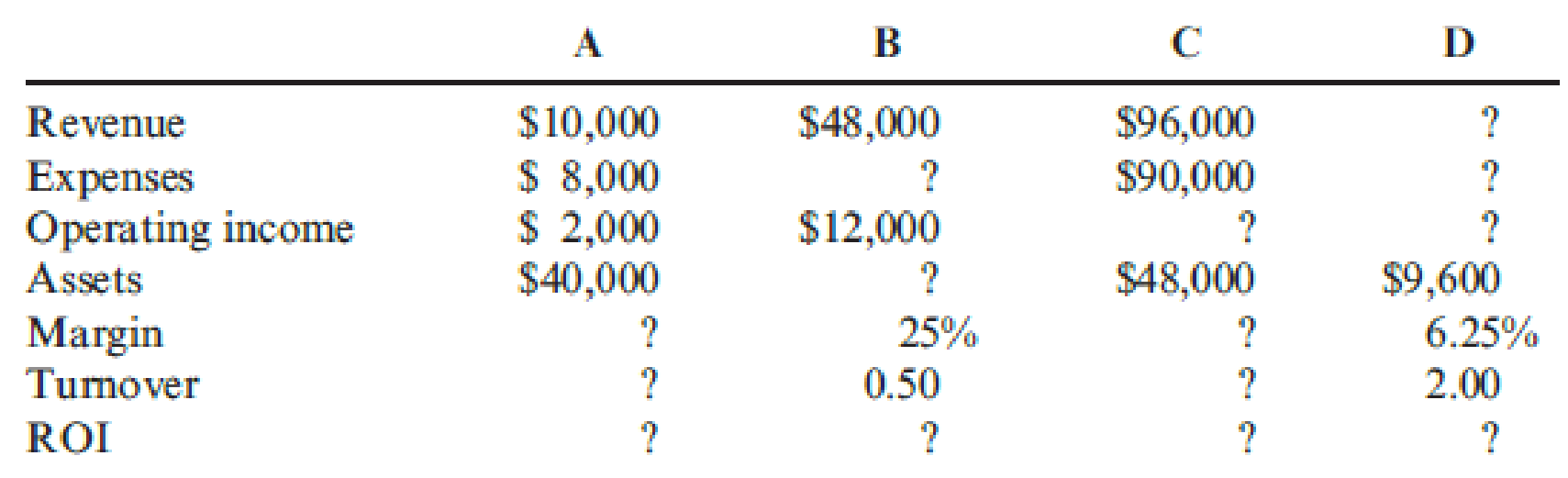

Consider the data for each of the following four independent companies:

Required:

- 1. Calculate the missing values in the above table. (Round rates to four significant digits.)

- 2. Assume that the cost of capital is 9 percent for each of the four firms. Compute the residual income for each of the four firms.

1.

Calculate the missing amounts in the given table.

Explanation of Solution

Margin: It is an amount income generated by a dollar of sales. It is calculated as follows:

Turnover: It is an amount of sales generate by average operating assets. It is calculated by dividing the sales by the average operating assets in the assets, required to generate those sales.

Return on investment (ROI): This financial ratio evaluates how efficiently the assets are used in earning income from operations. So, ROI is a tool used to measure and compare the performance of a units or divisions or a companies.

Calculate the missing amounts in the given table:

| Particulars | A | B | C | D | ||||

| Revenue | $10,000 | $48,000 | $96,000 | $19,200 | k | |||

| Expenses | $8,000 | $36,000 | d | $90,000 | $18,000 | l | ||

| Operating income | $2,000 | $12,000 | $6,000 | g | $1,200 | m | ||

| Assets | $40,000 | $96,000 | e | $48,000 | $9,600 | |||

| Margin | 20% | a | 25% | 6.25% | h | 6.25% | ||

| Turnover | 0.25 | b | 0.50 | 2.00 | i | 2.00 | ||

| ROI | 5.00% | c | 12.5% | f | 12.50% | j | 12.50% | n |

Table (1)

Notes to the above table:

a) Calculate margin for A:

b) Calculate the turnover for A:

c) Calculate the ROI for A:

d) Calculate the expenses for B:

e) Calculate the assets for B:

f) Calculate the ROI for B:

g) Calculate the operating income for C:

h) Calculate margin for C:

i) Calculate the turnover for C:

j) Calculate the ROI for C:

k) Calculate the Revenue for D:

m) Compute the Operating income for D:

l) Compute the expenses for D:

n) Compute the ROI for D:

2.

Calculate the residual income for each of the four firms.

Explanation of Solution

Residual income: It is an amount by which an operating income (earnings) exceeds a minimum acceptable return on the average capital invested.

Residual income for Firm A:

Therefore, residual income of Firm A is ($1,600).

Residual income for Firm B:

Therefore, residual income of Firm B is $3,360.

Residual income for Firm C:

Therefore, residual income of Firm C is $1,680.

Residual income for Firm D:

Therefore, residual income of Firm D is $336.

Want to see more full solutions like this?

Chapter 10 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub