Concept explainers

COST OF CAPITAL Coleman Technologies is considering a major expansion program that has been proposed by the company’s information technology group. Before proceeding with the expansion, the company must estimate its cost of capital. Suppose you are an assistant to Jerry Lehman, the financial vice president. Your first task is to estimate Coleman’s cost of capital Lehman has provided you with the following data, which he believes may be relevant to your task.

- The firm’s tax rate is 25%.

- The current price of Coleman’s 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity, is $1.153.72. Coleman does not use short-term, interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost.

- The current price of the firm’s 10%, $100.00 par value, quarterly dividend, perpetual

preferred stock is $111.10. - Coleman’s common stock is currently selling for $50.00 per share. Its last dividend (D0) was $4.19, and dividends are expected to grow at a constant annual rate of 5% in the foreseeable future. Coleman’s beta is 1.2, the yield on T-bonds is 7%, and the market risk premium is estimated to be 6%. For the bond-yield-plus-risk-premium approach, the firm uses a risk premium of 4%.

- Coleman’s target capital structure is 30% debt, 10% preferred stock, and 60% common equity.

To structure the task somewhat, Lehman has asked you to answer the following questions:

- a. 1. What sources of capital should be included when you estimate Coleman’s WACC?

2. Should the component costs be figured on a before-tax or an a after-tax basis?

3. Should the costs be historical (embedded) costs or new (marginal) costs?

- b. What is the market interest rate on Coleman’s debt and its component cost of debt?

- c. 1. What is the firm’s cost of preferred stock?

2. Coleman’s preferred stock is riskier to investors than its debt, yet the preferred’s yield to investors is lower than the yield to maturity on the debt Does this suggest that you have made a mistake? (Hint: Think about taxes)

- d. 1. Why is there a cost associated with

retained earnings ?2. What is Coleman’s estimated

cost of common equity using theCAPM approach? - e. What is the estimated cost of common equity using the DCF approach?

- f. What is the bond-yield-plus-risk-premium estimate for Coleman’s cost of common equity?

- g. What is your final estimate for rs?

- h. Explain in words why new common stock has a higher cost than retained earnings.

- i. 1. What are two approaches that can be used to adjust for flotation costs?

2. Coleman estimates that if it issues new common stock, the flotation cost will be 15%. Coleman incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued common stock, considering the flotation cost?

- j. What is Coleman’s overall, or weighted average, cost of capital (WACC)? Ignore flotation costs.

- k. What factors influence Coleman’s composite WACC?

- l. Should the company use the composite WACC as the hurdle rate for each of its projects? Explain.

a1.

To determine: The sources of capital that must be included when estimating Company C’s WACC.

Introduction: WACC is abbreviated as weighted average cost of capital, is an equation that computes the average rate of return that an organization requires to acquire to repay its security holders or investors. This computation is utilized to determine if a project is beneficial or in the event that it just repays the expense of subsidizing the project.

Explanation of Solution

The capital sources that must be included when estimating Company C’s WACC are as follows:

The weighted average cost of capital (WACC) is utilized fundamentally building the long term capital investment decisions such as for capital budgeting. Hence, the WACC ought to incorporate the form of capital that is utilised to pay for the long term assets, and this is ordinarily interest bearing debt, preferred stock whenever utilized, and common stock. The total debt comprises of both long term and short term interest bearing debt.

The short term interest bearing debt would incorporate notes payable. The noninterest-bearing liabilities, for example, accrued liabilities and accounts payable are excluded in the cost of capital estimation on the grounds that these assets are gotten out while deciding on the investment requirements, which is the net operating working capital as opposed to gross operating working capital is incorporated into capital expenses.

a2.

To Determine: Whether the component costs is figured on before-tax or on after-tax basis.

Explanation of Solution

The reasons on whether the component costs are figured on before-tax or on after-tax basis is as follows:

The investors or stockholders are concerned principally with those corporate cash streams, which are accessible for their utilization, in particular, those cash streams are accessible to pay dividends or to reinvest. As dividends and reinvestment are paid made with after-tax money, every cash flow and interest rate of return ought to be done on an after-tax premise.

a3.

To Determine: Whether the costs are historical costs or new costs.

Explanation of Solution

The reasons on whether the costs are historical costs or new costs are as follows:

In financial management, the capital cost is utilized principally to formulate decisions that include raising the new capital. In this manner, the appropriate segment costs are the present marginal costs as opposed to historical costs.

b.

To Determine: The market interest rate on Company C’s stock and its component cost of debt.

Answer to Problem 22IC

The market interest rate on Company C’s stock is 10% and its component cost of debt is 6%.

Explanation of Solution

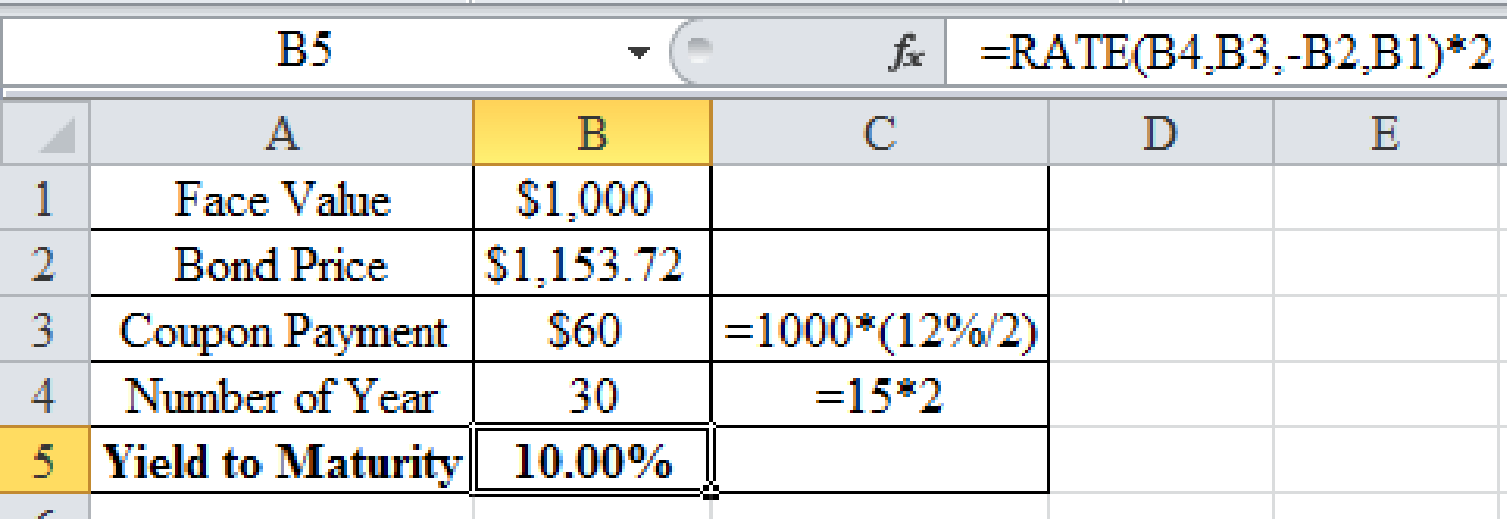

Determine the market interest rate on Company C

Using a excel spread sheet and excel function =RATE, the market interest rate on Company C is determined as 10%. The bond is traded on semi-annual basis.

Excel Spread sheet:

Therefore the market interest rate on Company C is 10%.

Determine the cost of debt

The tax at 25% is applicable for the market interest rate.

Therefore the cost of debt is 7.50%.

c1.

To Determine: The firm’s cost of preferred stock.

Answer to Problem 22IC

The firm’s cost of preferred stock is 9%.

Explanation of Solution

Determine the cost of preferred stock

As the preferred dividends are not tax deductible to the issuer, there is no requirement for a tax adjustment and that could have evaluated the effective yearly cost of the preferred, however as an account of debt, the nominal cost is by and large utilized.

Therefore the cost of preferred stock is 9%.

c2.

To Determine: Whether the statement on the preferred stock’s yield to investors is lesser than the yield to maturity on debt is appropriate.

Explanation of Solution

The reasons on whether the statement on the preferred stock’s yield to investors is lesser than the yield to maturity on debt is appropriate are as follows:

Corporate investors claim most of the preferred stock, as a result 50% of preferred dividends expected to be received by organizations are considered as non-taxable. In this way, preferred stock regularly has a lesser pre-tax yield than the pre-tax yield on debt issued by a similar organization.

It is also to be noted that however the after-tax yield to a corporate investor and the after-tax cost to the guarantor or the issuer are greater on preferred stock than on debt.

d1.

To Determine: The reasons on cost associated with retained earnings.

Explanation of Solution

The reason on cost associated with retained earnings is as follows:

The retained earnings of Company C can both be held and reinvested in the business or can be remunerated in terms of dividends. In the event that the earnings are held, Company C's shareholders do without the chance to get money and to reinvest it in stocks, securities, land and other resources. Accordingly, Company C ought to receive on its retained earnings in any event as much as its investors themselves could acquire on alternative investments of equivalent risk.

Additionally, the organization's investors could invest into Company C's very own common stock, where they could hope to gain the cost of common equity (rs). The retained earnings have an opportunity cost that is equivalent to the cost of common equity (rs), the rate of return the stockholders anticipate for the firm’s common stock.

d2.

To Determine: The estimated cost of common equity using CAPM approach.

Answer to Problem 22IC

The projected cost of common equity utilising CAPM approach is 14.2%.

Explanation of Solution

Determine the projected cost of common equity utilising CAPM approach:

Therefore the projected cost of common equity utilising CAPM approach is 14.2%.

e.

To Determine: The projected cost of common equity utilising DCF approach.

Answer to Problem 22IC

The projected cost of common equity utilising DCF approach is 13.80%.

Explanation of Solution

Determine the projected cost of common equity utilising DCF approach:

Here,

D0 - Current dividend

g - Growth rate

P0 - Current price of bond

Therefore the projected cost of common equity utilising DCF approach is 13.80%.

f.

To Determine: The bond yield plus risk premium estimate for Company C’s cost of common equity.

Answer to Problem 22IC

The bond yield plus risk premium estimate for Company C’s cost of common equity is14%.

Explanation of Solution

Determine the bond yield plus risk premium estimate for Company C’s cost of common equity

It is to be noted that the risk premium required in this technique is hard to appraise, so this methodology just gives a rough approximation of cost of equity (rs). It is valuable to keep an eye on the discounted cash flow (DCF) and capital asset pricing model (CAPM) approximations, which in specific situations, deliver unreasoning assessments.

Therefore the bond yield plus risk premium estimate for Company C’s cost of common equity is 14%.

g.

To Determine: The last estimate of cost of common equity (rs).

Answer to Problem 22IC

The final estimate of cost of common equity (rs) is 14%.

Explanation of Solution

Determine the average of cost of common equity

Here, an impressive decision is obligatory. In the event that a technique is considered to be mediocre due to the quality of its sources of info, at that point it may be given diminutive weight or even ignored. Here in the solution, the three techniques delivered moderately close outcomes of cost of common equity which ranges from 13.8% to 14.2%, hence midpoint of 14% is chosen to utilize the estimate for Company C's expense of common equity.

Here,

rs DCF – Denotes the rate of common equity using DCF approach

rs CAPM– Denotes the rate of common equity using CAPM approach

Therefore the final estimate of cost of common equity (rs) is 14%.

h.

To Determine: The reasons of why the new common stock has a larger cost than retained earnings.

Explanation of Solution

The reason of why the new common stock has a larger cost than retained earnings is as follows:

The organization is fund-raising with the end goal to make an investment. The cash has an expense, and this expense depends fundamentally on the stockholders' required rate of return, thinking about risk and alternative investment openings. Thus, the new venture must give a return in any event equivalent to the investors' opportunity cost. In the event that the organization raises capital by offering or trading stock, the organizations do not get the majority of the cash that investors subsidize.

For instance, if the investors set up $200,000, and in the event that they expect a 15% profit for that $200,000, at that point $30,000 of income must be produced. In any case, if flotation costs are 20% which is equal to $40,000, at that point the organization will get just $160,000 of the $200,000 investors contribute. The amount of $160,000 should then deliver a $30,000 income, or 18.75% ($30/$160) rate of return against a 15% return on equity raised as retained earnings.

i1.

To Determine: The two approaches that could be utilised to adjust for flotation costs.

Explanation of Solution

The two approaches that can be used to adjust for flotation costs are as follows:

- Up-front cost: This approach reduces the estimate return of the project.

- Regulate the cost of capital: This approach states by adjusting the cost of capital that includes flotation costs. This is most ordinarily done by joining flotation costs in the discounted cash flow model.

i2.

To Determine: The projected cost of newly issued common stock by considering the floatation cost.

Answer to Problem 22IC

The projected cost of newly issued common stock by considering the floatation cost is 15.35%.

Explanation of Solution

Determine the cost of newly issued common stock by considering the floatation cost

Here,

D0 - Current dividend

g - Growth rate

P0 - Current price of bond

F – Flotation costs rate

Therefore the projected cost of newly issued common stock by considering the floatation cost is 15.35%.

j.

To Determine: The WACC.

Answer to Problem 22IC

The WACC is 11.10%.

Explanation of Solution

Determine the WACC

Here,

wd - Weight of debt

rd - Rate of debt

T - Tax rate

wp - Weight of preferred stock

rp - Rate of preferred stock

wc - Weight of common stock

rs - Rate of common stock

Therefore the WACC is 11.55%.

k.

To Determine: The factors that influence Company C's composite WACC.

Explanation of Solution

The following factors that control a company's WACC are as follows:

- Investment policy

- Dividend policy

- Capital structure policy

The following factors that cannot control a company's WACC are as follows:

- Tax rates

- Interest rates

l.

To Determine: Whether the company should utilise the composite WACC as hurdle rate for each projects.

Explanation of Solution

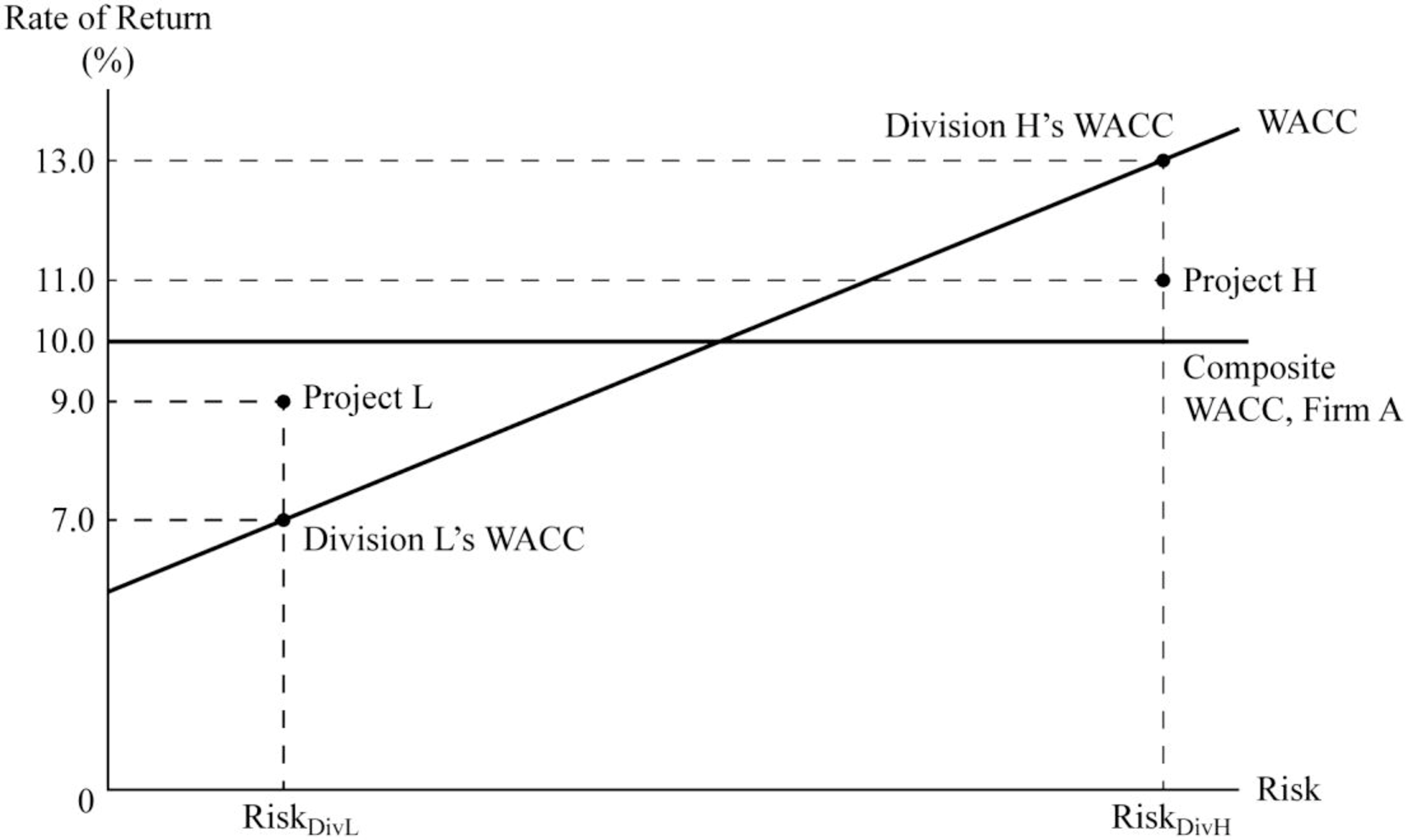

The graphical representation of the regarding the hurdle rate is as follows:

The reasons on whether the company should utilise the composite WACC as the hurdle rate for every projects is as follows:

No. The composite WACC mirrors the risk of an average project attempted by the firm. In this manner, the WACC just symbolize to the hurdle rate for a distinctive venture with average risk. Distinctive investments have diverse risks. The investment's WACC ought to be changed in accordance to reproduce the risk of the project.

Want to see more full solutions like this?

Chapter 10 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

- An insurance company has liabilities of £7 million due in 10 years' time and £9 million due in 17 years' time. The assets of the company consist of two zero-coupon bonds, one paying £X million in 7 years' time and the other paying £Y million in 20 years' time. The current interest rate is 6% per annum effective. Find the nominal value of X (i.e. the amount, IN MILLIONS, that bond X pays in 7 year's time) such that the first two conditions for Redington's theory of immunisation are satisfied. Express your answer to THREE DECIMAL PLACES.arrow_forwardAn individual is investing in a market where spot rates and forward rates apply. In this market, if at time t=0 he agrees to invest £5.3 for two years, he will receive £7.4 at time t=2 years. Alternatively, if at time t=0 he agrees to invest £5.3 at time t=1 for either one year or two years, he will receive £7.5 or £7.3 at times t=2 and t=3, respectively. Calculate the price per £5,000 nominal that the individual should pay for a fixed-interest bond bearing annual interest of 6.6% and is redeemable after 3 years at 110%. State your answer at 2 decimal places.arrow_forwardThe one-year forward rates of interest, f+, are given by: . fo = 5.06%, f₁ = 6.38%, and f2 = 5.73%. Calculate, to 4 decimal places (in percentages), the three-year par yield.arrow_forward

- 1. Give one new distribution channels for Virtual Assistance (freelance business) that is not commonly used. - show a chart/diagram to illustrate the flow of the distribution channels. - explain the rationale behind it. (e.g., increased market reach, improved customer experience, cost-efficiency). - connect the given distribution channel to the marketing mix: (How does it align with the overall marketing strategy? Consider product, price, promotion, and place.). - define the target audience: (Age, gender, location, interests, etc.). - lastly, identify potential participants: (Wholesalers, retailers, online platforms, etc.)arrow_forwardAn individual is planning for retirement and aims to withdraw $100,000 at the beginning of each year, starting from the first year of retirement, for an expected retirement period of 20 years. To fund this retirement plan, he intends to make 20 equal annual deposits at the end of each year during his working years. Assume a simple annual interest rate of 20% during his working years and a simple annual interest rate of 5% during retirement. What should his annual deposit amount be to achieve his desired retirement withdrawals? Please write down the steps of your calculation and explain result economic meaning.arrow_forwardAssume an investor buys a share of stock for $18 at t=0 and at the end of the next year (t=1), he buys 12 shares with a unit price of $9 per share. At the end of Year 2 (t=2), the investor sells all shares for $40 per share. At the end of each year in the holding period, the stock paid a $5.00 per share dividend. What is the annual time-weighted rate of return? Please write down the steps of your calculation and explain result economic meaning.arrow_forward

- On how far do you endorse this issue? Analyze the situation critically using official statistics and the literature.arrow_forwardIs globalization a real catalyst for enhancing international business? It is said that relevance of globalization and regionalism in the current situation is dying down. More specifically, concerned has been raised from different walks of life about Nepal’s inability of reaping benefits of joining SAFTA, BIMSTEC and WTO.arrow_forwardIn the derivation of the option pricing formula, we required that a delta-hedged position earn the risk-free rate of return. A different approach to pricing an option is to impose the condition that the actual expected return on the option must equal the equilibrium expected return. Suppose the risk premium on the stock is 0.03, the price of the underlying stock is 111, the call option price is 4.63, and the delta of the call option is 0.4. Determine the risk premium on the option.arrow_forward

- General Financearrow_forwardAssume an investor buys a share of stock for $18 at t = 0 and at the end of the next year (t = 1) , he buys 12 shares with a unit price of $9 per share. At the end of Year 2 (t = 2) , the investor sells all shares for $40 per share. At the end of each year in the holding period, the stock paid a $5.00 per share dividend. What is the annual time-weighted rate of return?arrow_forwardPlease don't use Ai solutionarrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning