number of visits | $900,000 | 150,000 | 6.00 |

| Process transaction | Number of transactions | $6,600,000 | 80,000,000 | 0.0825 |

| General bank overhead | Total deposits | $6,000,000 | 375,000,000 | 1.60% |

Table: (4)

| Customer A | Customer B | |

| Activity | Amount | Amount |

|

Sales revenue | $312 | $312 |

|

Interest on deposit | $30 | $30 |

| Account margin | $282 | $282 |

| Operating costs: | ||

|

Use ATM | $75 | $150 |

|

Add: Visit branch | $30 | $120 |

|

Add: Process transaction | $3 | $124 |

|

Add: General bank overhead | $96 | $69 |

| Total operating cost | $204 | $490 |

|

Customer profit | $78 | ($208) |

Table: (5)

| Particulars | Details |

| Deposit of customer A | $6,000 |

| Deposit of customer B | $6,000 |

| Interest earned | 5.20% |

| Interests charged | 0.50% |

Table: (6)

Want to see more full solutions like this?

Chapter 10 Solutions

Fundamentals of Cost Accounting

- What are the differences of gross profit and retail inventory methods? What are the similiarities of gross profit and retail inventory methods? Does a company need to take a physical inventory if the gross profit method or retail inventory method is used? Why or why not?arrow_forwardGeneral Accountingarrow_forwardSubject:-- general accountingarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College