Concept explainers

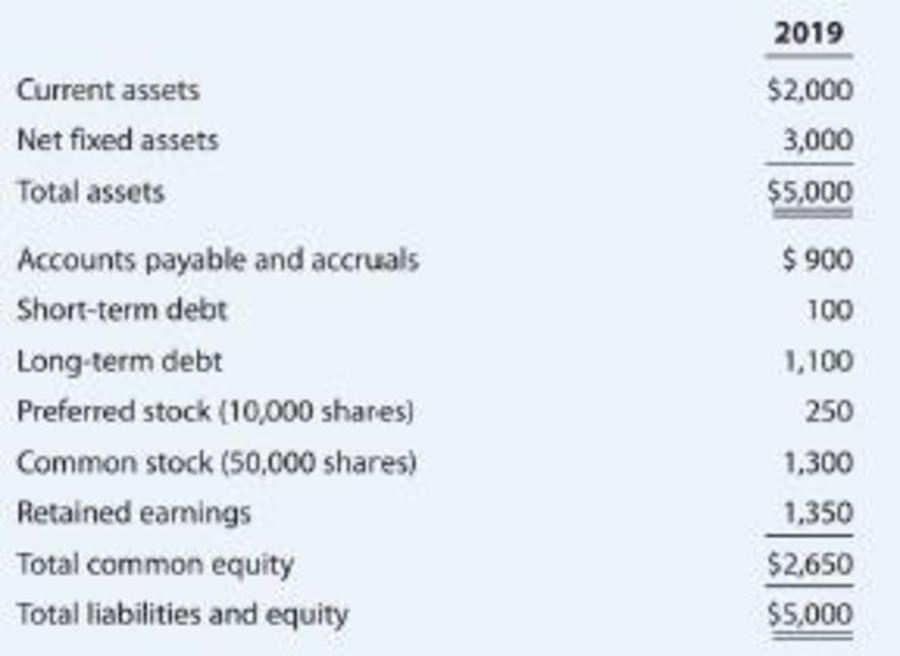

CALCULATING THE WACC Here is the condensed 2019 balance sheet for Skye Computer Company (in thousands of dollars):

Skye’s earnings per share last year were $3.20. The common stock sells for $55.00. last year’s dividend (D0) was $2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skye’s

- a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the

cost of equity fromretained earnings , and the cost of newly issued common stock. Use the DCF method to find the cost of common equity. - b. Now calculate the cost of common equity from retained earnings, using the

CAPM method. - c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r1 and rs as determined by the DCF method, and add that differential to the CAPM value for rs.)

- d. If Skye continues to use the same market-value capital structure, what is the firm’s WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock?

a.

To Determine: The after-tax cost of debt, cost of preferred stock, cost of common equity from retained earnings and cost of common equity from new common stock of Company SC.

Introduction: WACC is abbreviated as weighted average cost of capital, is a equation that computes the average rate of return that an organization requires to acquire to repay its security holders or investors. This computation is utilized to determine if a project is beneficial or in the event that it just repays the expense of subsidizing the project.

Answer to Problem 21SP

The after-tax cost of debt is 7.50%, cost of preferred stock is 11%, cost of common equity from retained earnings is 13.16% and cost of common equity from new common stock is 13.62%.

Explanation of Solution

Determine the after-tax cost of debt

Therefore the after-tax cost of debt is 7.50%.

Determine the cost of preferred stock

Therefore the cost of preferred stock is 11%.

Determine the cost of common equity from retained earnings

Here,

D0 - Current dividend

g - Growth rate

P0 - Current price of bond

Therefore the cost of common equity from retained earnings is 13.16%.

Determine the cost of common equity from new common stock based on DCF

Here,

D0 - Current dividend

g - Growth rate

P0 - Current price of bond

F - Flotation cost

Therefore the cost of common equity from new common stock based on DCF is 13.62%.

b.

To Determine: The cost of common equity from retained earnings of Company SC utilising CAPM method.

Answer to Problem 21SP

The cost of common equity from retained earnings of Company SC utilising CAPM method is 13.58%.

Explanation of Solution

Determine the cost of common equity from retained earnings using CAPM

Here,

rF - Risk free rate

rM - Market risk premium

B - Beta of stock

Therefore the cost of common equity from retained earnings using CAPM is 13.58%.

c.

To Determine: The cost of new common equity based on CAPM.

Answer to Problem 21SP

The cost of new common equity based on CAPM is 14.04%.

Explanation of Solution

Determine the difference between the cost of common equity from retained earnings and cost of common equity from new common stock

Therefore the difference between the cost of common equity from retained earnings and cost of common equity from new common stock is 0.46%

Determine the cost of new common equity based on CAPM

Therefore the cost of new common equity based on CAPM is 14.04%.

d.

To Determine: The WACC if the firm utilises only retained earnings for equity and if the firm expands rapidly in order to issue new common stock.

Answer to Problem 21SP

The WACC if the firm uses only retained earnings for equity and if the firm expands rapidly in order to issue new common stock

Explanation of Solution

Determine the market value of preferred stock

Therefore the market value of preferred stock is $300

Determine the market value of debt

Therefore the market value of debt is $1,200

Determine the market value of common stock

Therefore the market value of common stock is $2,750

Determine the total market value

Therefore the total market value is $4,250

Determine the weight of preferred stock

Therefore the weight of preferred stock is 7.06%

Determine the weight of debt

Therefore the weight of debt is 28.24%

Determine the weight of common stock

Therefore the weight of common stock is 64.71%

Determine the WACC if the firm uses only retained earnings for equity

For the rate of common stock, the average of old and new common stock values are considered.

Here,

wd - Weight of debt

rd - Rate of debt

T - Tax rate

wp - Weight of preferred stock

rp - Rate of preferred stock

we - Weight of common stock

re - Rate of common stock

Therefore the WACC if the firm uses only retained earnings for equity is 11.55%.

Determine the WACC if the firm expands rapidly in order to issue new common stock.

For the rate of common stock, the average of cost of new common equity based on CAPM and the cost of new common equity based on DCF values are considered.

Therefore the WACC if the firm expands rapidly in order to issue new common stock is 11.84%.

Want to see more full solutions like this?

Chapter 10 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

- Provide Answer of This Financial Accounting Question And Please Don't Use Ai Becouse In all Ai give Wrong Answer. And Provide All Question Answer If you will use AI will give unhelpful.arrow_forwardYou plan to save $X per year for 6 years, with your first savings contribution in 1 year. You and your heirs then plan to withdraw $43,246 per year forever, with your first withdrawal expected in 7 years. What is X if the expected return per year is 18.15 percent per year? Input instructions: Round your answer to the nearest dollar. 59 $arrow_forwardAre there assets for which a value might be considered to be hard to determine?arrow_forward

- You plan to save $X per year for 7 years, with your first savings contribution in 1 year. You and your heirs then plan to make annual withdrawals forever, with your first withdrawal expected in 8 years. The first withdrawal is expected to be $43,596 and all subsequent withdrawals are expected to increase annually by 1.84 percent forever. What is X if the expected return per year is 11.34 percent per year? Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou plan to save $41,274 per year for 4 years, with your first savings contribution later today. You then plan to make X withdrawals of $41,502 per year, with your first withdrawal expected in 4 years. What is X if the expected return per year is 8.28 percent per year? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou plan to save $X per year for 10 years, with your first savings contribution in 1 year. You then plan to withdraw $58,052 per year for 9 years, with your first withdrawal expected in 10 years. What is X if the expected return is 7.41 percent per year? Input instructions: Round your answer to the nearest dollar. 69 $arrow_forward

- You plan to save $X per year for 7 years, with your first savings contribution later today. You then plan to withdraw $30,818 per year for 5 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 6.64 percent per year? Input instructions: Round your answer to the nearest dollar. $arrow_forwardYou plan to save $24,629 per year for 8 years, with your first savings contribution in 1 year. You then plan to withdraw $X per year for 7 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 5.70 percent per year? Input instructions: Round your answer to the nearest dollar. $ SAarrow_forwardYou plan to save $15,268 per year for 7 years, with your first savings contribution later today. You then plan to withdraw $X per year for 9 years, with your first withdrawal expected in 8 years. What is X if the expected return per year is 10.66 percent per year? Input instructions: Round your answer to the nearest dollar. GA $arrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning