Concept explainers

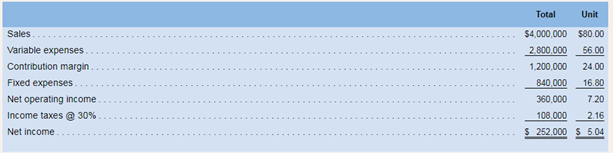

The -contribution format income statement for Huerra Company for last year is given below:

The company Lad average operating assets of $2,000,000 during the year.

Required:

1. Compute the company's return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover.

For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROE figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above.

2. Using Lean Production, the company is able to reduce the average level of inventory" by $400,000. (The released funds are used to pay off short-term creditors.)

3. The company achieves a cost savings of $32:000 per year by using less costly materials.

4. The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $500:000. Interest on the bonds is $60,000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by 520,000 per year.

5. As a result of a more intense effort by salespeople, sales are increased by 20%; operating assets remain unchanged.

6. At the beginning of the year obsolete inventory carried on the books at a cost of $40,000 is scrapped and written off as a loss.

7. At the beginning of the year the company uses $200,000 of cash (received on

- 1)

Return on Investment, Margin and Turnover:

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 4.5%

Explanation of Solution

- Given:

Sales = $4,000,000

Variable Expense = $2,800,000

Fixed Expenses=$840,000

Average Operating Assets = $2,000,000

- Formulae used:

- Calculations:

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 3.6%

Explanation of Solution

- Given:

Sales = $4,000,000

Variable Expense = $2,800,000

Fixed Expenses=$840,000

Average Operating Assets = $1,600,000

- Formulae used:

- Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Since the average level of inventory is reduced, the average operating assets for the year will also reduce by $400,000.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and reduces when the average operating assets decrease and turnover increases.

3)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 4.9%

Explanation of Solution

- Given: Sales = $4,000,000

Variable Expense = $3,168,000

Fixed Expenses=$840,000

Average Operating Assets = $2,000,000

- Formulae used:

- Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Since the cost savings take place for the company, the value of variable expenses will reduce $32,000.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and increases when there is a reduction in expenses.

4)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 5%

Explanation of Solution

- Given:

Sales = $4,000,000

Variable Expense = $2,780,000 [$2,800,000 - $20,000]

Fixed Expenses=$900,000 [$840,000 + $60,000]

Average Operating Assets = $2,500,000 [$2,000,000 + $500,000]

- Formulae used:

- Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Since the new plant and equipment is purchased, the average operating assets for the year will increase by $500,000.

- The cost of interest on bonds will increase the fixed expenses by $60,000 and the production cost savings will reduce variable costs by $20,000.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and increases when the average operating assets increases.

5)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 10.071%

Explanation of Solution

- Given: Sales = $4,800,000 [$4000000 + $800000]

Variable Expense = $2,800,000

Fixed Expenses=$840,000

Average Operating Assets = $2,000,000

- Formulae used:

- Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Sales increase by 20% i.e. $800,000.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and increases with an increase in the sale value.

6)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 3.92%

Explanation of Solution

- Given:

Sales = $4,000,000

Variable Expense = $2,840,000

Fixed Expenses=$840,000

Average Operating Assets = $1,960,000

- Formulae used:

Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Since the average level of inventory is scrapped, the average operating assets for the year will also reduce by $40,000 and variable expenses will increase by $40,000 to book loss on scrapping of assets.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and reduces when the average operating assets decrease and expenses increase.

7)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 4.05%

Explanation of Solution

- Given:

Sales = $4,000,000

Variable Expense = $2,800,000

Fixed Expenses=$840,000

Average Operating Assets = $1,800,000

- Formulae used:

Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Since cash which is received from accounts receivable, is used to purchase common stock, the value of average operating assets will reduce

- Hence there is no impact on the balance of average operating assets and return on investment.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and reduces when the average operating assets decrease.

Want to see more full solutions like this?

Chapter 10 Solutions

Introduction To Managerial Accounting

- The following selected data pertain to the Argent Division for last year: Required: 1. How much is the residual income? 2. How much is the return on investment? (Rounded to four significant digits.)arrow_forwardDuring the current year, Sokowski Manufacturing earned income of $350,000 from total sales of $5,500,000 and average capital assets of $12,000,000. A. Based on this information, calculate asset turnover. B. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?arrow_forwardThe income statement comparison for Rush Delivery Company shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the ROI. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the RI for each year. Explain how this compares to your findings in part C.arrow_forward

- The income statement comparison for Forklift Material Handling shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the return on investment. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the residual income for each year. Explain how this compares to your findings in part C.arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. A. In the correct format, prepare the income statement using the following information: B. Calculate the profit margin, return on investment, and residual income. Assume an investment base of $100,000 and 6% cost of capital. C. Prepare a short response to accompany the income statement that explains why uncontrollable costs are included in the income statement.arrow_forwardProfit margin, investment turnover, and ROI Briggs Company has operating income of 36,000, invested assets of 180,000, and sales of 720,000. Use the DuPont formula to compute the return on investment and show (A) the profit margin, (B) the investment turnover, and (C) the return on investment.arrow_forward

- During the current year, Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?arrow_forwardCarrow_forwardProfit Margin, Investment Turnover, and ROI Briggs Company has operating income of $13,824, invested assets of $96,000, and sales of $230,400. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin ? b. Investment turnover ? c. Return on investment ?arrow_forward

- Profit Margin, Investment Turnover, and ROI Briggs Company has income from operations of $132,756, invested assets of $299,000, and sales of $1,106,300. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin % b. Investment turnover c. Return on investment %arrow_forwardEarrow_forwardProfit Margin, Investment Turnover, and ROI Snodgrass Company has income from operations of $232,800, invested assets of $970,000, and sales of $3,880,000. Use the DuPont formula to compute the return on investment and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round your answers to one decimal place. a. Profit margin b. Investment turnover c. Return on investment %arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning